GSTR-2B Reconciliation

Invoice Reconciliation

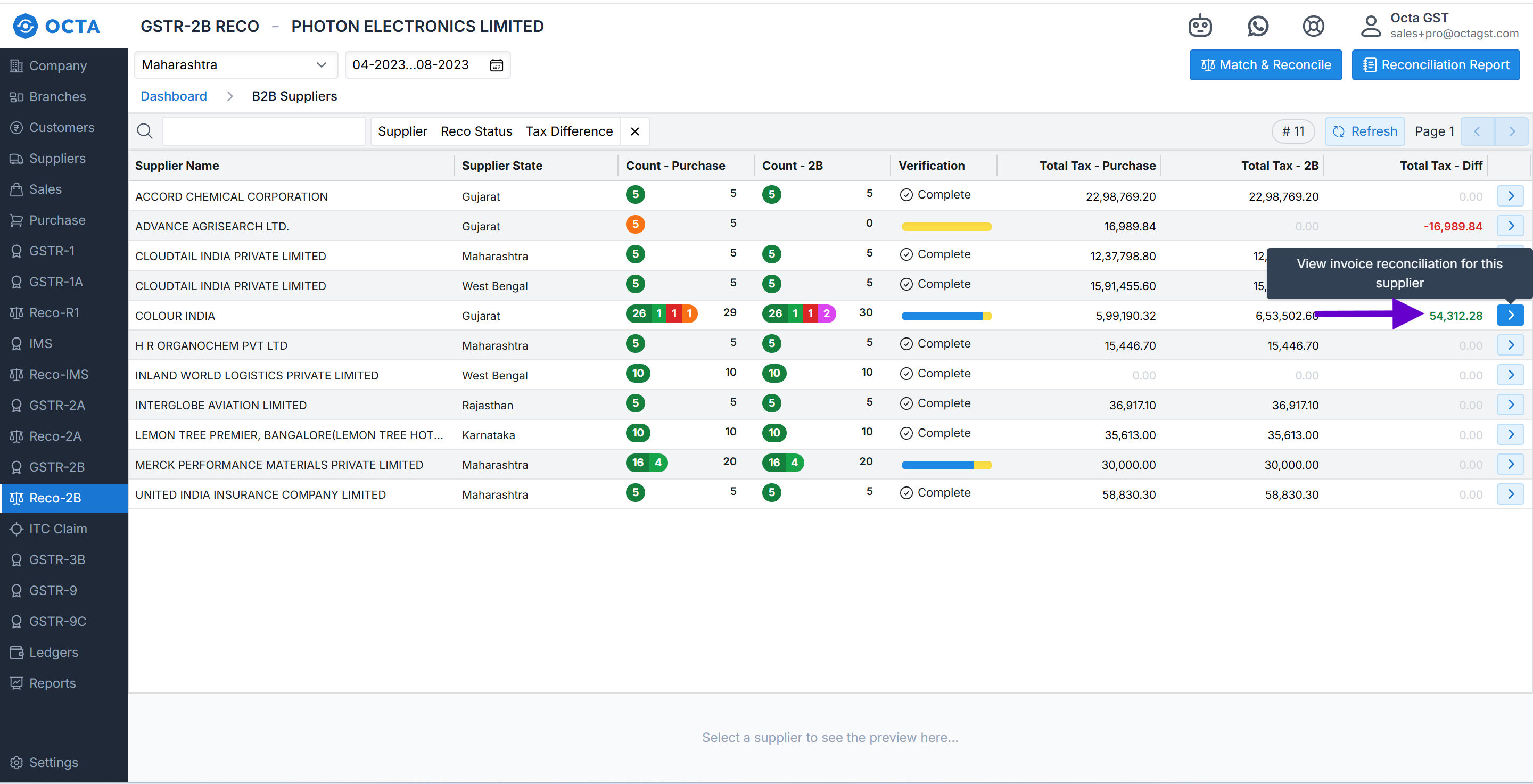

To check the invoice-level reconciliation for any particular supplier, Octa GST provides an option to view detailed

invoice-level data. To access this, click the arrow button on the right side of the supplier’s row. The Invoice-Level

Dashboard for that supplier will open. In this tab, you can filter documents based on reconciliation status.

Additionally, this dashboard offers multiple functionalities to analyse the data in detail, which is explained one by

one.

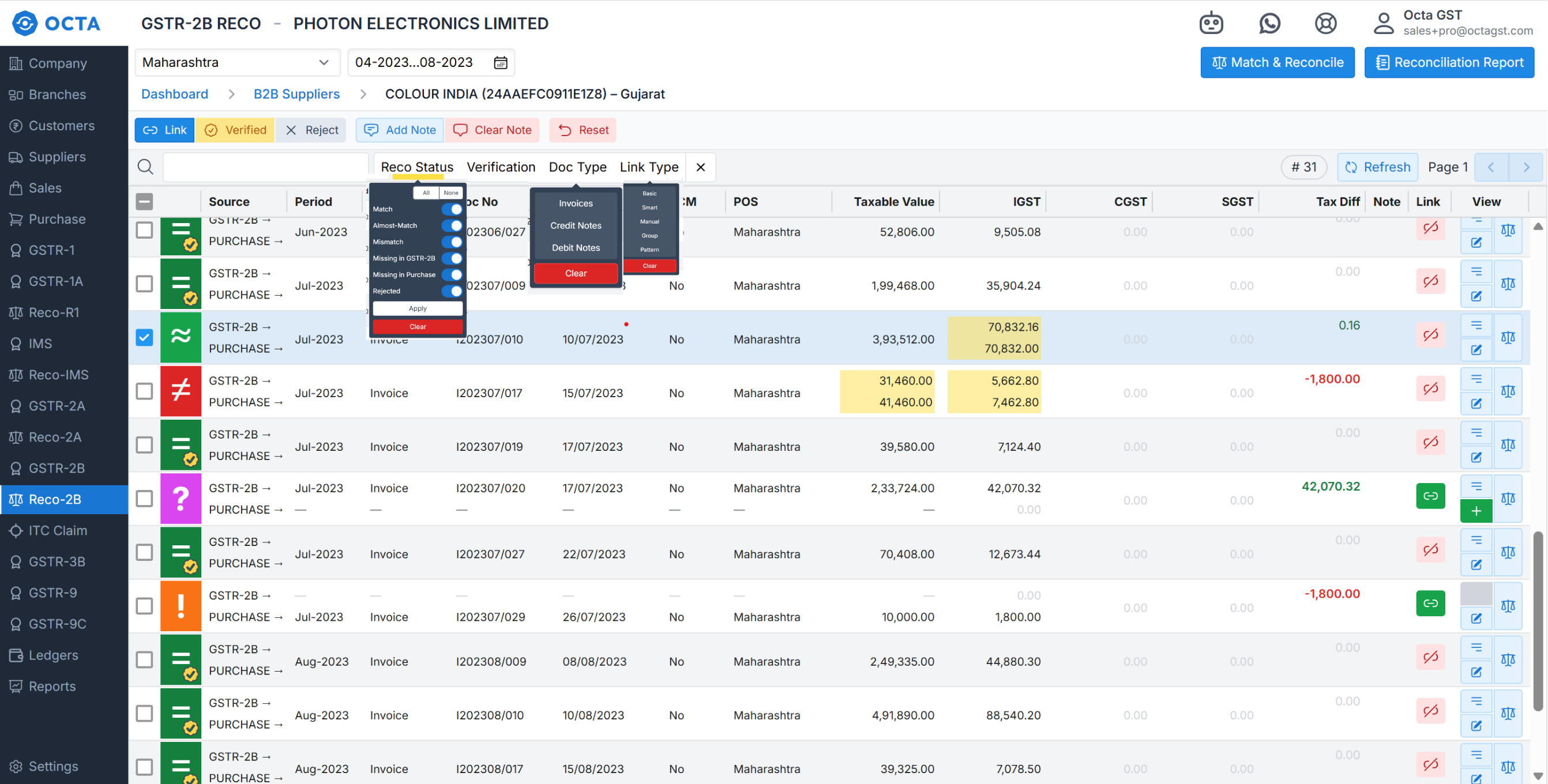

Filter the Document

Invoice-Level Dashboard, you can filter documents by several criteria:

- Reco Status – Matched, Almost Match (Smart Match), Mismatched, Missing in GSTR-2B, Missing in Purchase.

- Verification – Verified or Unverified.

- Document Type – Invoice, Debit Note, Credit Note.

- Link Type – Basic, Smart, Manual, Group.

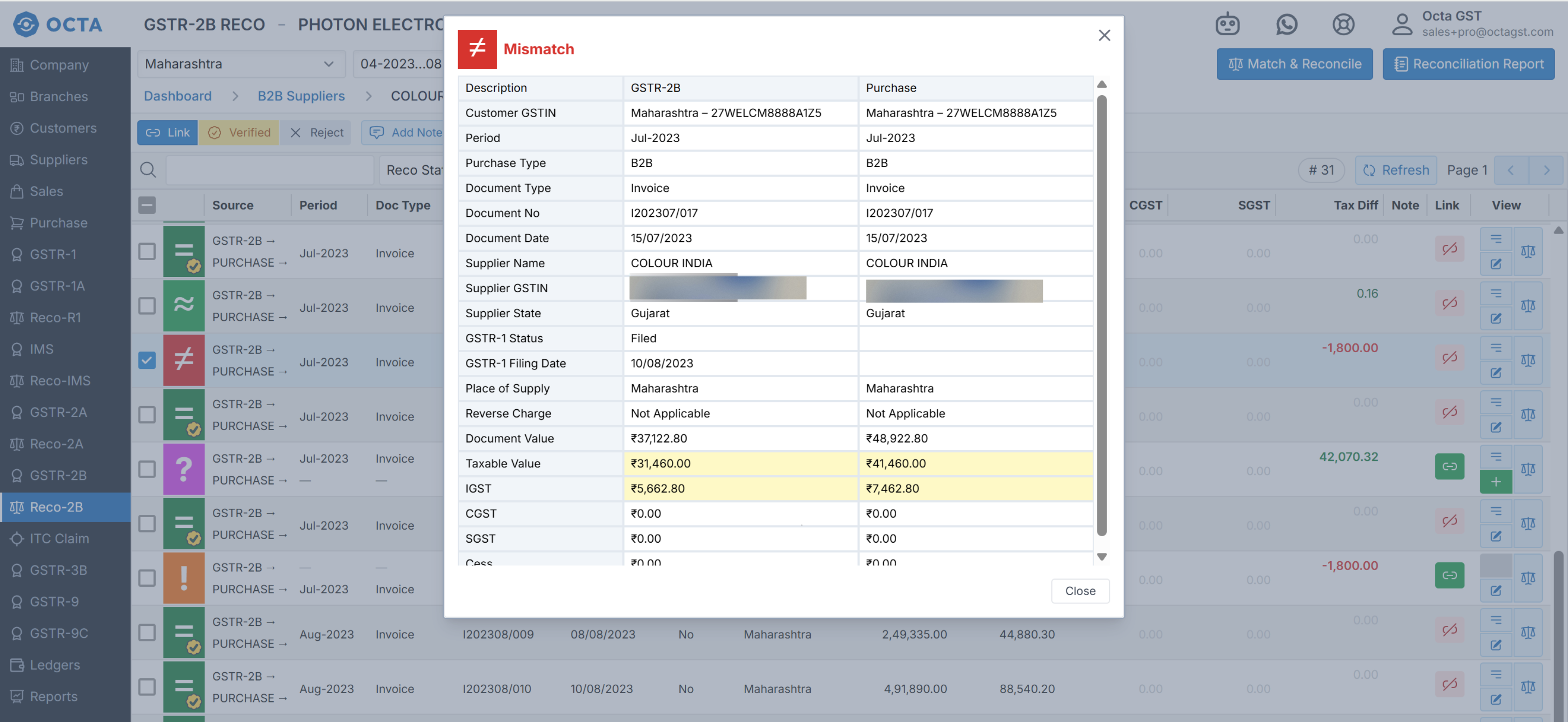

Side By Side full comparison

If you double-click any document, a side-by-side view of the full reconciliation data for that document will

open. This allows you to identify multiple differences within a single invoice or document, making it easier to review

discrepancies and verify the accuracy of your records.

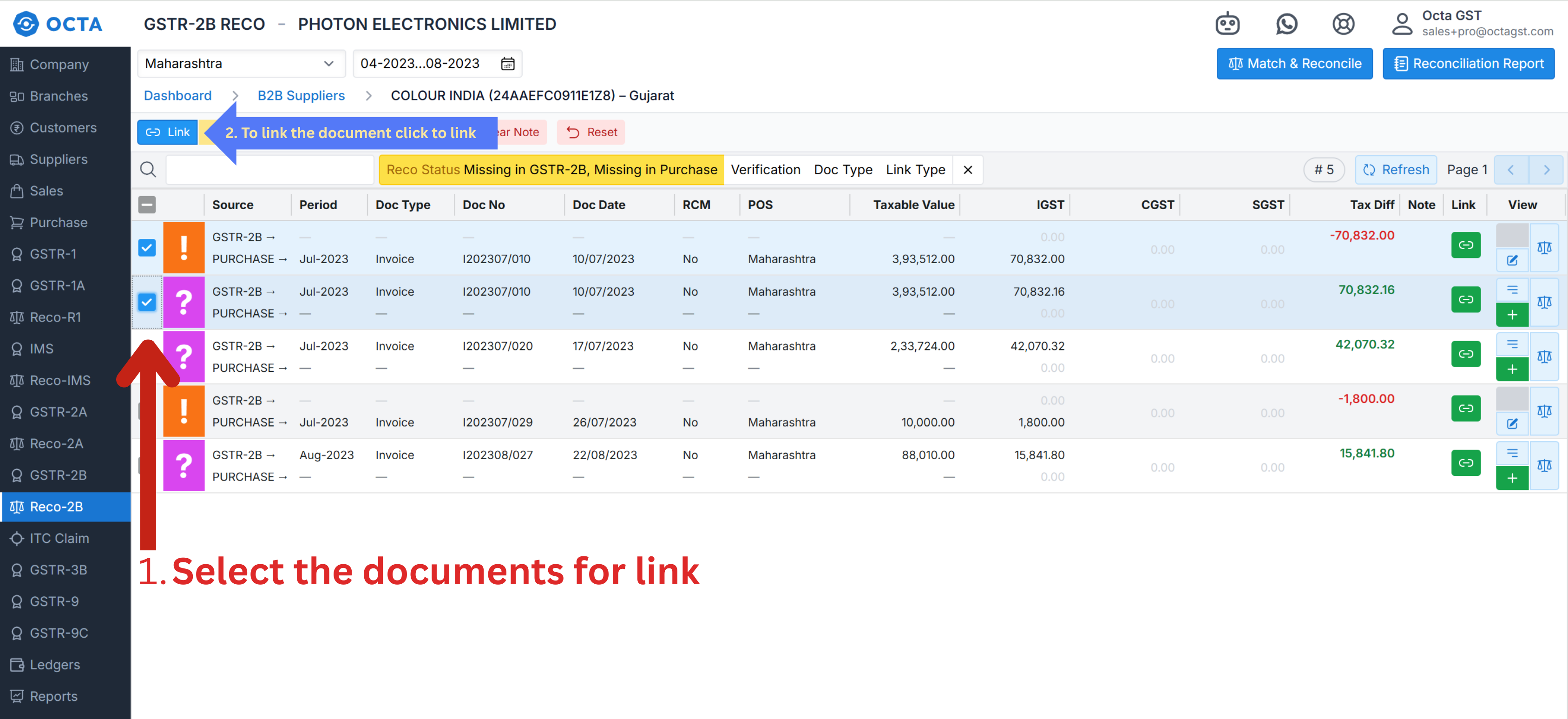

Manual Linking

If during a manual check you find that a document should be reconciled with another document—whether it is GSTR-2B to

GSTR-2B, Purchase to Purchase, or GSTR-2B with Purchase—you can do so manually. To link the documents, select both

documents that you want to reconcile and click the Link button located on the upper-left side of the dashboard. This

allows you to manually correct any unmatched or unlinked documents for accurate reconciliation.

Group Linking

If any document is accounted on a net basis or, for any other reason, two or more documents are recorded as a single invoice, you can use the group linking feature in Octa GST. In such a scenario, select all documents that need to be linked together and click the Link button. This allows multiple documents to be reconciled as a group, ensuring accurate reconciliation even for aggregated entries.

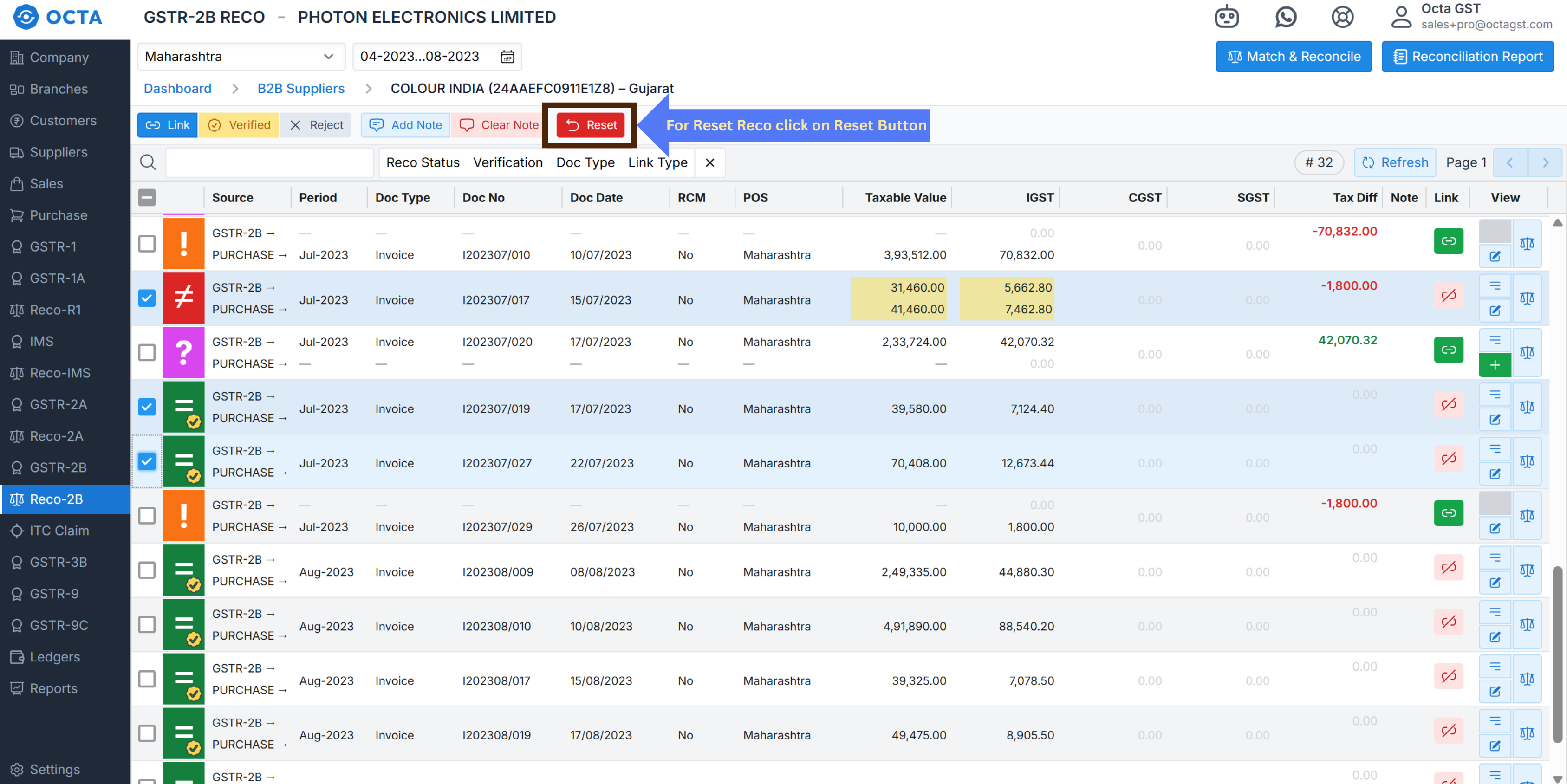

Reset button

The Invoice-wise Reconciliation Dashboard in Octa GST provides several action buttons. Among these, the Reset button,

highlighted in red, allows you to reset the reconciliation of selected documents. To use this feature, simply select the

documents you want to reset and then click the Reset button. This will unlink the selected documents, effectively

removing their existing reconciliation status so you can reconcile them again as needed.

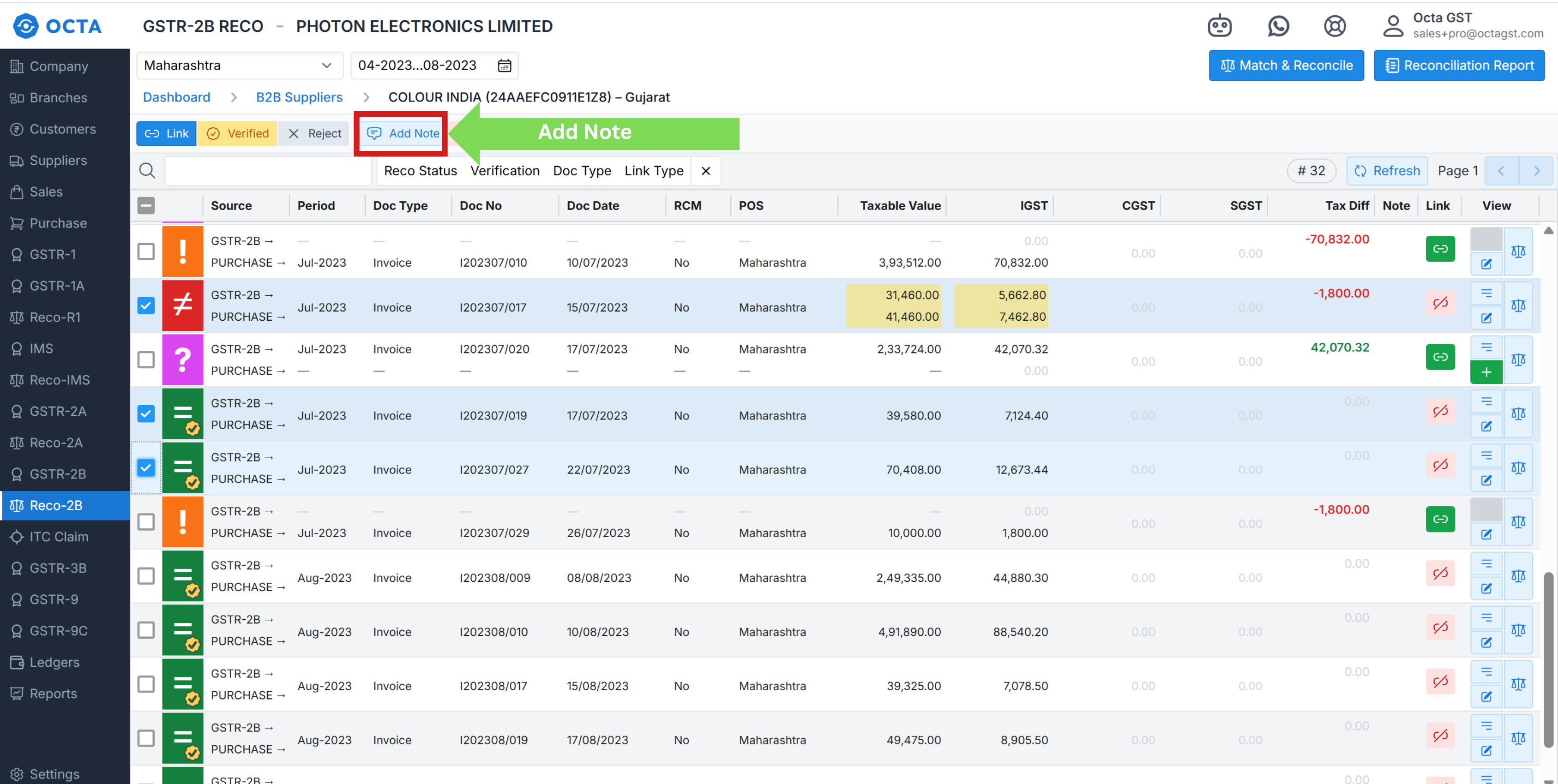

Add Note and clear note

For the purpose of future reference, Octa GST allows you to add notes or comments to one or multiple documents. To do

this, simply select the documents, click the Add Note button, type your comment, and click Update. The note will then be

saved in the system for future use. If you want to clear a note, again select the documents and click the Clear Note

button (highlighted in red) to remove the saved note.

What is the Use of Reject button

Octa GST lets you maintain full control over all documents during the ITC reconciliation process. If you come across any GSTR-2B document that does not belong to your records and you do not intend to claim ITC on it, simply use the Reject button. By clicking Reject, that document will be excluded from your reconciliation and future ITC actions. Rejection can be applied to any GSTR-2B document that is not linked with a purchase document, helping you keep your reconciliation clean, accurate, and up to date.