GSTR-2B Reconciliation

Invoice Matching

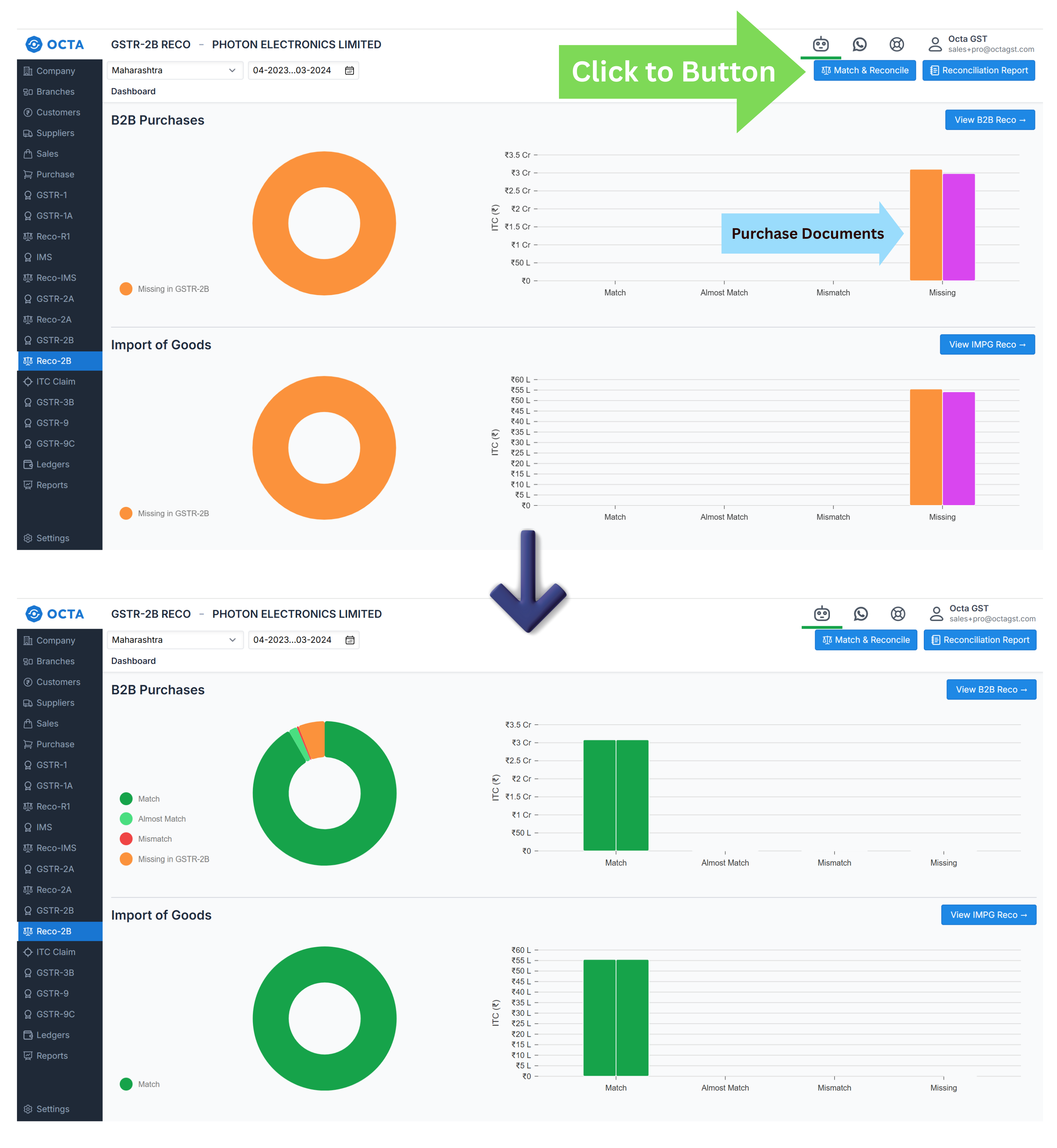

For matching the GSTR-2B with the Purchase Register, navigate to the GSTR-2B Reconciliation section in Octa GST. When you click on GSTR-2B Reco, the GSTR-2B Reconciliation Dashboard will open. First, select the period for which you want to reconcile the Purchase Register with GSTR-2B. After selecting the period, two coloured rows will appear: one in orange and another in purple. Here, orange represents Purchase documents, and purple represents GSTR-2B documents.

To perform the reconciliation, click on Match and Reconcile. The system will automatically match the data and

update the dashboard. In the reconciliation view:

- Fields matching perfectly are shown in green.

- Fields almost matching are shown in light green.

- Fields not matching are shown in red.

- Orange indicates Purchase documents that remain unmatched.

- Purple indicates GSTR-2B documents that could not be reconciled with your Purchase Register.

Match

Match indicates that a purchase document is fully aligned with its corresponding GSTR-2B entry. This means the document is completely identified, and all details—such as invoice number, date, and taxable value—exactly correspond between the Purchase Register and GSTR-2B. When a document is fully matched, there are no discrepancies, ensuring that the record is accurate, verified.

Almost Match

Almost matching, also called smart matching, occurs when a purchase document and the corresponding GSTR-2B entry are not exactly identical but are close enough for the system to recognize a probable match. This could happen due to minor differences, such as rounding off of amounts, slight discrepancies in invoice details, or variations in entry formats. The smart matching feature helps identify these near matches, allowing taxpayers to quickly verify and reconcile documents without manually checking each small discrepancy.

Mismatch

Mismatch means that a purchase document does not match the corresponding GSTR-2B document. This indicates that the system could not find a proper alignment between the invoice in the Purchase Register and its corresponding GSTR-2B entry.

Missing in 2B

Not in GSTR-2B (shown in orange) indicates that a purchase document exists in the Purchase Register but does not have a corresponding entry in GSTR-2B. This means the invoice has been recorded in the books but is not reflected in the government portal data.

Missing in Purchase

Missing in Purchase Register (shown in purple) indicates that a GSTR-2B document exists in the government portal but does not have a corresponding purchase entry in the Purchase Register. This means the invoice is recorded in GSTR-2B but is absent in the books of the taxpayer.