Getting Started

Managing Companies

In Octa GST, the term “Company” refers to the taxable person whose GST compliance you’re managing. This could be any registered entity under GST.

Each “company” represents GST-registered entity. You can:

- Add a new company by entering its GSTIN.

- Manage multiple companies under a single Octa GST login.

- Switch between companies easily to view or file returns, reconcile data, and generate reports.

This structure makes it simple to handle GST compliance for any taxable person, regardless of its business structure.

How To Add Company

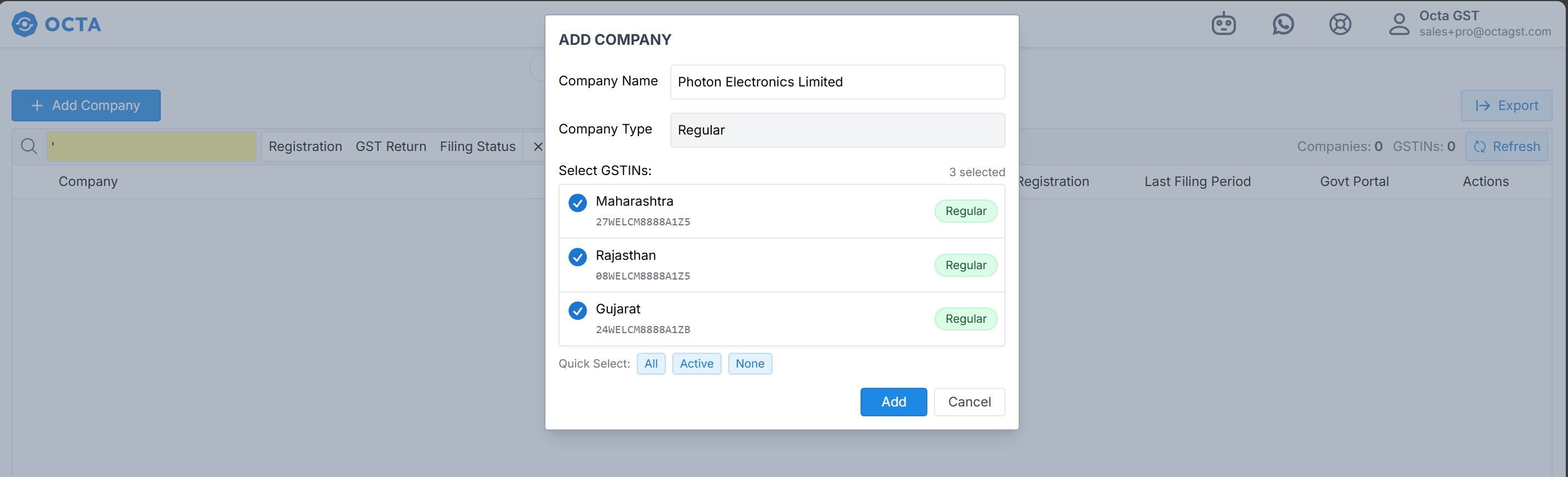

After logging in, Home Page will open. Here, We can add company. In Octa GST, a “company” can include multiple GSTINs under the same PAN. To add a company:

- Click on the Add Company button.

- Enter the GSTIN you want to add.

- Octa GST will check if the PAN has multiple GSTINs.

- If multiple GSTINs exist, you can select the specific GSTIN you want to use for GST compliance within Octa GST.

Review the GSTIN Selection tab to confirm whether cancelled GSTINs should be added or excluded.

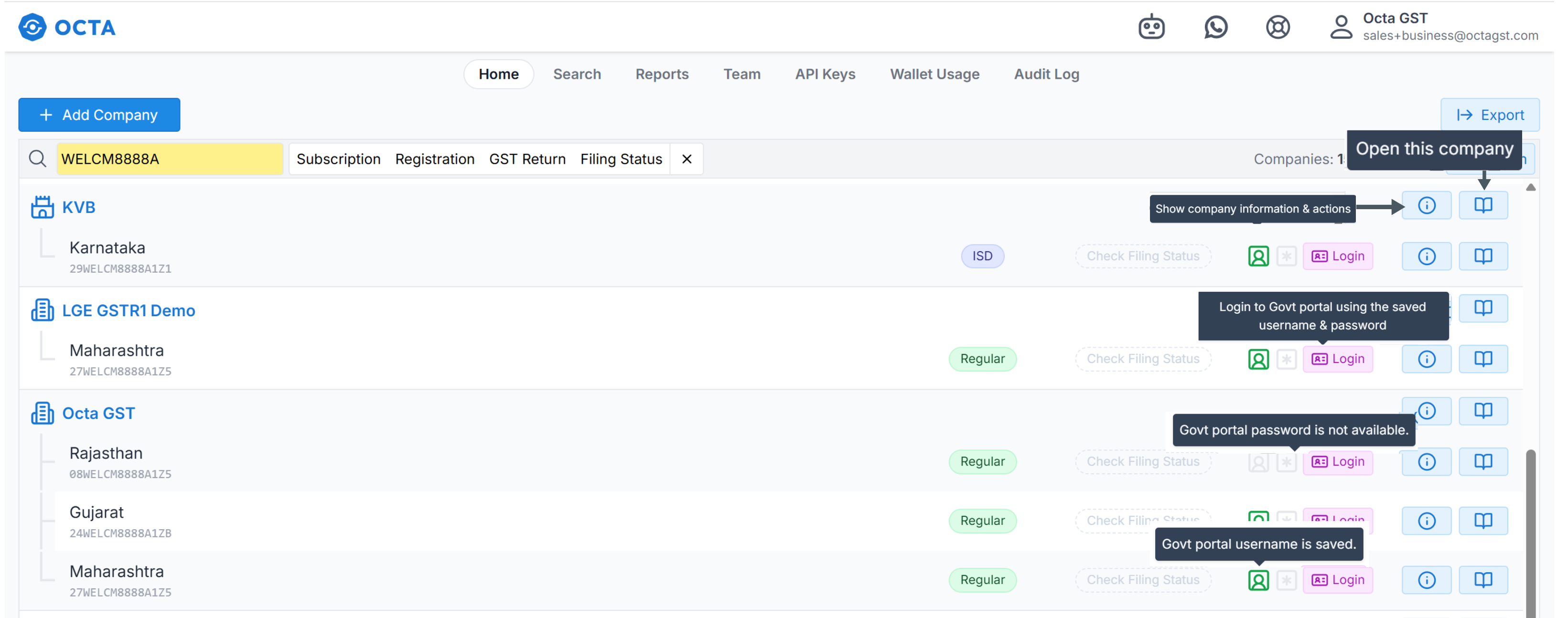

Open company

To open a company, simply click on the company name or use the Open Company button.

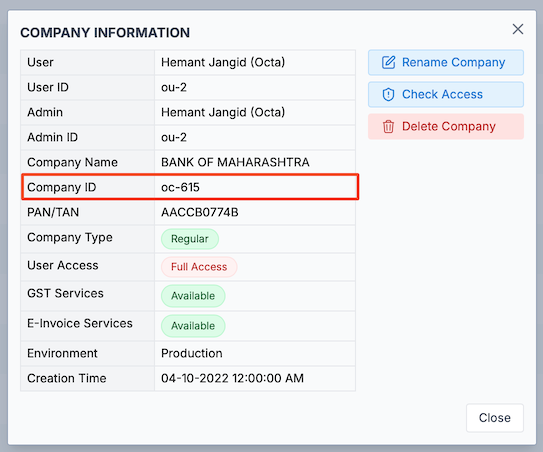

For information about the company, click on the ⓘ button (Show Company information and actions) to view its details. To check the details of a GSTIN added under that company, click on the ⓘ button (Show GSTIN Information and action) in front of the GSTIN to view its information.

To delete a company in Octa GST, click on the company information ⓘ button, where you will find the option to delete the company.

Company Information and actions:

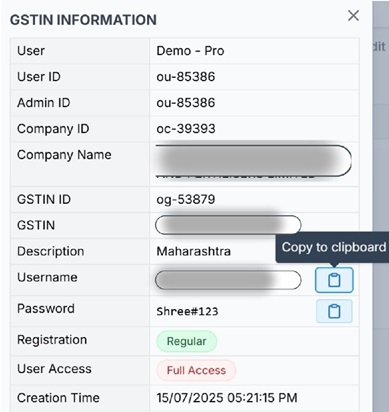

GSTIN Information and action: