Reports

Annual Reports

Octa GST’s Reports section provides a comprehensive set of analytical reports that help businesses review and analyse GST data for the entire financial year. These reports summarize each head of data across every GST return and report, making it easier to review trends, compare performance, and take informed decisions.

A key benefit of this section is the ability to export consolidated data for all GSTINs under the same PAN. This makes it simple to combine, review, and share information across different registrations, ensuring a clear, unified view of your compliance position.

Type of Analytical Reports

- GSTR-1 Summary - The GSTR-1 Summary report in Octa GST provides a quick, consolidated view of all sections of GSTR-1 — B2B, B2C, Exports (Zero-Rated Supplies), SEZ Supplies, Advances Received/Adjusted, Nil Rated/Exempted/Non-GST Supplies etc. — for a selected financial year.

Whenever you file GSTR-9 or analyse book data for a specific period, it is important to merge both GSTR-1 and GSTR-1A. To simplify this process, Octa GST automatically reflects the effects of GSTR-1A amendments in your GSTR-1 annual summary reports. This ensures that all corrections or changes made through GSTR-1A are accurately captured, giving you a complete and compliant annual summary. For the GSTR-1A effects to be applied, the respective data must be available in the Octa system.

Unlike conventional reports, Octa GST Annual Report not only shows data for the selected financial year but also includes data if any invoices or sales reported in the next financial year that pertain to the current financial year.

- GSTR-2A Summary - The GSTR-2A Summary in Octa GST provides both month-wise and yearly consolidated summaries of all sections of GSTR-2A. This includes: B2B invoices, B2B RCM (Reverse Charge Mechanism), Amendments, ISD credits, TDS/TCS credits, Imports, and other relevant sections.

- GSTR-2B Summary - The GSTR-2B Summary in Octa GST provides both month-wise and yearly consolidated summaries of all sections of GSTR-2B. This includes: B2B invoices, B2B RCM (Reverse Charge Mechanism), Amendments, ISD credits, TDS/TCS credits, Imports, and other relevant sections.

- GSTR-3B Summary - The GSTR-3B Summary report in Octa GST provides a consolidated view of all GSTR-3B filings for a financial year. It summarizes the total outward supplies, inward supplies, input tax credits (ITC), and tax liabilities across all relevant sections.

- GSTR-1 vs GSTR-3B comparison - The GSTR-1 vs GSTR-3B Comparison report in Octa GST allows businesses to reconcile all outward supplies reported in GSTR-1 with the corresponding summary declared in GSTR-3B, covering every section including B2B, B2C, Exports, SEZ Supplies, Advances, Credit/Debit Notes, and Nil Rated/Exempted/Non-GST supplies.

- GSTR-2A vs GSTR-3B comparison - The GSTR-2A vs GSTR-3B Comparison report in Octa GST allows businesses to reconcile inward supplies summery in GSTR-2A with the corresponding summary declared in GSTR-3B, covering all sections such as B2B, B2B RCM, Amendments, Imports, and Credit/Debit Notes. This helps identify discrepancies in ITC claims.

- GSTR-2B vs GSTR-3B comparison - The GSTR-2A vs GSTR-3B Comparison report in Octa GST allows businesses to reconcile inward supplies recorded in GSTR-2A with the corresponding summary declared in GSTR-3B, covering all sections such as B2B, B2B RCM, Amendments, Imports, and Credit/Debit Notes. This helps identify discrepancies in ITC claims.

How to Download Reports

To export any analytical reports in Octa GST, the relevant data must first be uploaded into the system. This includes GSTR-1, GSTR-3B, GSTR-2A, and GSTR-2B data. Reports can only be generated for periods where the corresponding data is available in Octa. To upload the data, navigate to the respective return or report section for each GST return type and follow the upload process.

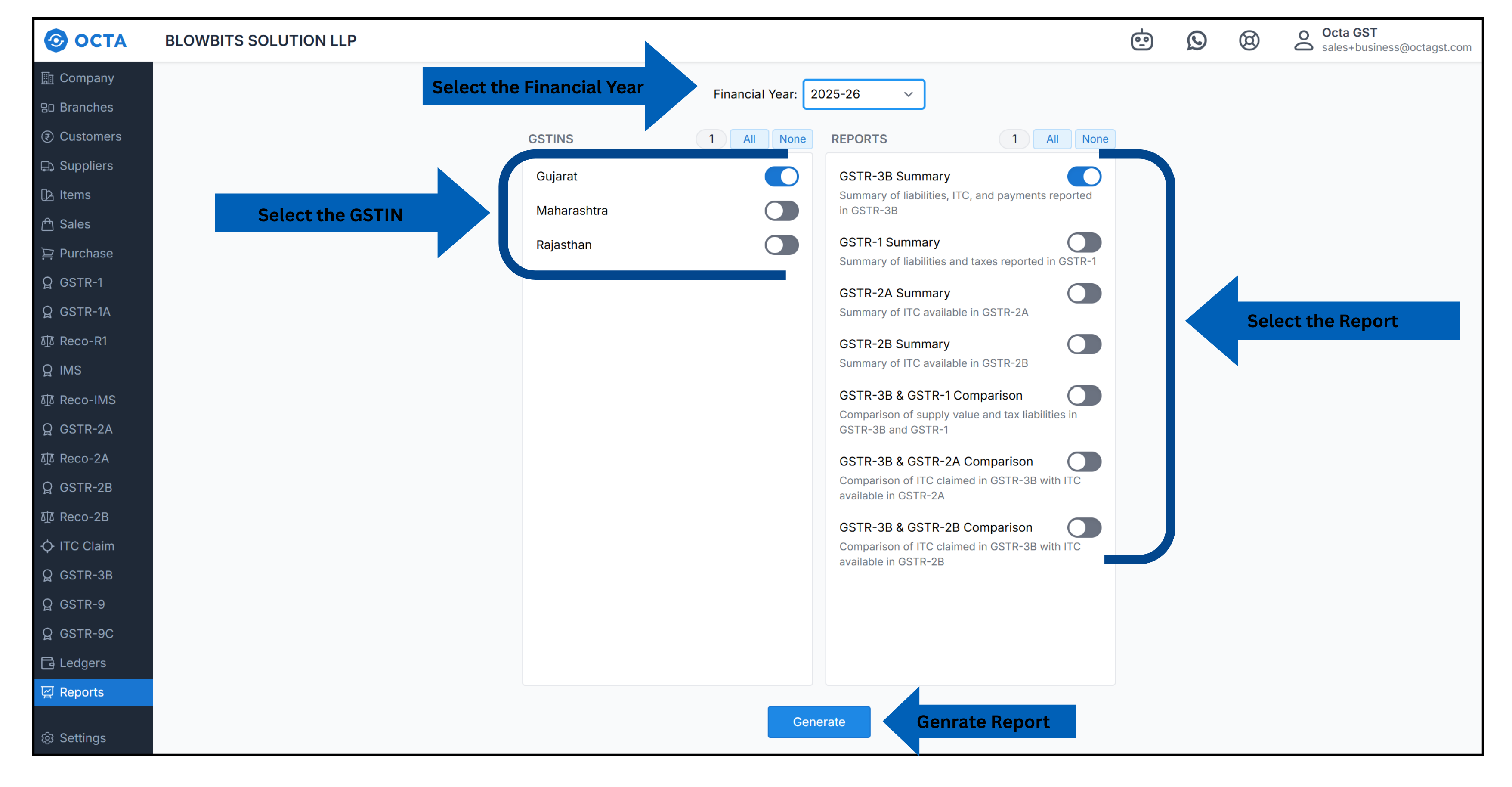

Once the data is uploaded and available, follow these steps to download the report in Octa GST:

- Navigate to the Reports section.

- Select the report you want to export.

- Choose the financial year for which the report is required.

- Select the GSTIN.

- Click Generate.

- To download the report check robot tab.