ITC Claim

Overview

Introduction

ITC claim is probably the most important activity in GST compliance because:

- If you miss to claim the ITC which is available as per GST law/rules, it inversely affects the cash-flow of your business.

- If you inadvertently claim the ITC which is not available as per GST law/rules, it results in non-compliance. Therefore, your business may face notices, penalties, and interest charges.

Octa GST helps you claim the maximum ITC while maintaining the compliance with GST laws & rules. This section explains how Octa GST manages the ITC claims on your purchase invoices.

Basics

While claiming the ITC, you will have the following 2 sets of data:

- Purchase Register: These are the purchases booked in your ERP. This purchase register has the information of supplier from which you have purchased the goods or services, along with the amount & eligibility of ITC.

- GSTR-2B: This is the statement of purchases, automatically generated by Govt GST System every month. This is generated based on the invoices reported by your suppliers in their GSTR-1.

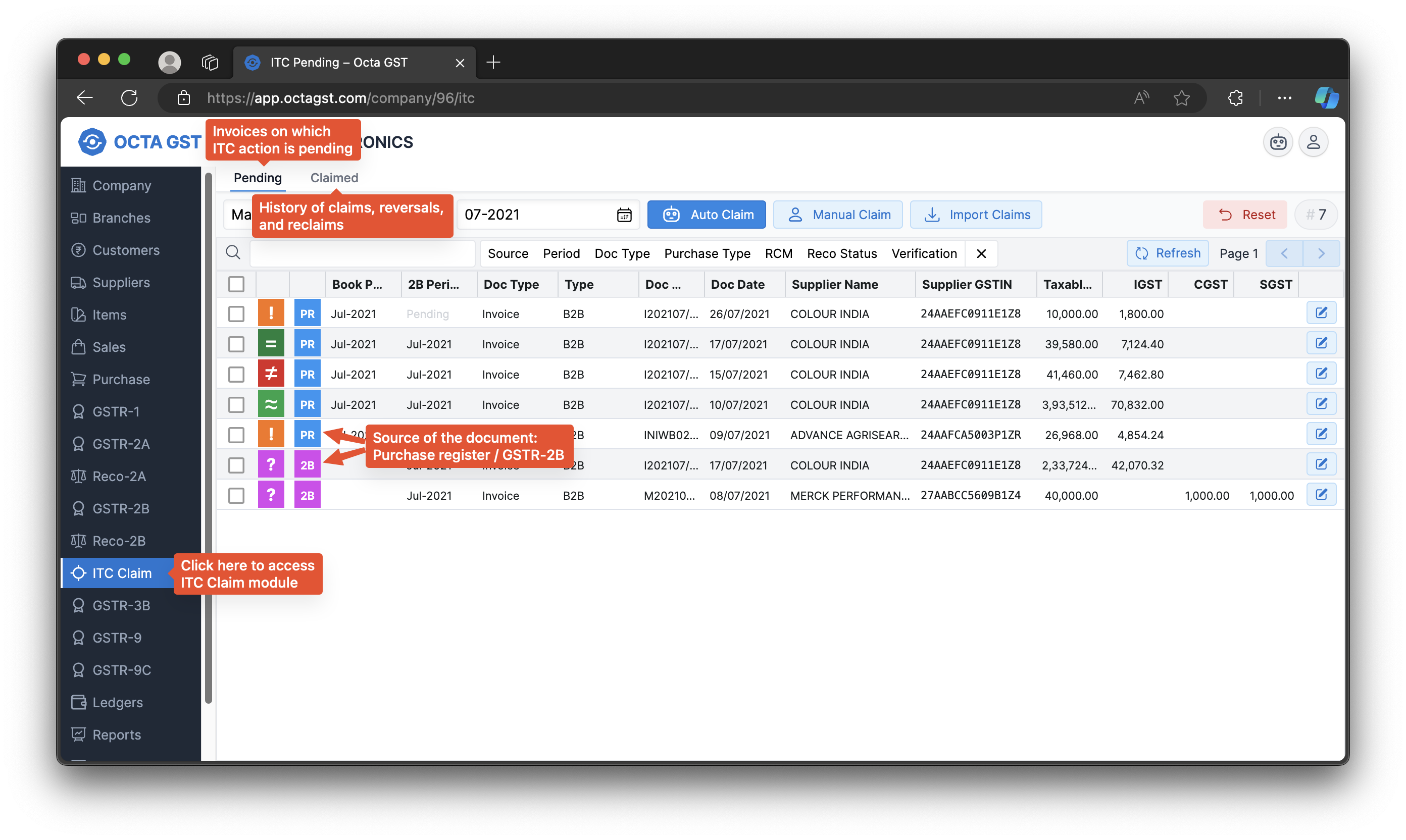

Octa GST maintains ITC Actions and Claim-Status on both Purchase and GSTR-2B invoices. To manage the ITC claims, open the company in Octa GST and simply click on ITC Claim button on the left side.

Purchase Register

Subject to the requirements and conditions of claiming ITC, you will need to claim the ITC on the purchase documents in the following cases:

- Purchases from unregistered suppliers: These purchases would never appear in GSTR-2B since the supplier is not registered. In this case, you will need to discharge the reverse charge liability and also claim the ITC on these purchase invoices.

- Import of Services: Same as previous case (purchase from unregistered suppliers).

- B2B Purchases: You can claim the ITC on the B2B invoice once it is reconciled with GSTR-2B. In some cases, you may also have to temporarily (e.g. non-payment to supplier) or permanently (e.g. self consumption) reverse the ITC after claiming it. If the reversal was temporary, you need to reclaim the ITC in a subsequent period.

- Import of Goods: You can claim the ITC on these invoices once they are reconciled with GSTR-2B. This is auto-populated from the ICE-GATE system.

GSTR-2B

If an invoice appears in GSTR-2B but it is not yet booked, then you will need to claim and temporarily reverse the ITC. This ITC can be reclaimed once the invoice appears in the purchase register and the invoice reconciles with GSTR-2B.

Claim Status

Octa GST maintains a Claim-Status on both Purchase and GSTR-2B documents. Claim-Status can be either Pending or

Complete. All invoices in purchase register & GSTR-2B having Pending claim-status are shown on the Pending page.

Any ITC action you have already taken (e.g. Claim, Reversal, Reclaim etc.) are shown on the Claimed page.

| Claim Status | Effect |

|---|---|

| Pending | Shown on the Pending page |

| Complete | Not shown on the Pending page |

It is possible that an invoice is shown on both Pending and Claimed pages. This can happen if you have claimed ITC

on an invoice but still kept the Claim Status Pending for some reason.

ITC Actions

Octa GST tracks ITC action on both Purchase and GSTR-2B documents along with the period in which action was taken. Depending on the sequence of ITC events, you may have to take ITC action on either or both. The table below shows the supported ITC actions and their effect in GSTR-3B reporting:

| ITC Action | GSTR-3B | Example |

|---|---|---|

| Claim | 4-A5 | B2B Invoice matches with GSTR-2B of same period |

| Re-Claim | 4-A5 & 4-D1 | Claiming ITC on B2B Invoice which was temporarily reversed in previous period |

| Reversal-Others | 4-B2 | Invoice appearing in GSTR-2B but not booked yet |

| Reversal-Rule37 | 4-B2 | Non-payment to supplier for 180 days |

| Reversal-Rule38 | 4-B1 | Reversal of credit by banking or financial institution |

| Reversal-Rule42 | 4-B1 | Goods or services: Partly personal use or partly used to provide exempt supply |

| Reversal-Rule43 | 4-B1 | Capital goods: Partly personal use or partly used to provide exempt supply |

| Reversal-Sec17(5) | 4-B1 | ITC blocked |

| Reversal-Sec16(2A) | 4-B2 | Not having valid tax invoice |

| Reversal-Sec16(2B) | 4-B2 | Goods or services not yet received |

| Ineligible-Others | Not Reported | Credit note received against an invoice on which ITC was permanently reversed |

| Ineligible-Sec17(5) | Not Reported | Credit note received against an invoice on which ITC was blocked |

| Ineligible-PosMismatch | 4-D2 | Place of supply is different than receiver state, e.g. Hotel stay in different state |

| Ineligible-Sec16(4) | 4-D2 | Time limit of ITC claim has passed, e.g. Invoice dated 13/01/2023 received in GSTR-2B of Jan-2024 |

In order to support various use-cases, Octa GST offers the following 4 methods to claim ITC on an invoice:

- Auto Claim - Recommended for majority of cases

- Manual Claim - Single Invoice

- Manual Claim - Bulk

- Import Claims from Excel file

The details of the above ITC claim methods are described in the subsequent sections.

Summary

- Octa GST maintains separate Claim Status on Purchase and GSTR-2B.

- Octa GST maintains separate ITC Actions on Purchase and GSTR-2B.

- A purchase invoice will be shown on the Pending page, if Claim-Status of that invoice is

Pending. - Pending page shows invoices from both Purchase Register & GSTR-2B.

- Claimed page shows all ITC actions taken on Purchase or GSTR-2B invoices.

- ITC Actions taken on Purchase & GSTR-2B invoices are combined and reported in GSTR-3B.