Importing Sales Register

Meesho Format

Octa makes GST filing super simple for Meesho sellers! With direct import of your Meesho GST reports (Sales + Sales Return), Octa automatically reads your data, handles sales, returns, cancellations, and reversals correctly, and prepares the key parts of your GSTR-1 — no manual copying or adjustments needed. Save time and reduce errors every month!

How Octa Smartly Processes Your Meesho Data?

Meesho provides GST data in two separate Excel files inside a ZIP file:

- tcs_sales (for regular sales and related transactions)

- tcs_sales_return (for returns, cancellations, and reversal of returns)

Octa processes all transaction types intelligently:

- Sales → Treated as outward supplies

- Returns & cancellations → Treated as Credit Notes (reduces your tax liability)

- Reversal of returns → Adjusted as fresh supplies where needed

This ensures:

- Accurate net GST liability

- Proper handling of adjustments

- Full compliance with GST rules for e-commerce platforms

After importing both files, Octa auto-generates these GSTR-1 sections for you:

- B2C Summary (state-wise outward supplies)

- HSN Summary (product-wise tax breakup)

- E-commerce Summary (including TCS collected by Meesho)

Everything ready for review and filing!

How to Import?

Step-1: Download Meesho GST Reports

- Log in to your Meesho Supplier Panel at supplier.meesho.com

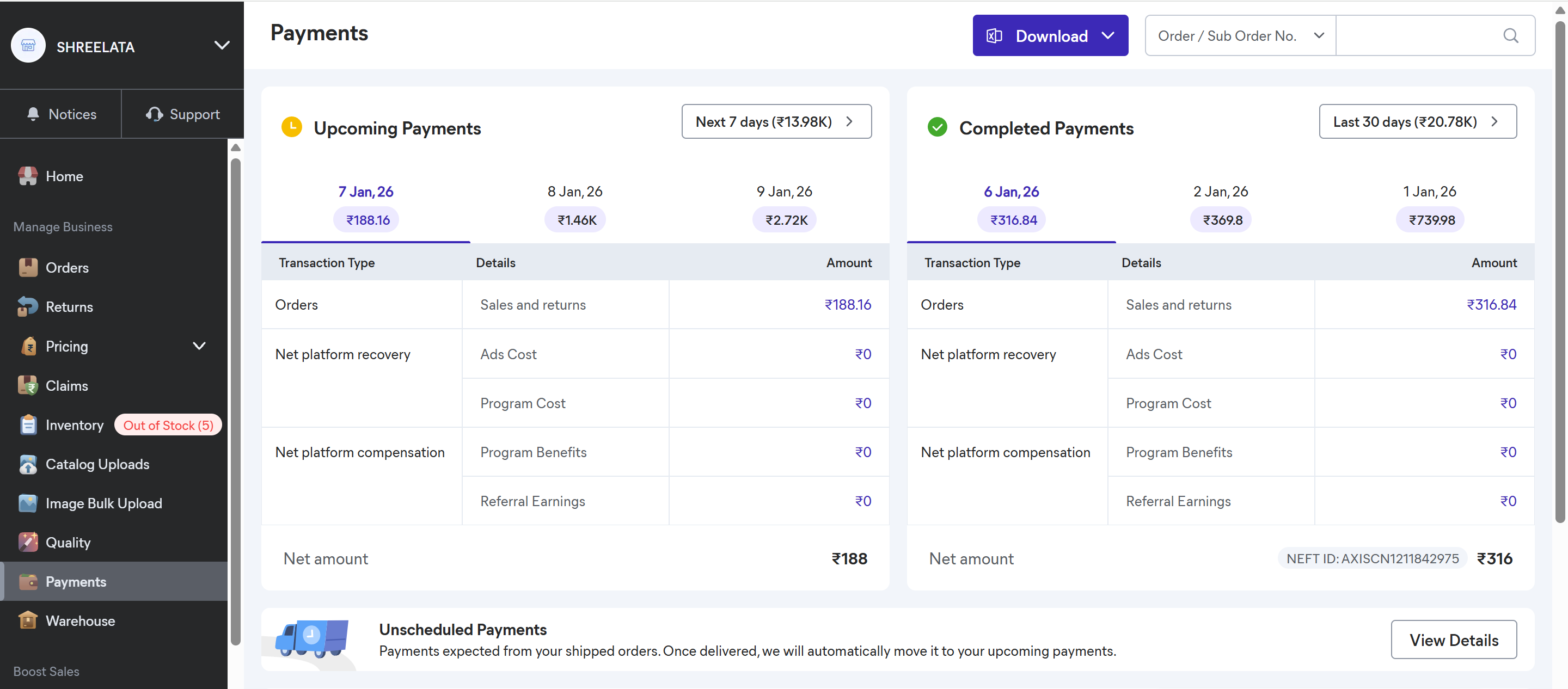

- From the left menu, go to Payments section

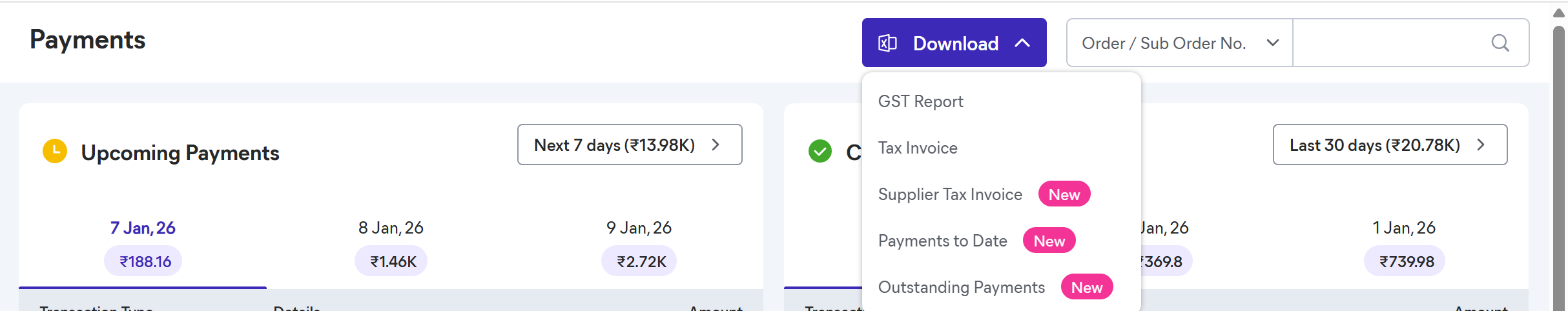

- Click the Download button (usually at the top right)

- Select GST Report from the options

- Choose the Year and Month you need (reports are typically available after the 5th of the next month)

- Click OK — a ZIP file will download

- Extract (unzip) the file on your computer — you'll find two Excel files:

- tcs_sales.xlsx (sales data)

- tcs_sales_return.xlsx (returns data)

Always extract the ZIP before importing — Octa can import the individual Excel files only.

Step-2: Import into Octa

- Open your company in Octa

- Go to the Sales page

- Click the Import button

- From the format dropdown, choose Meesho Format

- Upload the first file (e.g., tcs_sales.xlsx)

- Click Continue and follow the easy on-screen instructions

- Repeat the same steps for the second file (tcs_sales_return.xlsx)

Octa combines both files automatically — import usually completes in less than a minute!

Quick Tips & Troubleshooting

- Import both files for the same month to get complete & accurate GSTR-1 data.

- If the ZIP is missing files or download fails, raise a ticket in Meesho's Help section (Payments > I want GST or Sales report) — attach your downloaded ZIP for faster help.

- Errors during import? Octa shows clear row details — fix in the Excel, save, and re-import.

- Need reports for multiple months? Download and import one month at a time.

This direct import feature cuts manual work dramatically and keeps your GSTR-1 spot-on.