GSTR-2B Reconciliation

Import GSTR-2B

Step-1 GSTR-2B Dashboard

First, navigate to the GSTR-2B Dashboard in Octa GST. To do this

- Log in and Select Company: Log in to Octa GST, select the company you want to work with, and open it.

- Navigate to GSTR-2B Tab: Go to the GSTR-2B tab. This will open the GSTR-2B dashboard for all periods.

- Check Data Status: Hover your mouse over any period to see whether data is available or not.

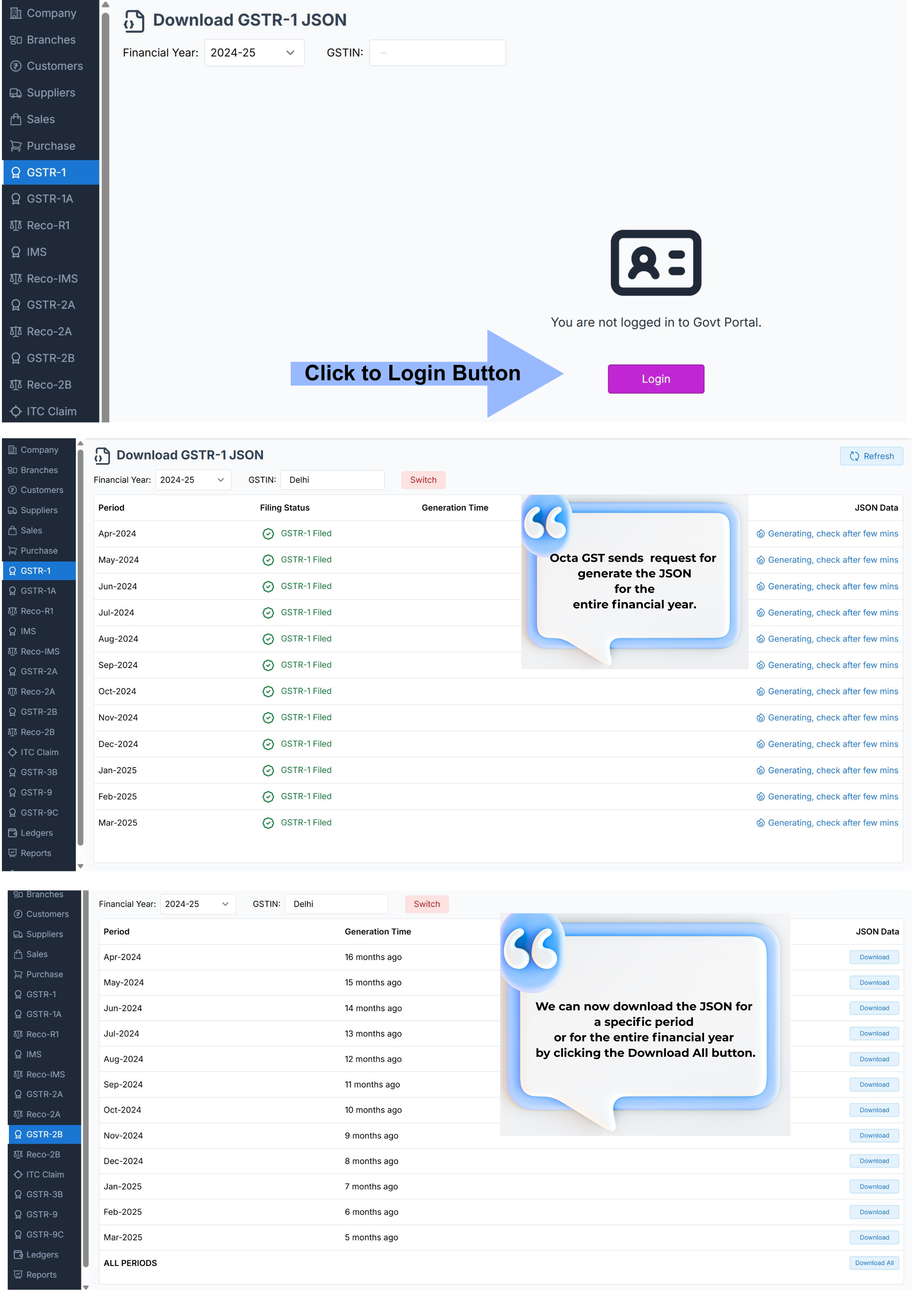

Step-2 Download JSON Files

- Click the JSON Button: In the GSTR-2B dashboard, click the JSON button.

- Log In to the GST Portal: A login tab will open. Click the Login button and enter your GST Government Portal credentials (User ID and Password).

- Generate JSON: Once logged in, the screen for JSON generation will appear.

- Full-Year Download Option: Octa GST allows you to download the JSON file for the entire financial year. In this tab, Octa GST sends the generation request to the government portal.

- Refresh and Download: After a short time, once the JSON is generated, refresh the page. The Download option will appear. Click Download to save the JSON file.

Step-3 Adding JSON Files

- Go to the GSTR-2B Dashboard: In Octa GST, open the company and navigate to the GSTR-1 tab to access the dashboard.

- Click the Import Button: On the dashboard, click the Import button.

- Select JSON Files: Click Select, then browse your computer and choose the JSON file(s) you want to import.

-

Open the Files: After selecting, click Open to confirm your selection.

-

Continue to Import: Click the Continue button to start importing the data into Octa GST. To add data into Octa GST, go to the GSTR-1 dashboard and click the Import button. Then click Select and choose the JSON file(s) from your folder — multiple files can be selected at once. After selecting the file(s), click Open, and then click the Continue button to proceed with the import.

Pull data (using OTP)

Octa GST also provides a data pull option to fetch data directly from the government portal without using JSON. To use this feature, Octa GST must first be connected to the GST portal. To pull data, click the Pull button, select the desired period, and then click Continue. The system will retrieve data from the government portal for that period.