GSTR-2B Reconciliation

Reconciliation Report

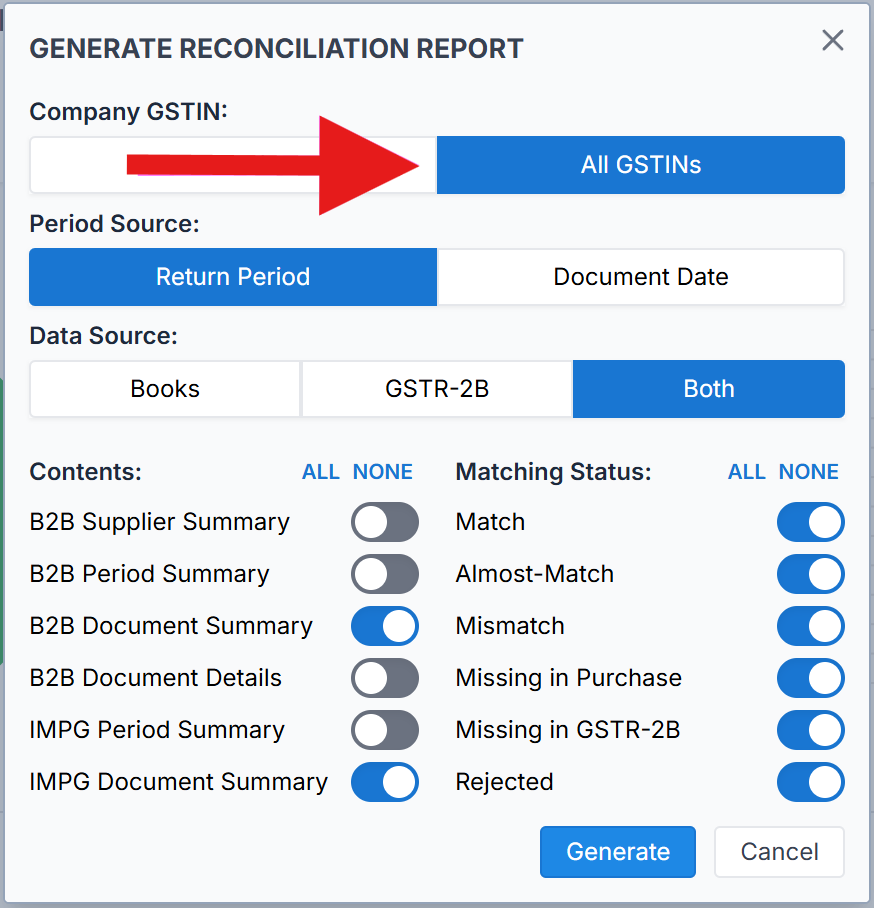

Octa GST provide you export the reconciliation report in Excel format. To do this, simply navigate to the GSTR-2B Reconciliation tab, select the period, and click the Reconciliation Report button on to right corner. A window will open where you can configure several options to generate the report:

-

Period Source – Choose what period documents are picked for the report:

- Document Date: only documents with that period’s document date will appear.

- Return Period: all documents filed in that return period will appear, regardless of document date.

-

Data Source – Specify which data Source you want to export: Books, GSTR-2B, or Both (exporting Both is recommended for a better understanding).

-

Filter the Content – Refine the data before export. Octa GST lets you create different types of reports such for analysis of reconciliation like B2B Supplier Summary, B2B Period Summary, B2B Document Summary, B2B Document Details, IMPG Period Summary, and IMPG Document Summary.

-

Filter by Matching Results – Export only selected reconciliation status, for example: Match, Almost-Match, Mismatch, Missing in Purchase, Missing in GSTR-2B, or Rejected.

After checking the configuration, click on generate. The report will be generated in robot tab.

To download the report, navigate to the Robot tab in the top-right corner and

click Download.

Type of Reports

Octa GST provides multiple types of reconciliation reports for analysis. These include:

-

B2B Supplier Summary - This report gives a supplier-wise reconciliation summary. It shows each supplier’s name, GSTIN, total number of purchase records, total number of GSTR-2B records, matched status counts, tax amounts as per Books vs. GSTR-2B, and the tax differences. It’s useful to quickly identify which suppliers have discrepancies and which are fully matched.

-

B2B Period Summary - This report provides a period-wise summary of B2B transactions. It displays the total purchase tax amount and GSTR-2B tax amount for each period, the difference between them, the count of purchase and 2B documents, the count difference, and the matching results in numbers. This helps you quickly identify periods with discrepancies and analyse reconciliation trends over time.

-

B2B Document Summary - This report provides a summary at the document level for all B2B transactions. It shows each invoice or document, the corresponding purchase and GSTR-2B tax amounts, the difference, and the matching status (Match, Almost-Match, Mismatch, Missing in Purchase, Missing in GSTR-2B, or Rejected). This report helps quickly identify specific documents that need attention during reconciliation.

-

B2B Document Details - This report provides a detailed, line-by-line view of each B2B transaction. It includes all relevant information such as invoice number, date, supplier details, taxable value, tax amounts, and reconciliation status. This report is useful for a deep dive analysis, allowing users to review every entry in detail and identify discrepancies at the most granular level.

-

IMPG Period Summary - This report provides a period-wise summary of import of goods (IMPG) transactions. It shows the total purchase and GSTR-2B tax amounts, the difference, the count of IMPG documents, the count difference, and the matching results in numbers for each period. This helps in analysing import-related transactions over time and identifying discrepancies for reconciliation purposes.

-

IMPG Document Summary - This report provides a document-level summary for import of goods (IMPG) transactions. It shows each import invoice or document, the corresponding purchase and GSTR-2B tax amounts, the difference, and the matching status (Match, Almost-Match, Mismatch, Missing in Purchase, Missing in GSTR-2B, or Rejected). This report helps identify specific import-related documents that require attention during reconciliation.

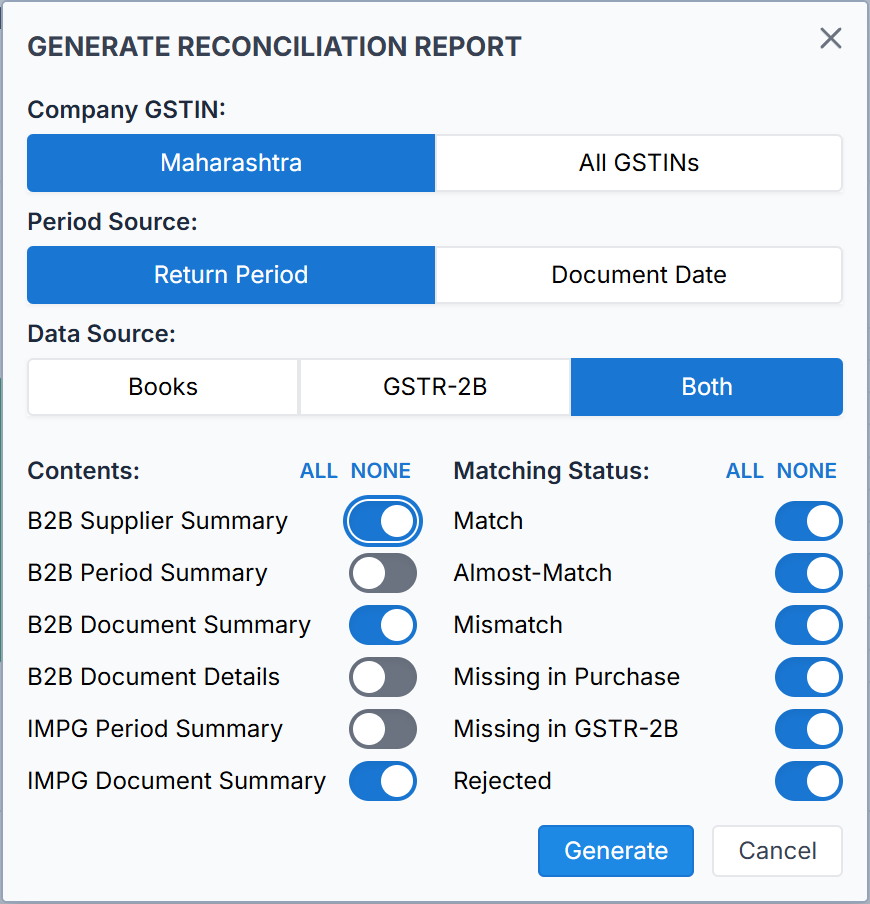

PAN Level Reconciliation Report

When you click Generate Report, and if more than one GSTIN under the same PAN is added in Octa GST, an additional

configuration option will appear at the top. Here, you can choose to generate the report for all GSTINs or select

specific GSTINs. If you select All GSTINs, a PAN-level reconciliation report will be generated, providing a consolidated

view of all GSTINs under that PAN.