ITC Claim

Upgrading

This article is applicable only if you have been using Octa GST to manage your ITC claims before 24/06/2024. If you have started using Octa GST after 24/06/2024, no action is required.

Introduction

A new ITC claim design has been introduced in Octa GST on 24/06/24. This new design aims to aligns the ITC claim process with the current recommendations as per GST laws & rules. If you are using Octa GST for managing your ITC Claims, you need to update your existing data so that correct ITC actions can be taken going forward.

The table below summarizes the key changes:

| Feature | Previous Design (Before 24/06/2024) | New Design (24/06/2024 onwards) |

|---|---|---|

| Recording ITC Actions | Can take ITC action on Purchase Register only | Can take ITC action on both Purchase Register & GSTR-2B |

| Tracking Claim-Status | Tracks the Claim Status of documents in Purchase Register only | Tracks the Claim-Status of documents in both Purchase Register & GSTR-2B |

It is recommended to read the Overview of ITC Claim first.

Impact

You must have been recording the ITC actions on your purchase documents till now but Octa GST doesn't know the Claim-Status and ITC Actions you may have taken in the past on GSTR-2B documents. Therefore, as a one-time exercise, you need to update ITC Actions & Claim Status of all pending GSTR-2B documents. The right method depends on your current practice of filing GSTR-3B. You might be following one of the following two practices:

No Action on unreconciled GSTR-2B

In this method, you claim the ITC only when the purchase invoices gets reconciled with GSTR-2B. If an invoice appears in GSTR-2B, but this invoice is not yet booked in Purchase Register, you simply keep the GSTR-2B invoice pending and no ITC claim or reversal is reported in GSTR-3B.

If you have been following this method, then you will see all your GSTR-2B documents on the Pending page. Since you

have not taken any ITC action on these documents, you can simply update the Claim-Status of these documents to

Complete. Use can use the steps below to update the status in bulk:

- Open ITC Claim → Pending page

- Select the Company GSTIN

- Apply the filters:

- Period: Previous period in which GSTR-2B documents are pending

- Source:

GSTR-2B

- Click the Check-Box in the table header to select all rows in the table

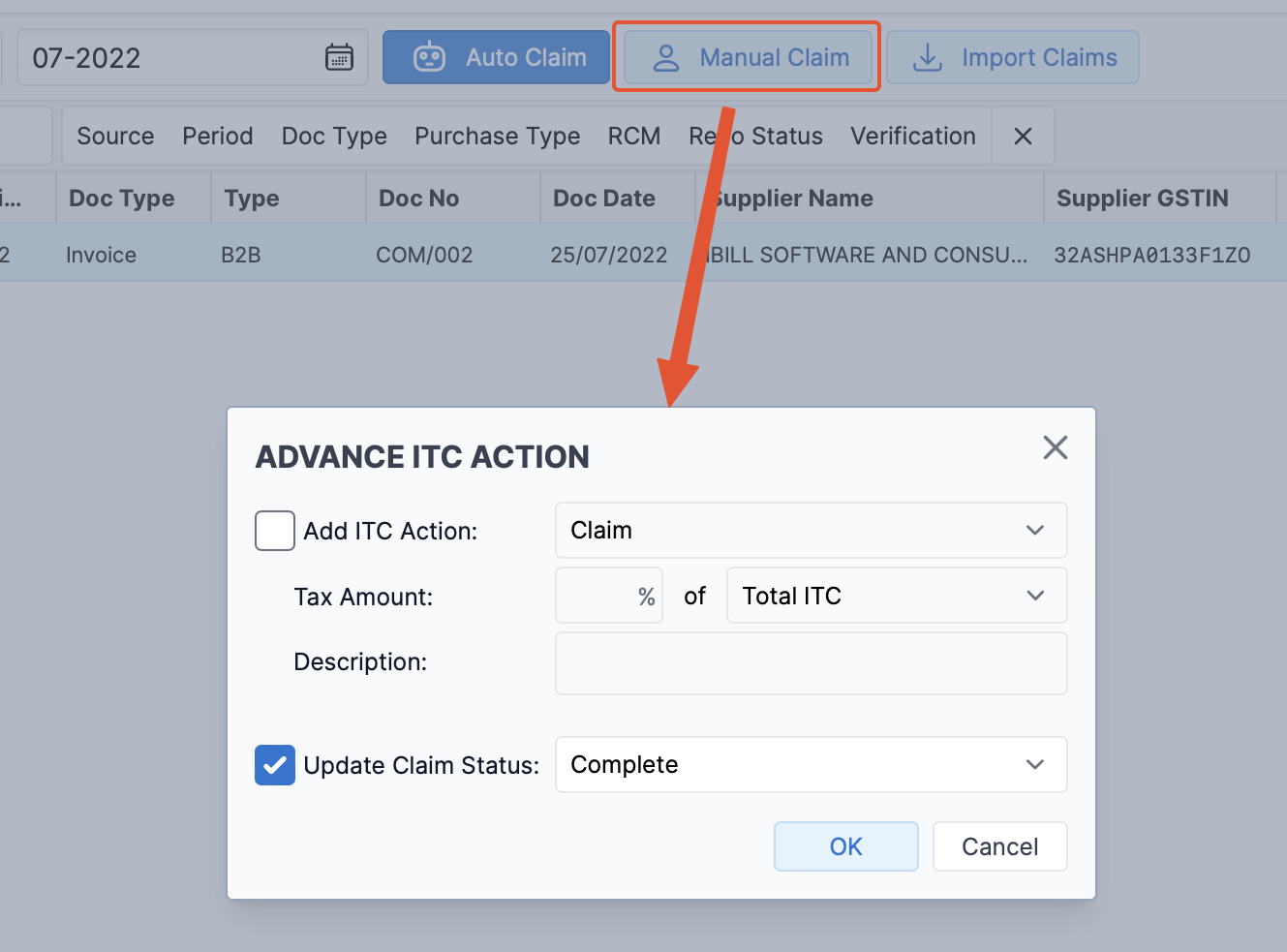

- Click on Manual Claim

- Check Update Claim Status:

Complete - Click OK to continue

Temporary Reversal of unreconciled GSTR-2B

In this method, if an invoice appeared in GSTR-2B but the corresponding invoice is not yet booked in Purchase Register, then you claimed and temporarily reversed the ITC while reporting in GSTR-3B. It is important to record these past actions of claim and temp-reversal in Octa GST so that Octa GST can correctly report the re-claims in upcoming periods (i.e. reporting the same in both Table 4-A5 and 4-D1).

If you have been following this method, you must have reported the claims and temp-reversals in GSTR-3B in previous periods. These actions need to be updated in Octa GST also. You can follow the steps below to update all such documents in bulk:

- Open ITC Claim → Pending page

- Select the Company GSTIN

- Apply the filters:

- Period: Previous period in which GSTR-2B documents are pending

- Source:

GSTR-2B - Reco Status:

Match & Almost Match

- Click the Check-Box in the table header to select all rows in the table

- Click on Auto Claim

The above steps will automatically take care of GSTR-2B document which matched in the same period. For the rest of the documents, you will need to record the same ITC action as you have taken in the past while reporting in GSTR-3B. For example, if you have reported the claim/reversal in GSTR-3B, you can follow the steps below to record the same:

- Apply the filters:

- Period: Previous period in which GSTR-2B documents are pending

- Source:

GSTR-2B

- Click the Check-Box in the table header to select target records in the table

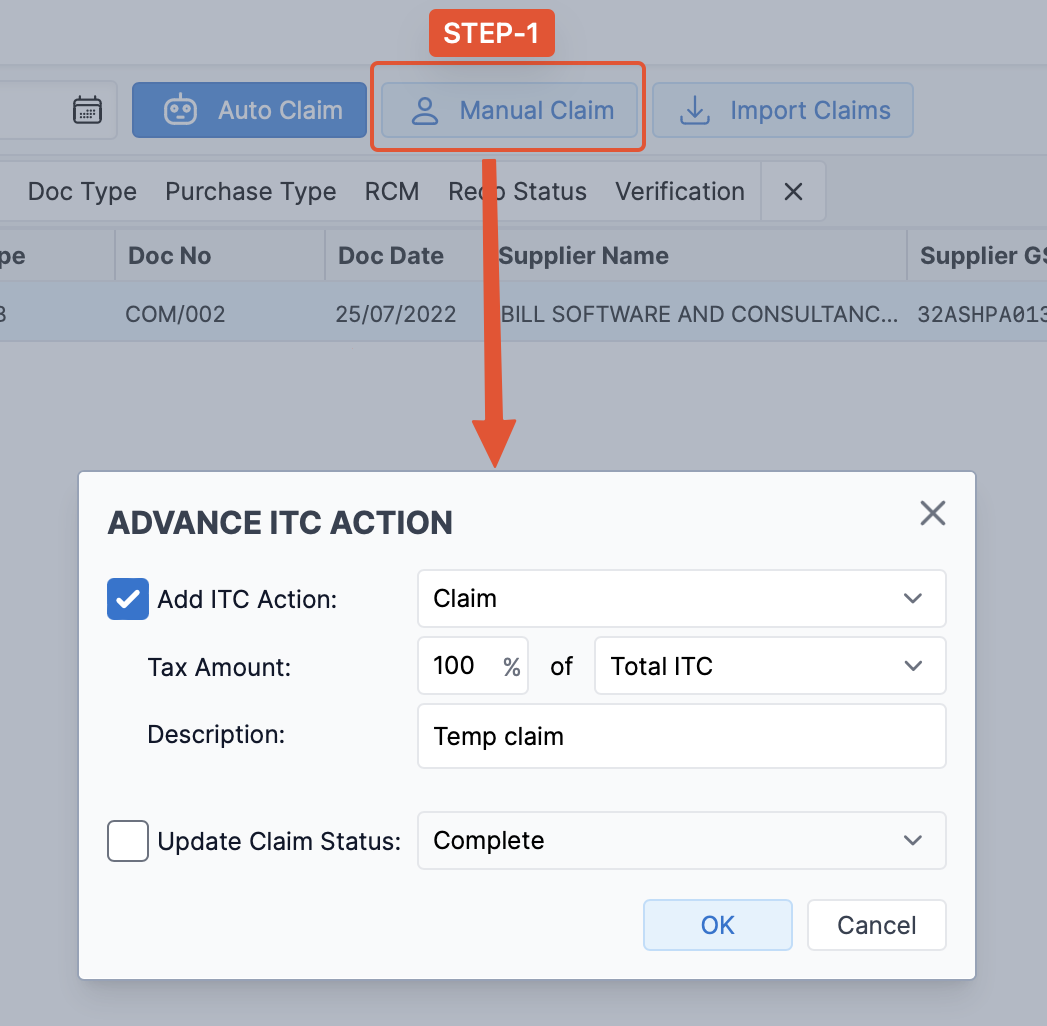

- Click on Manual Claim

- Check Add ITC Action:

Claim, Tax Amount:100%, Description:Temp Claim - Click OK to continue

- Continue with the same selection as above step:

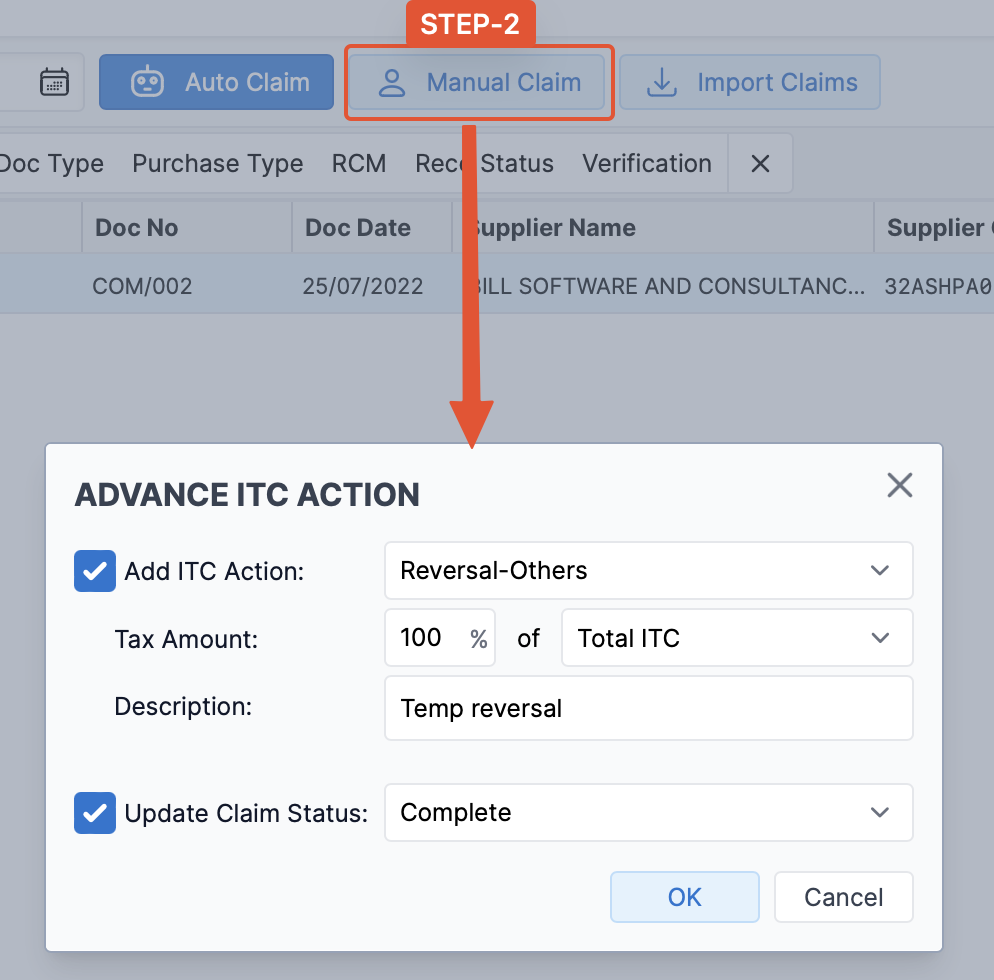

- Again click on Manual Claim

- Check Add ITC Action:

Reversal-Others, Tax Amount:100%, Description:Temp Reversal - Check Update Claim Status:

Complete - Click OK to continue

Summary

If you take appropriate ITC action on all pending GSTR-2B invoices, the table in Pending page will show only pending documents in Purchase Register. If there are no pending Purchase documents, the table may even be blank. Based on the recorded GSTR-2B ITC actions, Octa GST will take the right ITC action automatically in next GSTR-3B period.