Invoice Management System (IMS)

Import Actions

Octa GST provides two ways to take action on IMS records — either directly through reconciliation or by using the export/import method.

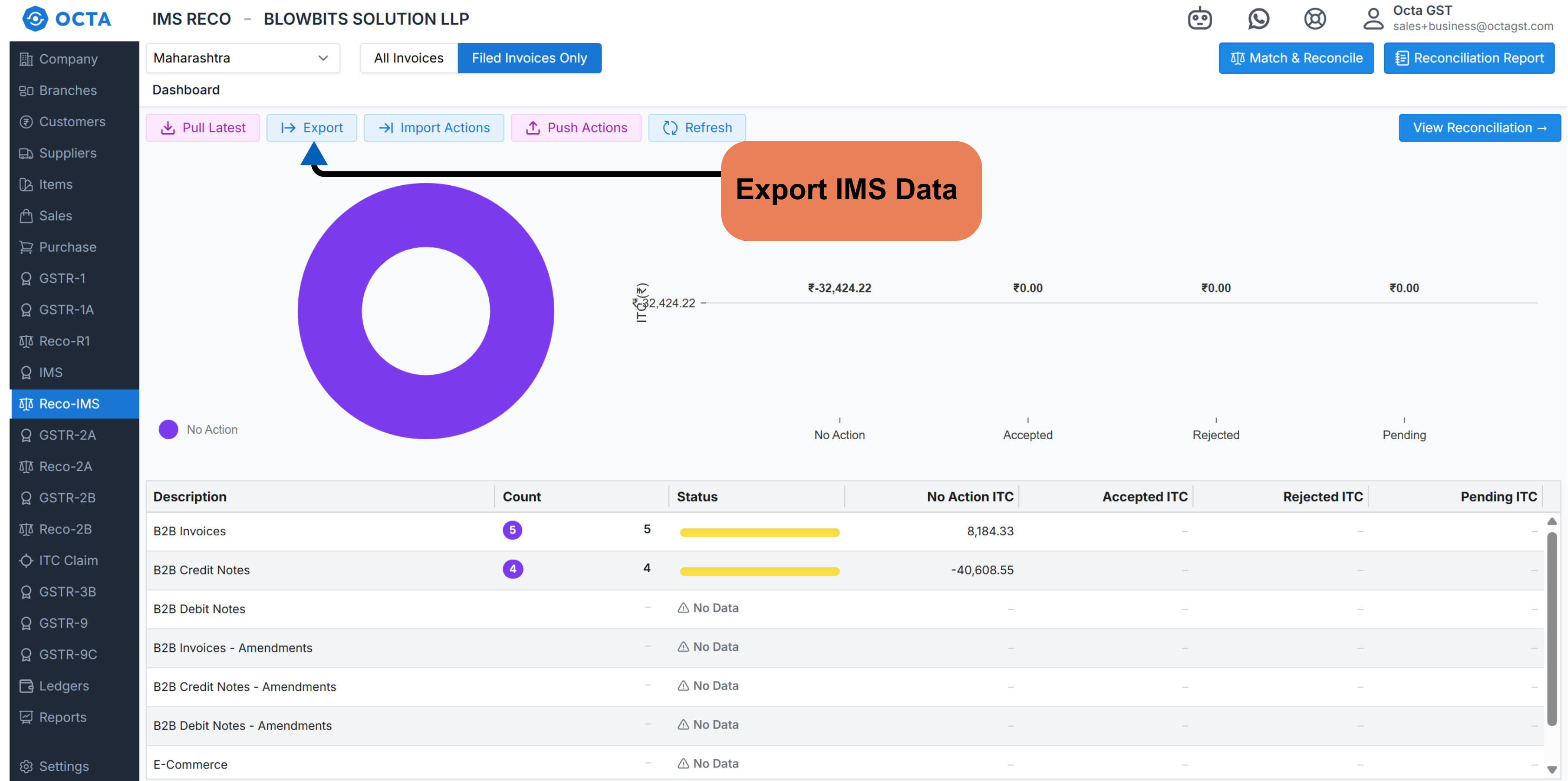

- Export the IMS File

- Navigate to Reco IMS in Octa GST.

- Click the Export button.

- The IMS report will be generated under the Robot tab.

- Download the IMS Excel file from the Robot tab.

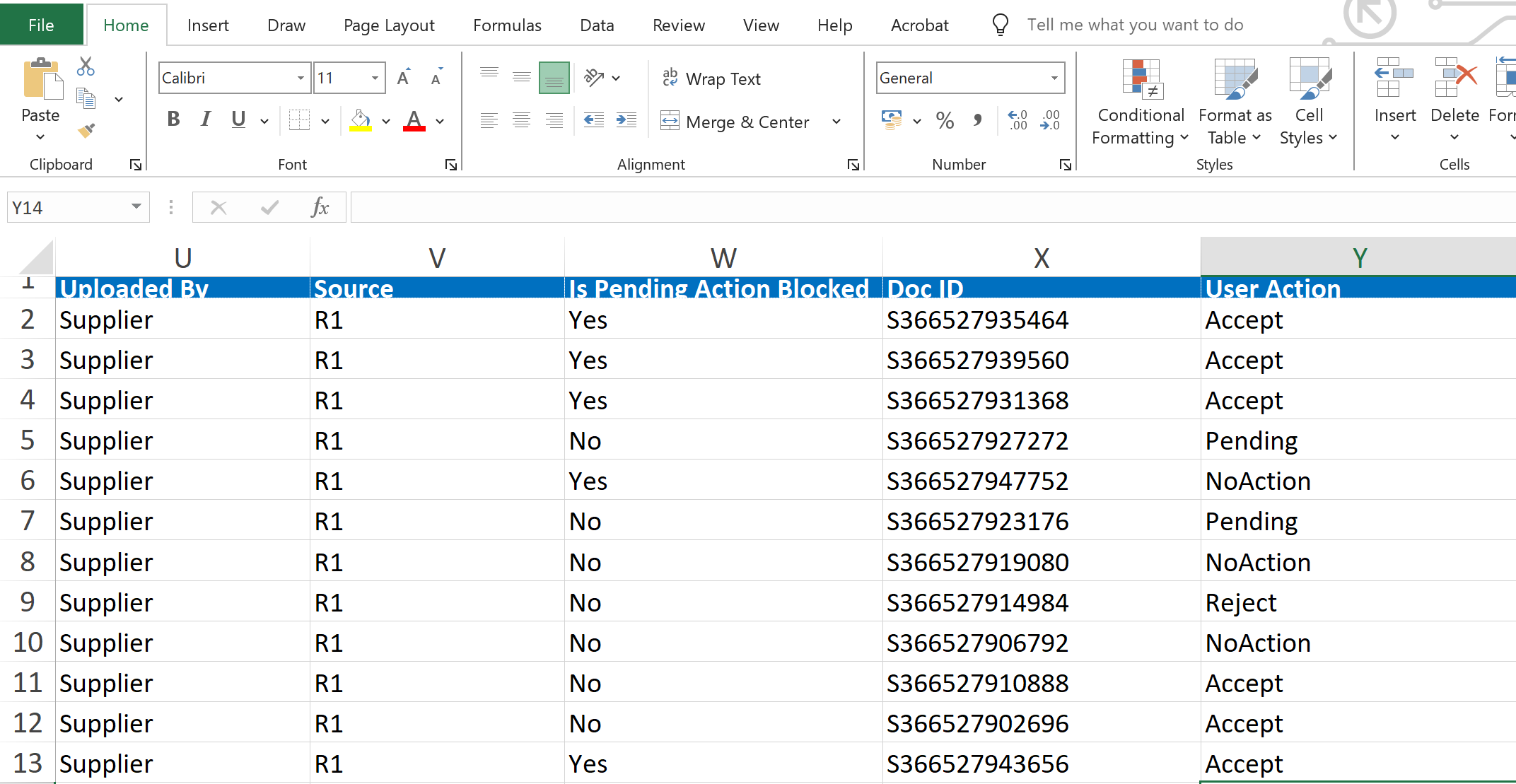

- Update Actions in Excel

- Open the downloaded IMS Excel file.

- In the last column, User Action, update the status for each record as Accept, Reject, Pending, or No Action

according to your requirement.

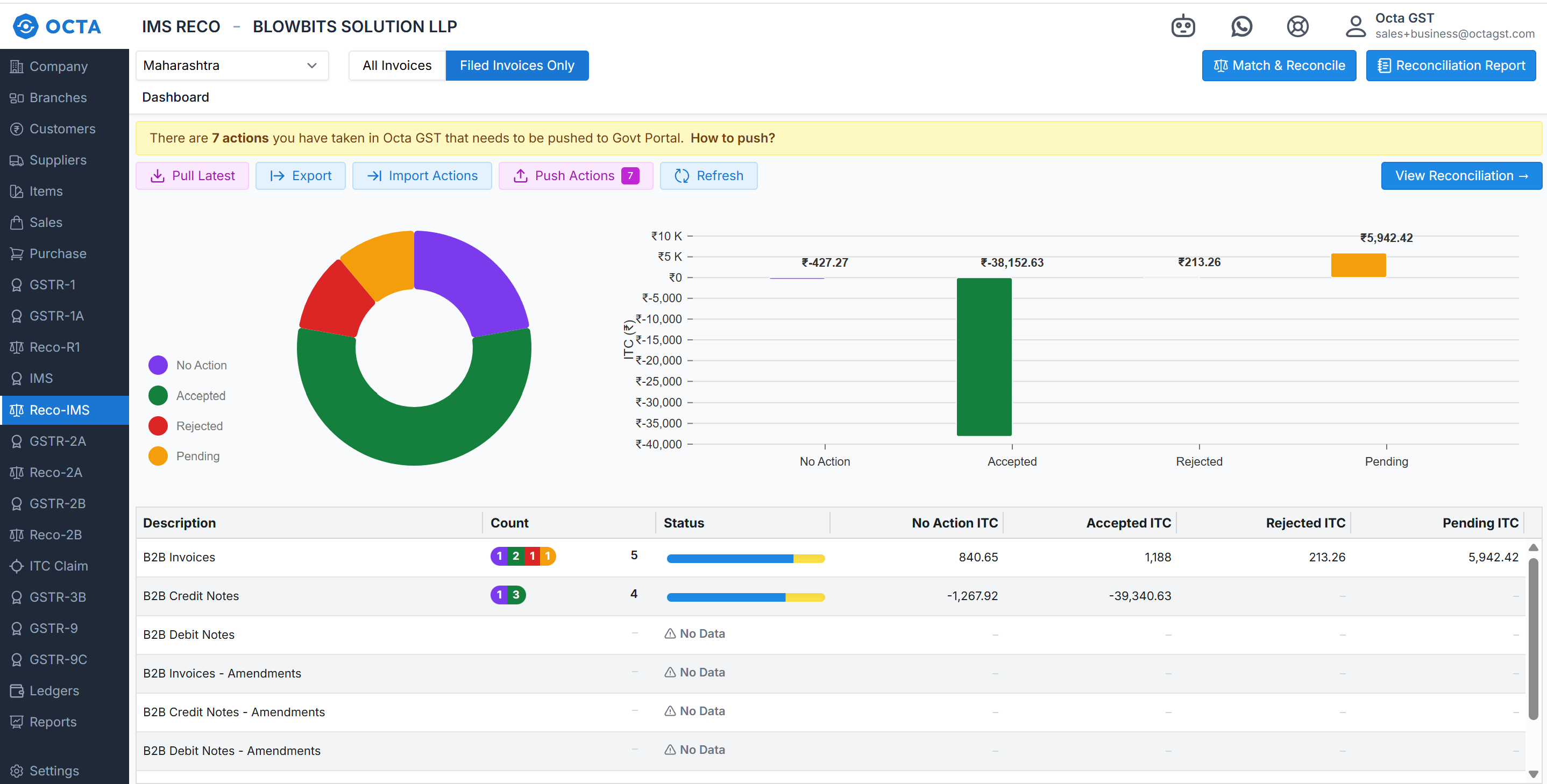

- Import the Updated Actions Back to Octa

- Return to the IMS Reco Dashboard in Octa GST.

- Click Import Actions.

- Select and upload the updated IMS Excel file.

Once imported, your chosen actions will be updated in Octa GST. You can then push the actions to the GST Portal directly from Octa.