Getting Started

Overview

Octa GST is a comprehensive GST compliance software designed to simplify and automate GST processes for every taxable person. With its intuitive visual interface and streamlined workflows, Octa enables users to efficiently manage multiple GSTINs under a single PAN, reconcile data, file returns, and maintain compliance with GST regulations - all in one place.

Login

To access Octa GST, open any web browser and enter octagst.com in the address bar. you will be directed to the login page. Here, existing users can enter their registered email ID and password to log in securely.

For new users you will need to complete the registration process first. Click on the Register button on the login page, provide the required details such as email ID, mobile number, and password, and complete the verification steps. After successful registration, you can return to the login page and sign in using your newly created credentials.

Home Page

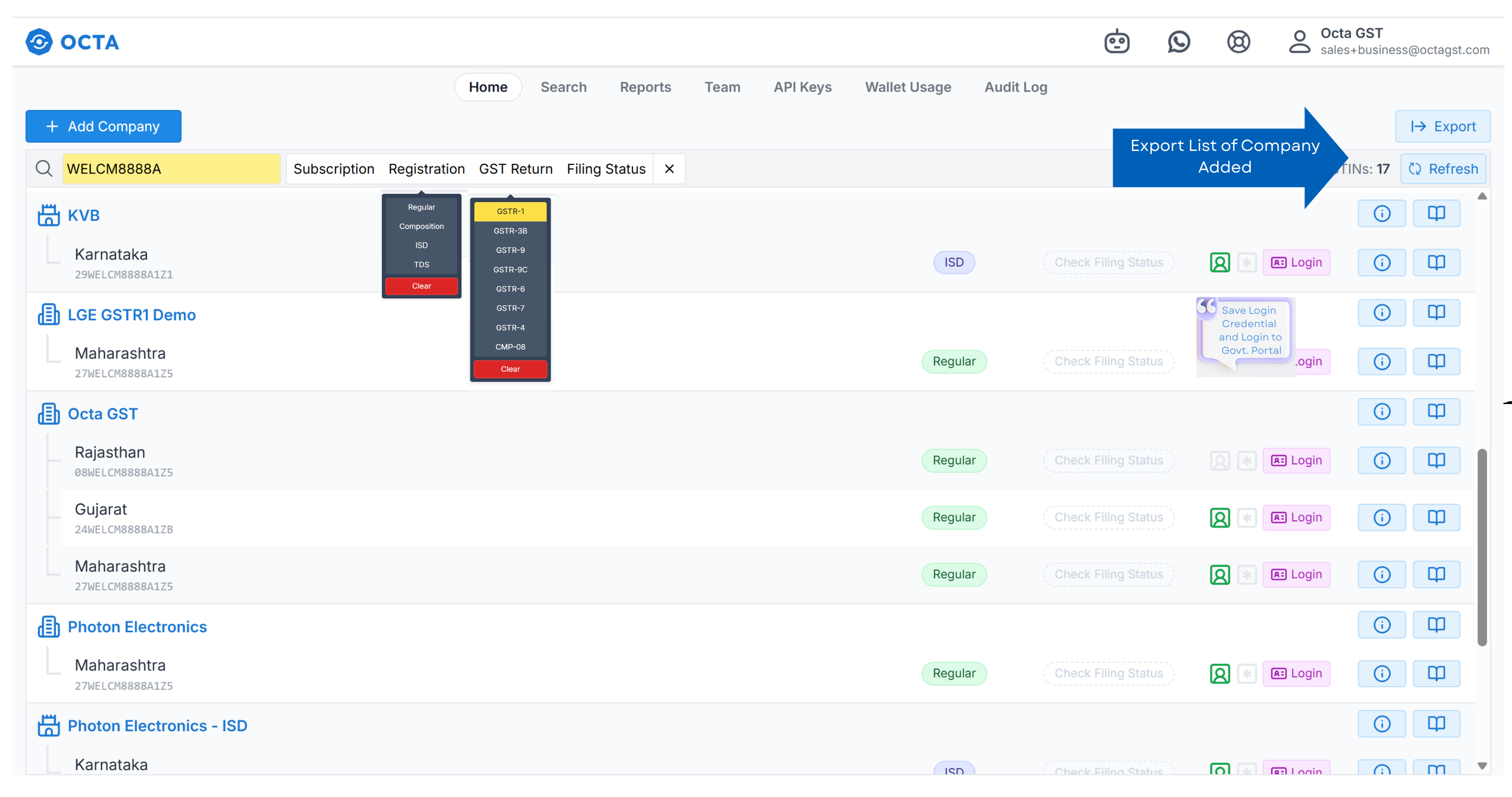

The Home Page of Octa GST serves as the central hub for managing all GST-related activities for your companies. Once logged in, you are presented with an intuitive interface that allows quick access to key features and tools.

Key Features of the Home Page:

- Add and Manage Companies - You can add, alter and delete company.

- Once added, you can select a company to start managing its GST operations, including return filing, data reconciliation, and report generation.

- Company List and Export -The Home Page displays a list of all added companies along with their GSTINs. You can export this list for record-keeping or compliance purposes.

- Government Portal Access - Octa allows you to save government login credentials to connect directly with the GST portal. This enables features like data pull, JSON download, and filing, eliminating the need to repeatedly log in to the GST portal.

- Filtering and Sorting - The Home Page provides powerful filtering options to quickly find companies based on registration type, GST return status and filing status. This is particularly useful for managing multiple GSTINs under the same PAN efficiently.

Additionally from home tab you can Quick access to Teams, Audit Logs, and other operational tools ensures smooth

navigation and effective GST management.