Introduction

Quick Start

Octa GST is high performance on-premise software designed to assist you in various processes related to GST compliance while maintaining the privacy of your business data. It has an extremely simple, consistent and user-friendly interface and you can get started with it in minutes.

Once Octa GST is installed, you can start it by double clicking the Octa GST icon on desktop or in the start menu. Once started, you will see the Octa GST home screen.

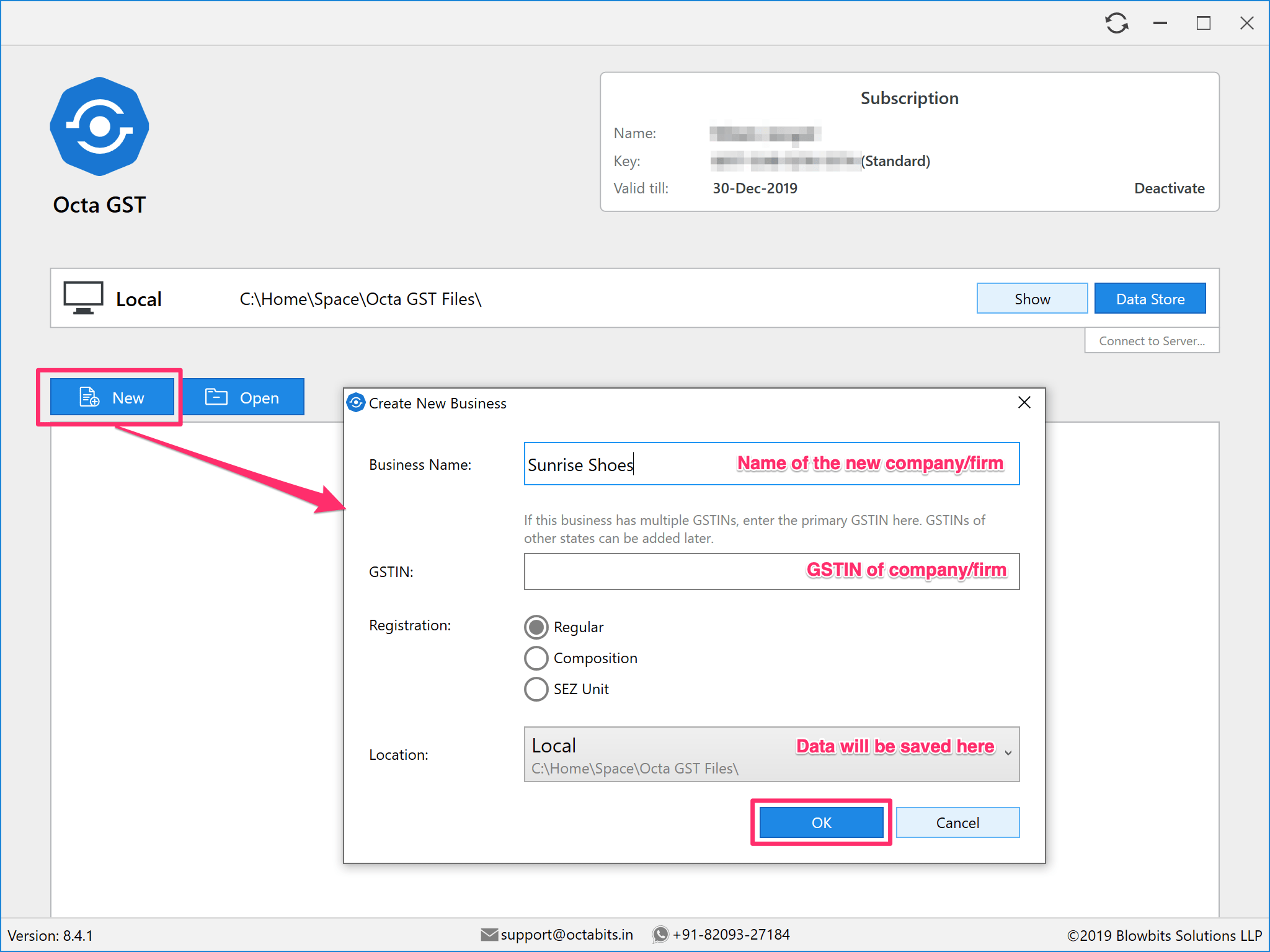

Create a new company

Creating a new company in Octa GST is extremely simple. Just click on the New button on the Octa GST home screen. Enter the name of the business, GSTIN and GSTIN registration type.

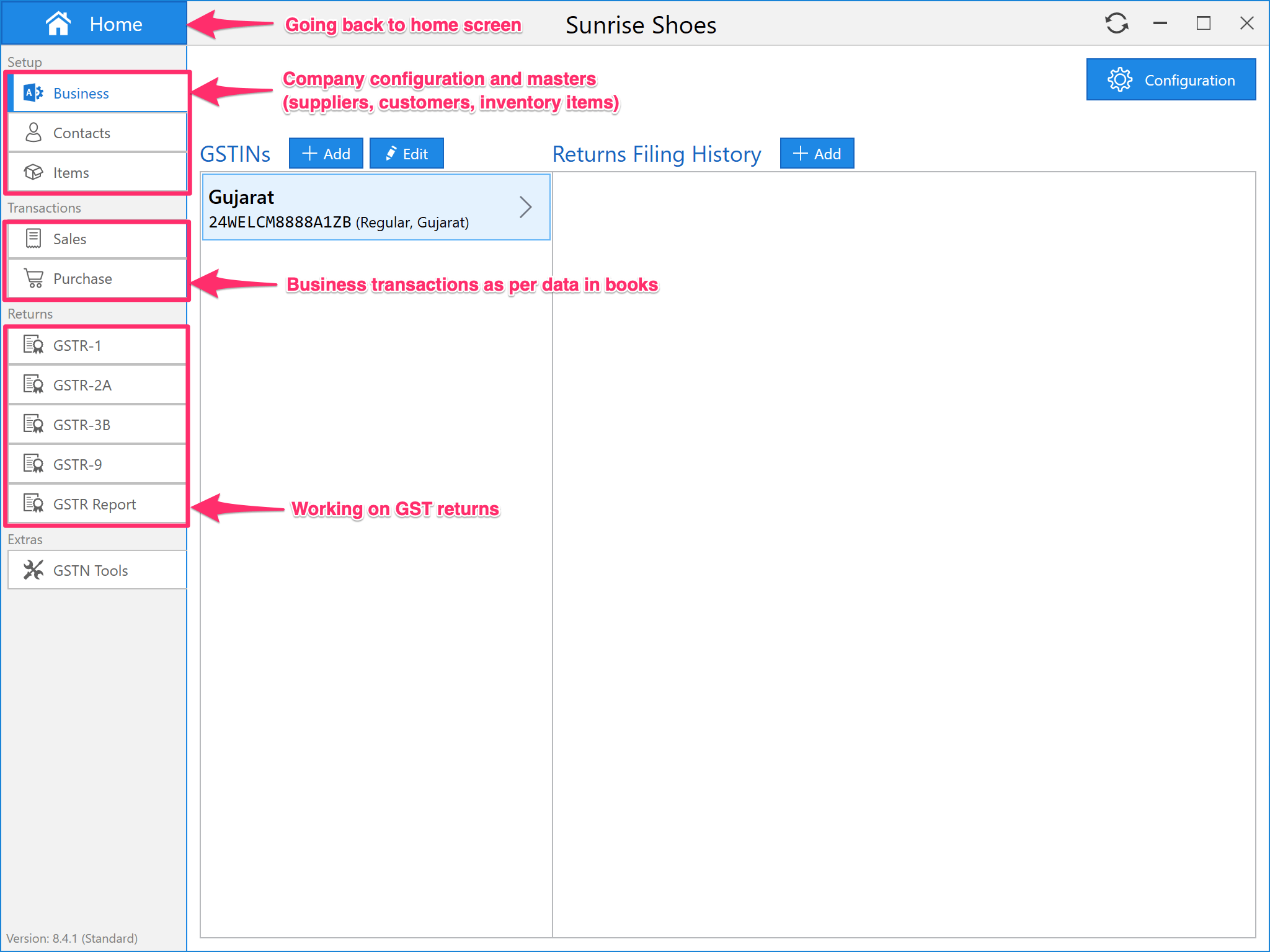

Once the company is created, you will see the company screen. In the top left corner, you will find the Home button using which you can go back to home screen. On the left you will find a list of buttons. Using these buttons, you can switch to any page in Octa GST.

Adding more GSTINs

This page contains the list of GSTINs registered by the company. If the company is registered in a single state, this list will contain only one GSTIN. If the company has registration in multiple states, you can add more GSTINs here.

If you have large number of transactions (more than 1 lakh invoices per year), it is recommended to create a separate company for each GSTIN.

Contacts & Items

Contacts page contains the master data of customers and suppliers. This master is used for auto-completion during manual entry of invoices, credit/debit notes.

Items page contains the master of inventory items which your business typically sell or purchase. This master is also useful during manual entry of invoices and credit/debit notes.

You can safely skip the Contacts and Items pages. These masters will be automatically prepared when you start using Octa GST.

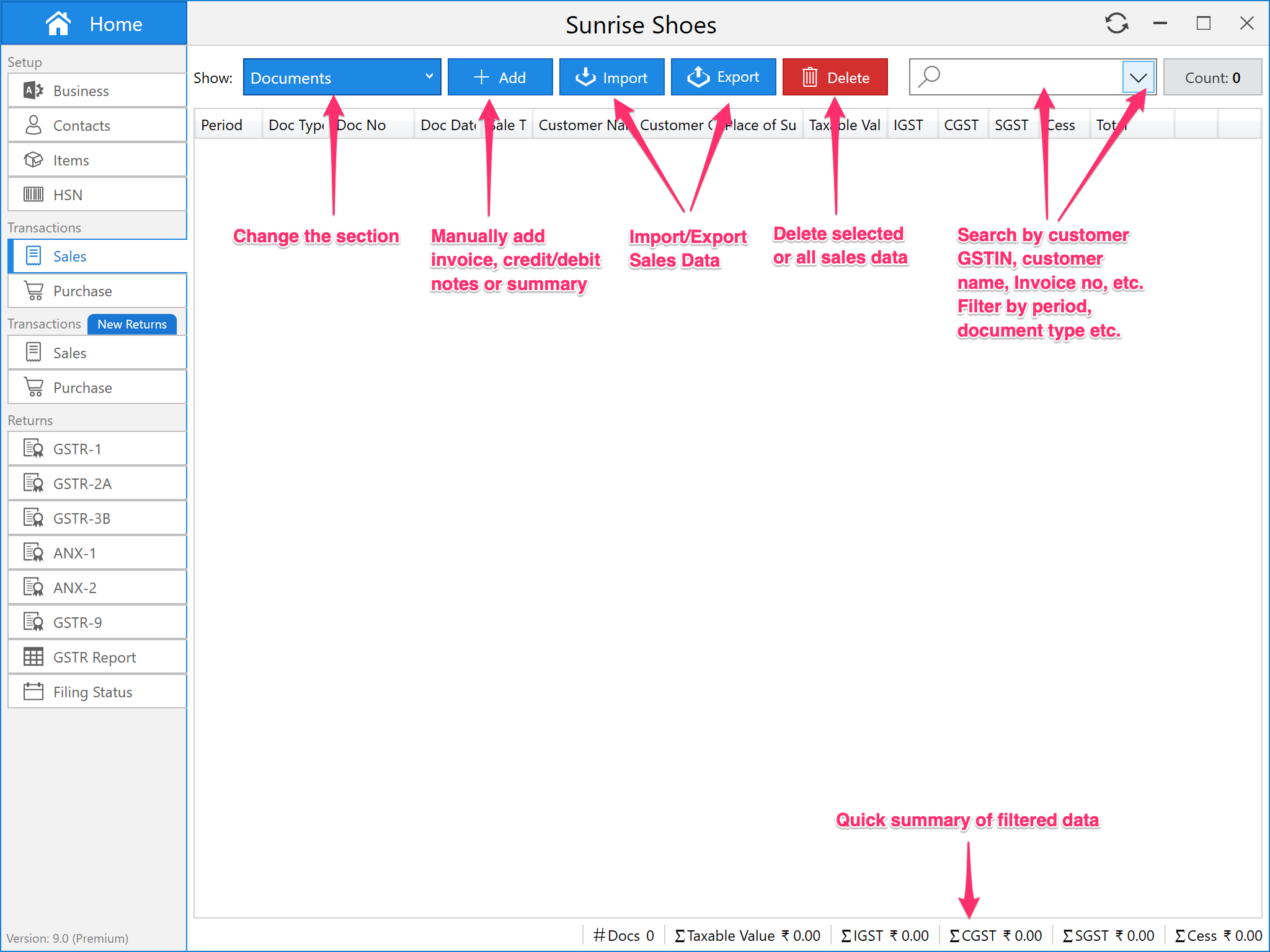

Adding Sales Register

This page contains all the transactions and summary level data related to sales (outward supplies). On this page, you can manually add the invoices or import/export the sales data. You can also clear the sales data of a particular period.

More on managing sales data:

- Import Sales Data from Excel/CSV files →

- Import Sales Data from Tally →

- How to get the sample/templates of Octa GST import formats?

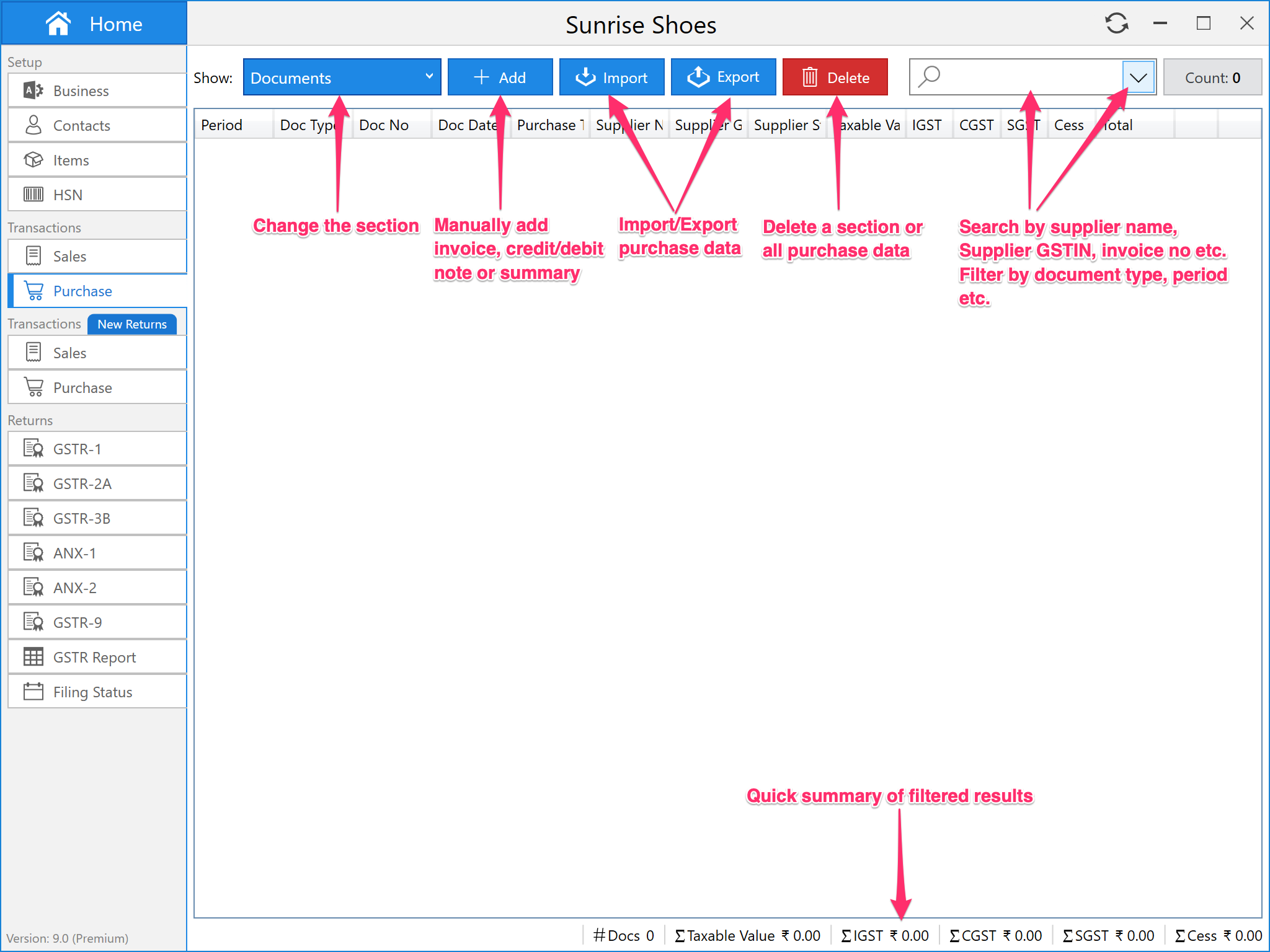

Adding Purchase Data

This page contains all the transactions and summary level data related to business purchases (inward supplies). On this page, you can manually add the invoices or import/export the purchase data. You can also clear the purchase data of a particular period.

More about purchase:

- Import Purchase Data from Excel/CSV files →

- Import Purchase Data from Tally →

- How to get the sample/templates of Octa GST import formats?

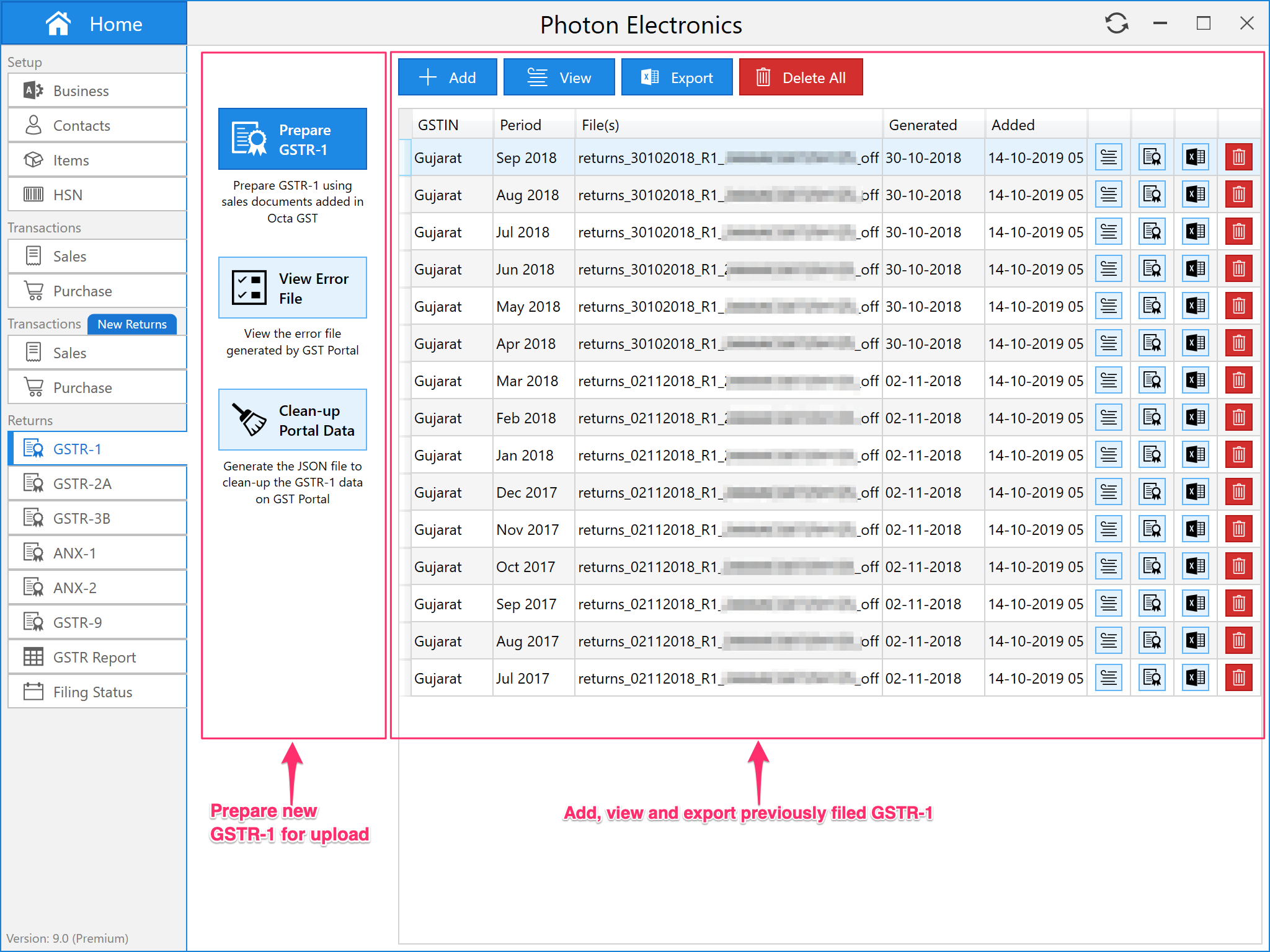

GSTR-1

On GSTR-1 page, you can prepare a new GSTR-1 return using the business data entered on the Sales page (Prepare Return button). If you upload a GSTR-1 return to GST Portal and it is processed with error, you can view the contents of error file (View Error File button).

You can also add previously filed GSTR-1 returns for your future reference of analysis. Simply click on Add button and select the JSON/ZIP files downloaded from GST Portal. You can select and multiple files in one go. Click on the Export button to export the contents of GSTR-1 in Excel format.

More about GSTR-1:

- How to file GSTR-1 return?

- How to convert GSTR-1 JSON files to Excel format?

- How to clear/delete GSTR-1 on GST Portal?

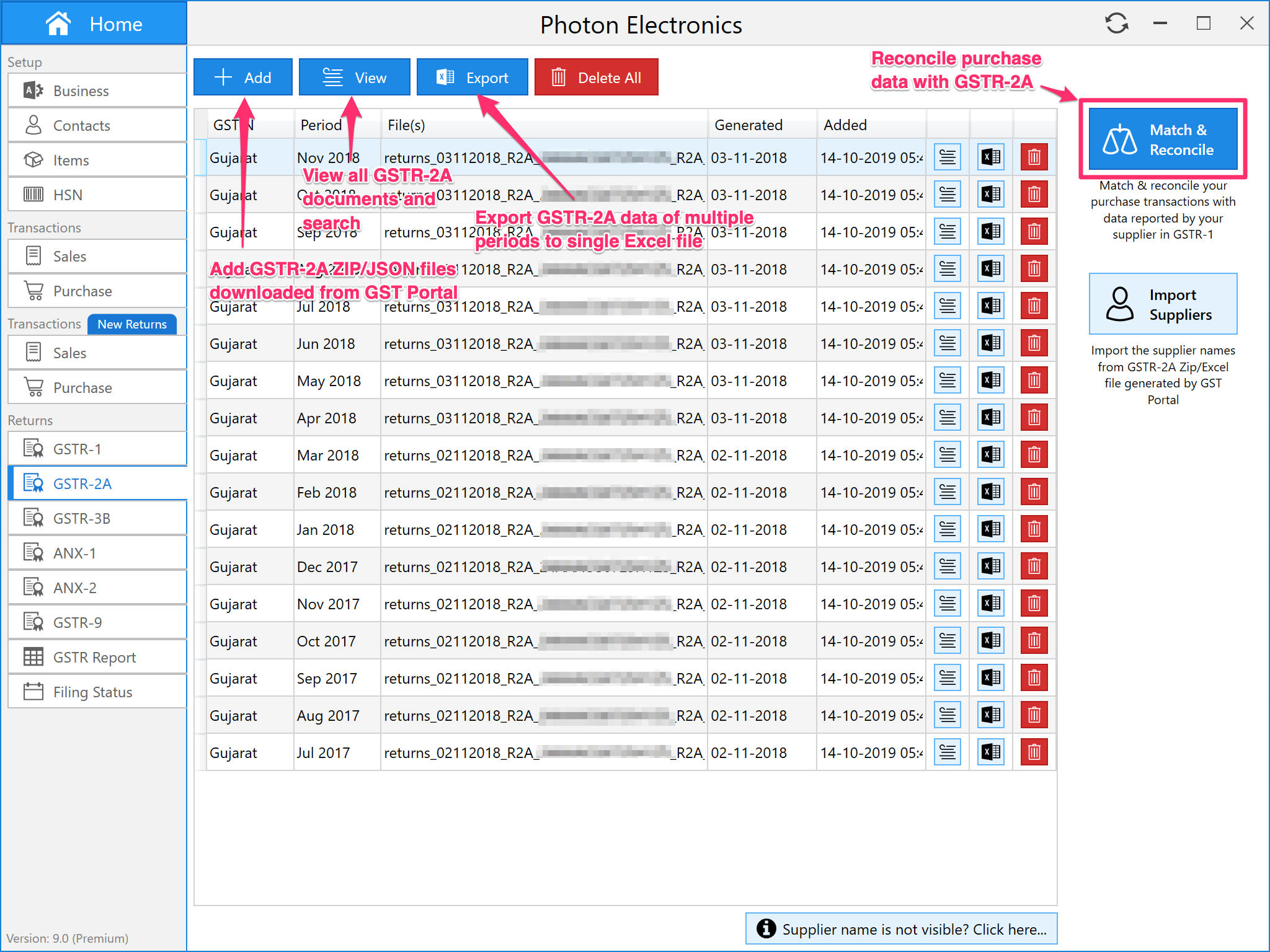

GSTR-2A

On GSTR-2A page, you can add the GSTR-2A JSON/ZIP files downloaded from GST Portal. Once the data has been added, you can view or export the data to Excel format. If you import the purchase transactions from your books, you can also reconcile the purchase data with GSTR-2A.

More about GSTR-2A:

- How to add GSTR-2A JSON/ZIP data?

- How to convert GSTR-2A JSON/ZIP file to Excel?

- How to reconcile purchase data with GSTR-2A?

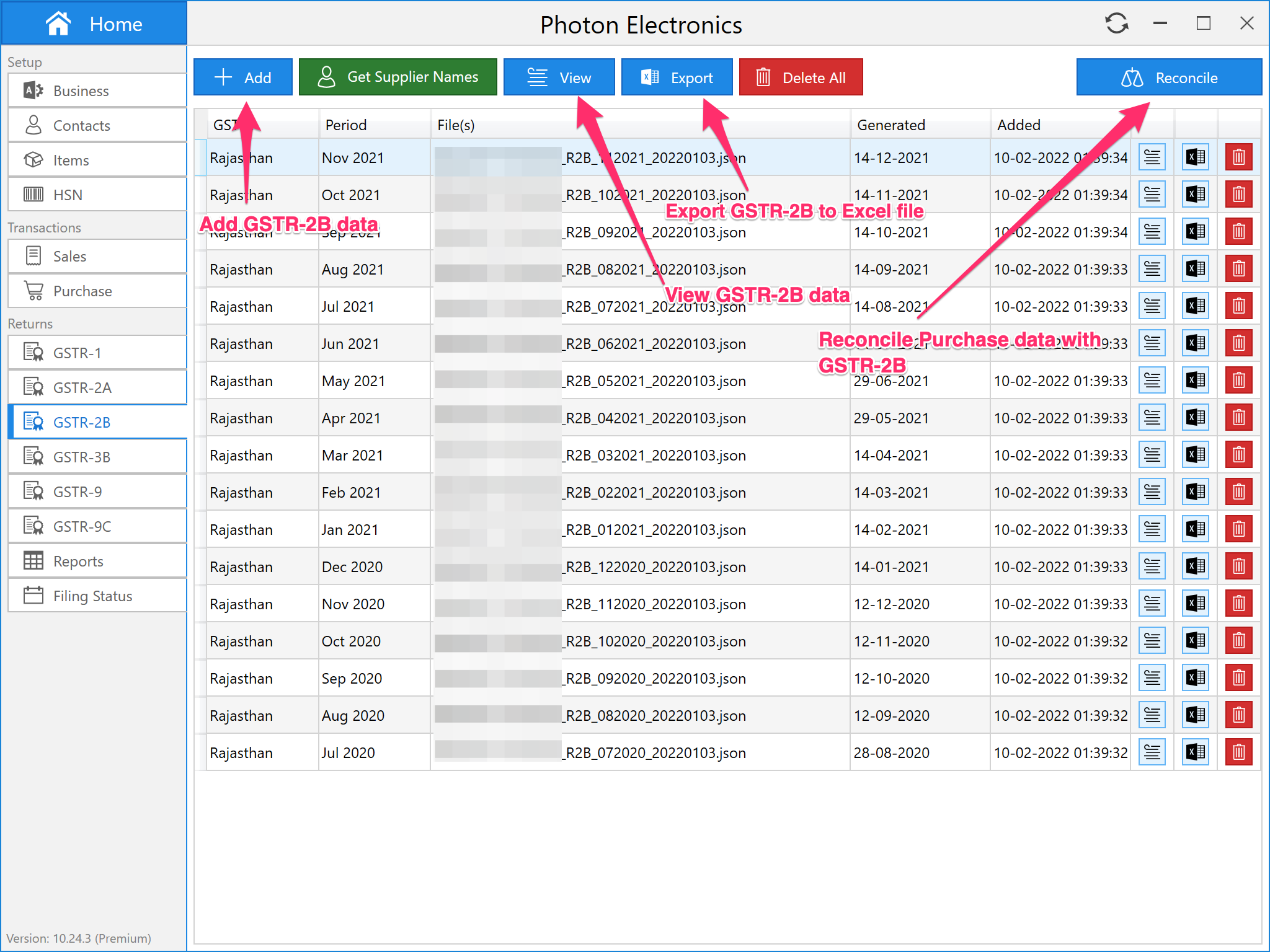

GSTR-2B

On GSTR-2B page, you can add the GSTR-2B JSON/ZIP files downloaded from GST Portal. Once the data has been added, you can view or export the data to Excel format. If you import the purchase transactions from your books, you can also reconcile the purchase data with GSTR-2B.

More about GSTR-2B:

- How to add GSTR-2B JSON/ZIP data?

- How to convert GSTR-2B JSON/ZIP file to Excel?

- How to reconcile purchase data with GSTR-2B?

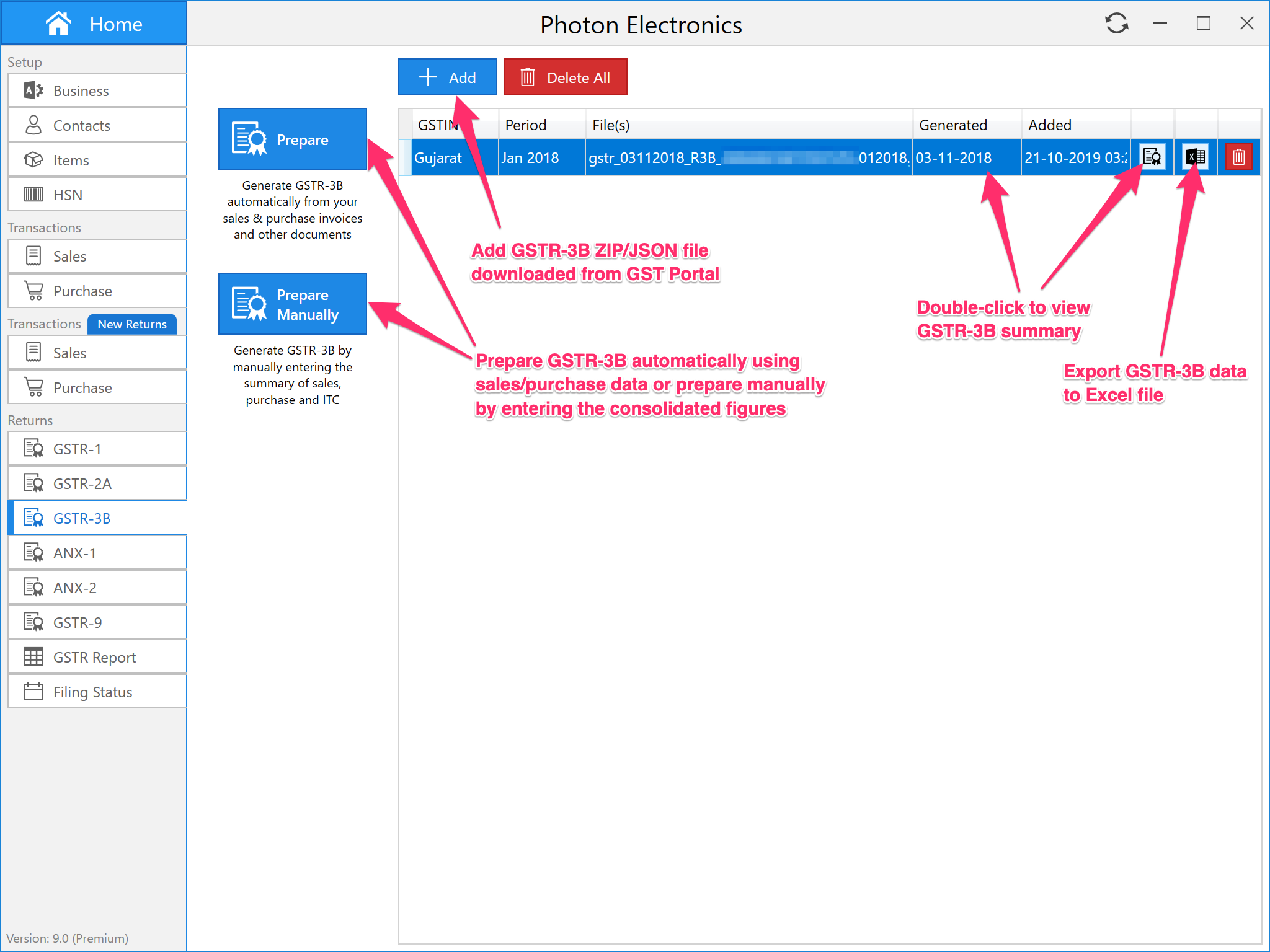

GSTR-3B

GSTR-3B module in Octa GST can be used to prepare GSTR-3B return.

- Auto Mode: Prepare GSTR-3B return from sales and purchase data

- Manual Mode: Prepare GSTR-3B return by manually entering consolidated sales and purchase/ITC data

More about GSTR-3B:

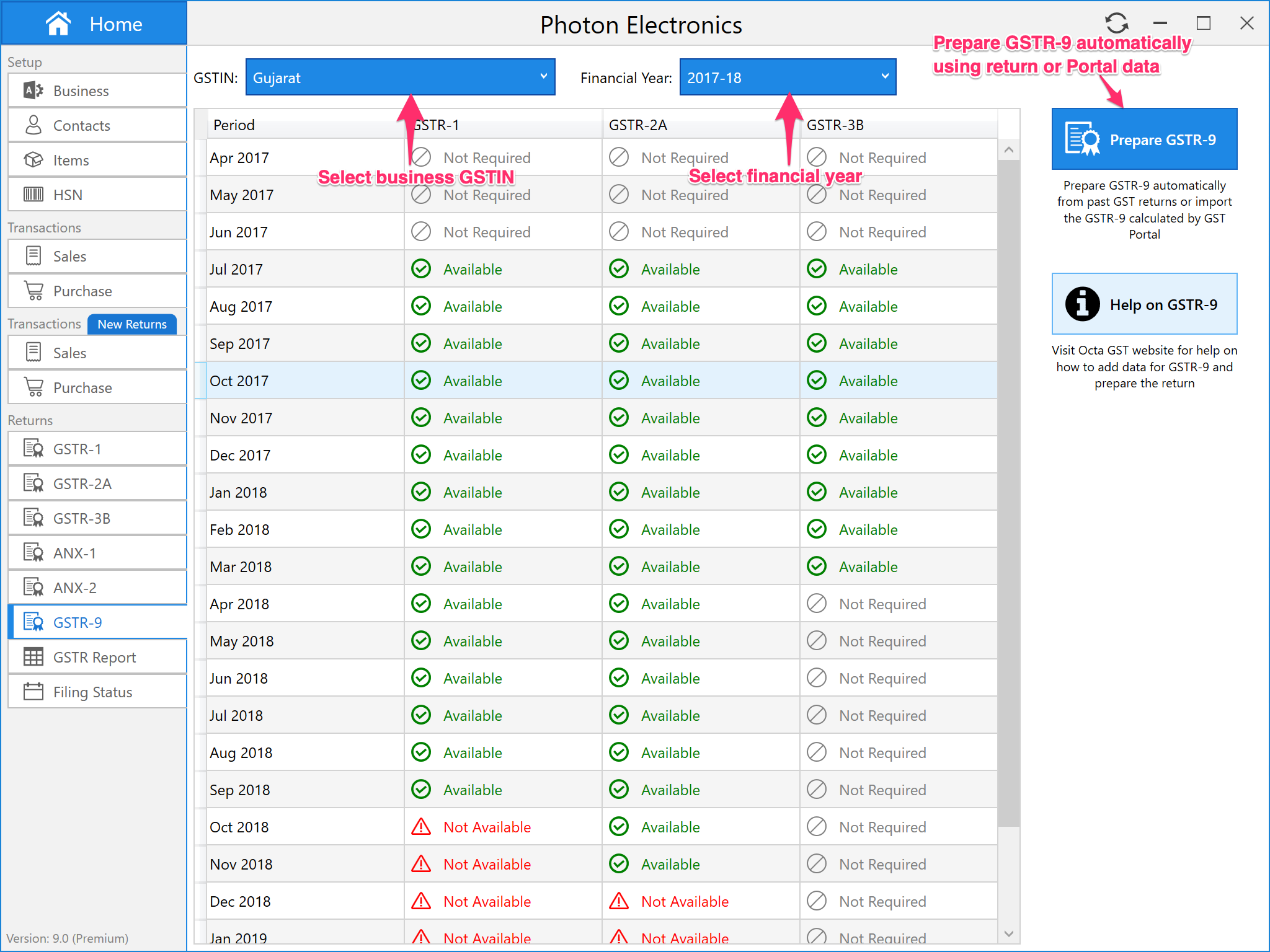

GSTR-9

You can add GSTR-1, GSTR-2A, GSTR-3B JSON/ZIP files to Octa GST and automatically calculate GSTR-9 return based on the return data. GSTR-9 page will show the current status of all return data that has been added. You can review the status and click Prepare GSTR-9 button to open the preview.

More about GSTR-9:

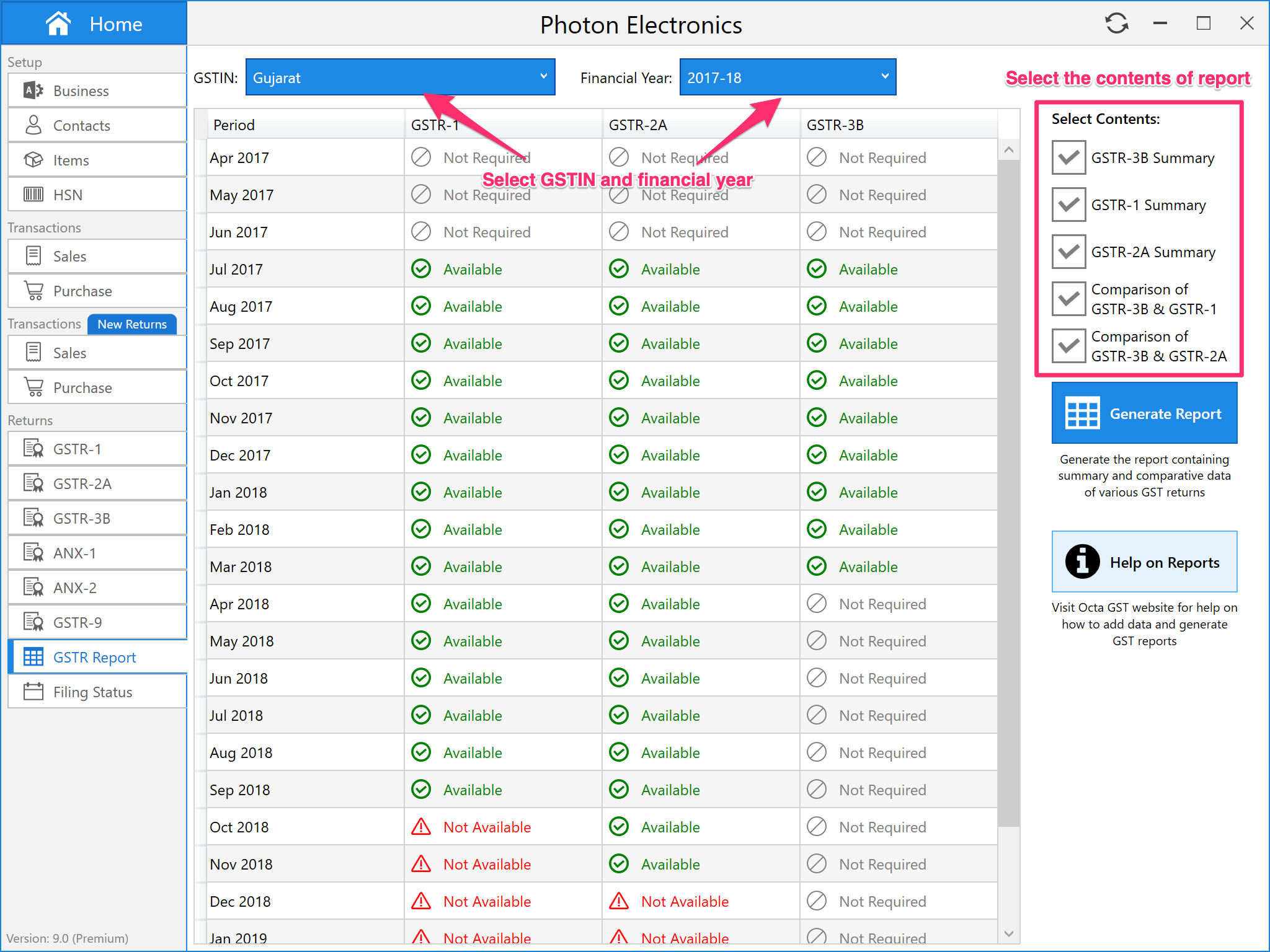

Reports

You can add GSTR-1, GSTR-2A, GSTR-3B JSON/ZIP files to Octa GST and automatically calculate annual consolidated and comparative annual report of returns data. Octa GST will show the current status of all return data that has been added. You can review the status and click Generate Return button to save the report.

More about GST returns annual report: