Importing Sales Register

Octa Format

The Octa Format is our custom, easy-to-use Excel template designed for any business. It works perfectly when your ERP or software doesn't match other formats (like Amazon, Flipkart, or GSTR-1).

Key advantages:

- Super simple structure with just a few sheets

- Supports both document-level (individual invoices) and summary-level (totals) data

- Handles multiple GSTINs and multiple tax periods in one single file — import your entire company's sales register at once!

- Includes built-in tax period info to prevent mistakes like uploading to the wrong month

How to Import Using Octa Format

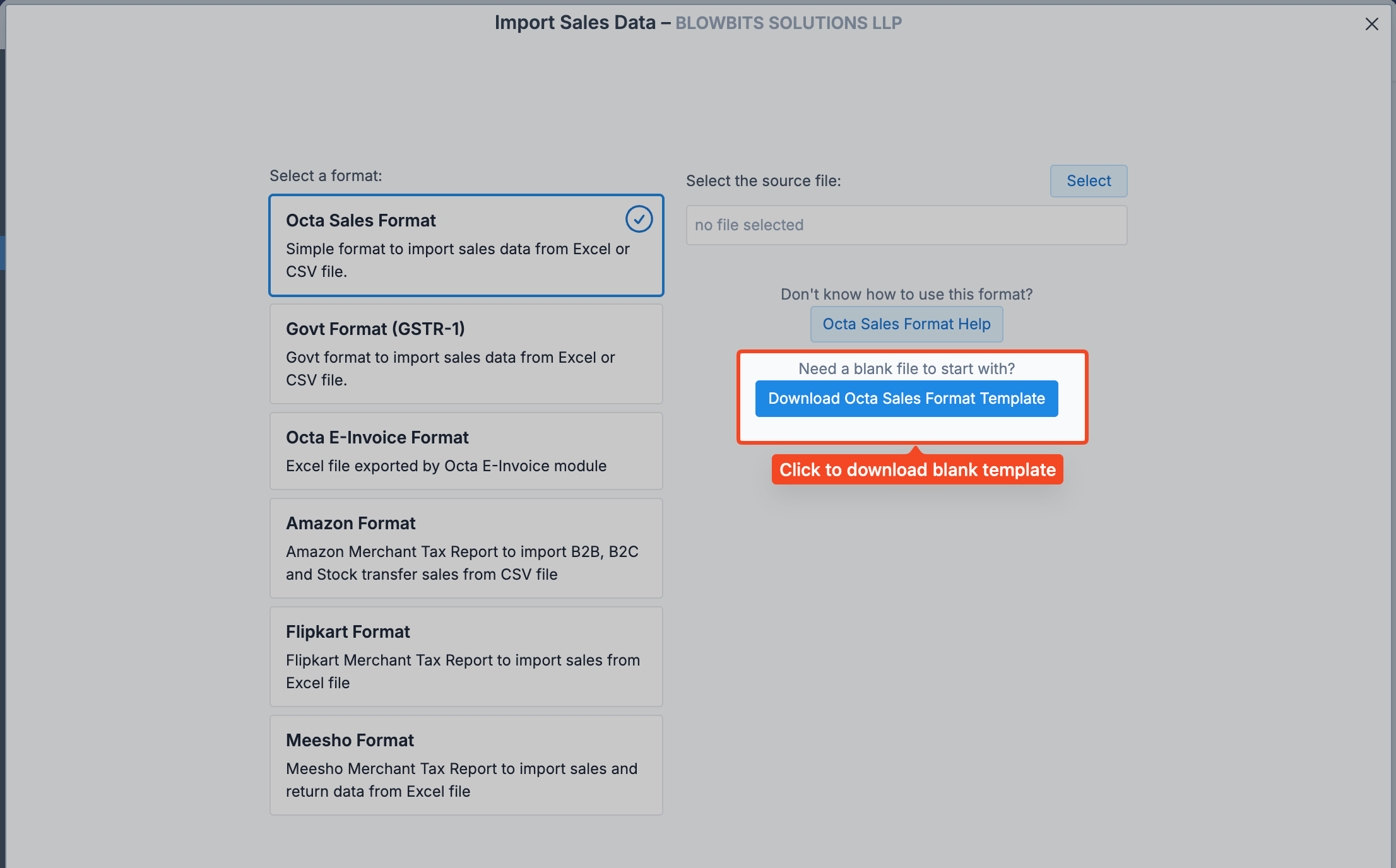

Step 1: Download the Blank Octa Template

- Open your company in Octa

- Go to the Sales page/section

- Click the Import button

- Look for the Octa Sales Format option in the dropdown/list

- Click the Download Template button (next to Octa Sales Format box)

- The blank Excel file (.xlsx) will download to your computer

Step 2: Fill the Template with Your Sales Data

Open the downloaded template — it has these key sheets:

| Sheet | What it's for |

|---|---|

| Overview | Just info & instructions (Octa ignores this sheet) |

| Help | Super helpful! Explains every sheet and column in detail — read this first! |

| Sales | Enter document-level data (individual invoices, credit notes, etc.) — recommended! |

| SalesSummary | Enter summary-level totals (only if document-level isn't available) |

| SalesHSN | Enter HSN-wise summary (only if HSN code and quantity is not specified in Sales sheet) |

| DocIssued | List document number series used in the period |

| References | Master lists for codes (state codes, UQC (unit quantity codes), etc.) |

Color coding in the template makes it easy:

- Blue columns → Mandatory (must fill)

- Green columns → Optional (fill if you have the info)

- Light Blue columns → Conditional (only required in specific cases, like exports or e-commerce)

If possible, always import at document level including HSN codes (using the Sales sheet) — even for B2C sales. Octa will automatically calculate all summaries (B2C, HSN, e-commerce, etc.) for you — accurate and zero effort!

Never import the same transaction at both document level and summary level. This causes double counting of sales, taxes, and liability — leading to wrong GSTR-1 totals.

Step 3: Import into Octa

- Open your company in Octa (same as Step 1)

- Go back to the Sales page

- Click the Import button again

- From the format dropdown, select Octa Format

- Upload the filled Excel file you prepared

- Click Continue and follow the simple on-screen prompts (Octa will guide you!)

The import is lightning-fast — usually done in under a minute!

What Happens If There Are Errors?

Octa checks everything before importing. Nothing is imported until the file is error free.

- If issues are found, you'll see a clear error list with row/sheet details.

- You can download an Error Report Excel file.

- Correct the problems in your template, save, and re-upload — repeat until all errors are gone!

This format gives you maximum control and flexibility — ideal for businesses with complex sales or multiple GSTINs. If filling the template feels tricky or you need help mapping your data, raise a support ticket — our team can guide you!