Reports

GSTR-3B

Export GSTR-3B

Step-1 GSTR-3B Dashboard

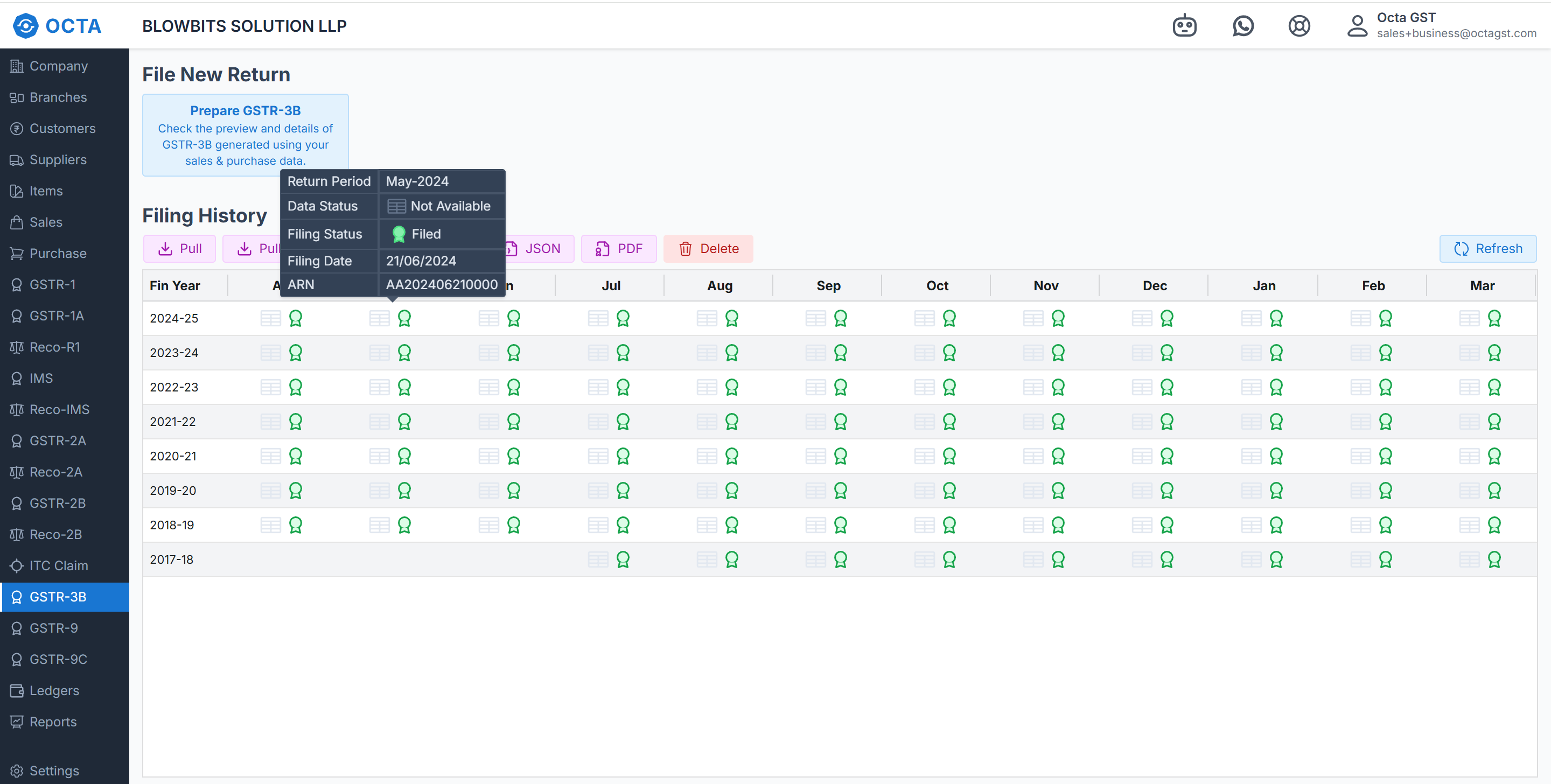

First, navigate to the GSTR-3B Dashboard in Octa GST. To do this

- Log in and Select Company: Log in to Octa GST, select the company you want to work with, and open it.

- Navigate to GSTR-3B Tab: Go to the GSTR-3B tab. This will open the GSTR-3B dashboard for all periods.

- Check Return Status: Hover your mouse over any period to see whether the return has been filed or if data is

available or not.

If data is not available than follow the 2'nd step and if data available directly follow 3rd step.

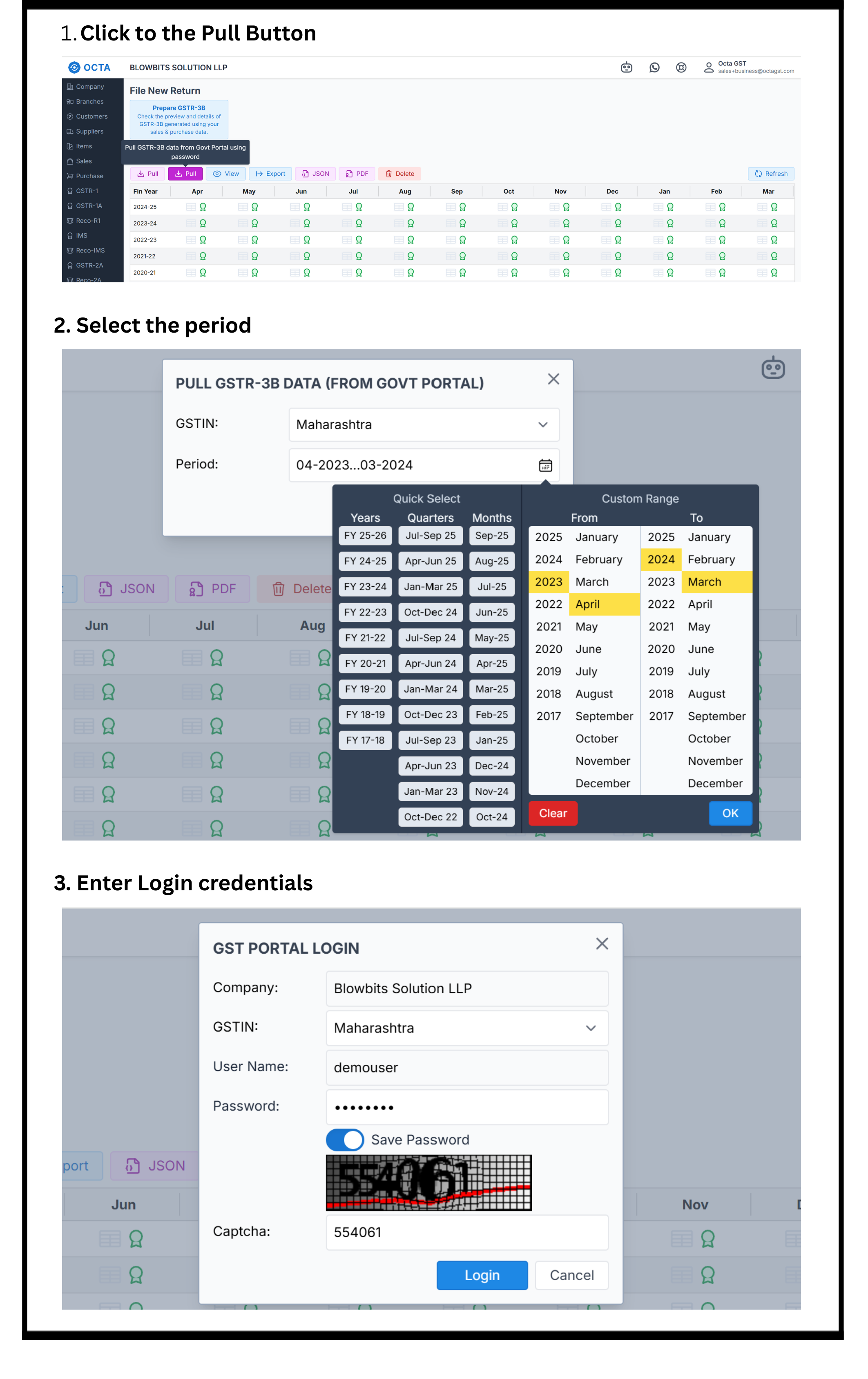

Step-2 Pull GSTR-3B

- Click to the Pull Button: In the GSTR-3B dashboard, click the Pull button and select the period for downloading the data.

- Log In to the GST Portal: A login tab will open. Click the Login button and enter your GST Government Portal credentials (User ID and Password) and the data will downloaded.

Step-3 Export GSTR-3B

After downloading Data, you can export it in Excel format. To do this, simply click the Export button, select the desired period, and click Continue. The file will be generated in the Robot tab, from where we can download the Excel file containing the data.