ITC Claim

Manual Claim

Introduction

Manual-Claim mode allows you to take an ITC action on multiple documents in one go. You can take ITC action on Purchase

or GSTR-2B or both. You can also update the Claim-Status to Complete in bulk once no-more action is required on a

document.

In Manual-Mode, Octa GST will add an ITC action and update the Claim-Status as specified by you. No validation is done before applying the updates. Please understand first what you are doing, before you manually claim ITC in bulk. Take help of your tax consultant if you are not sure.

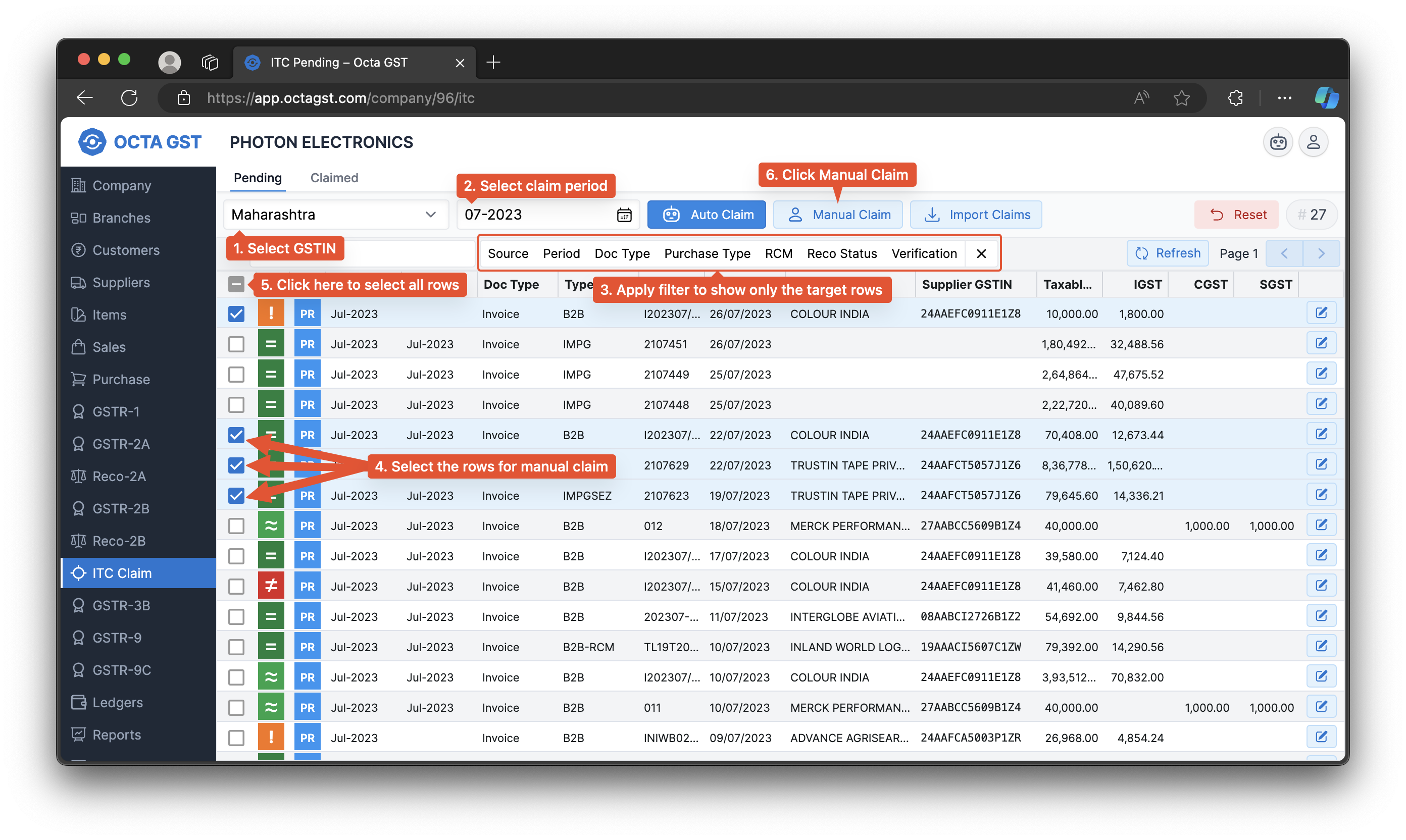

Bulk Action

In order to take action on multiple documents, simply select the rows on Pending page. You can use various filters to easily select the intended rows. If you want to select all rows, simply click on Check-Box in the header row. Once all desired rows are selected, click on the Manual Claim button.

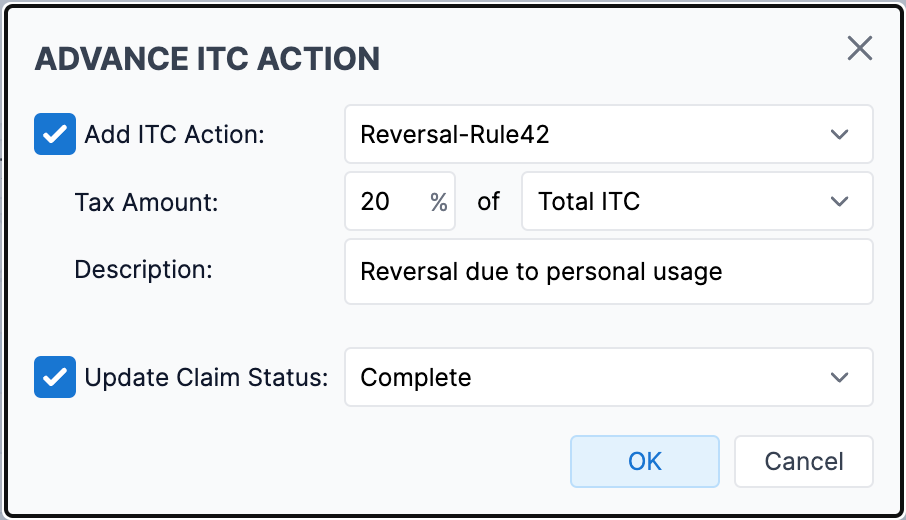

Octa GST will allow you to select the action and amount of ITC. If you continue, same action will be applied on all the

selected rows. For example, in the following selection, user is reversing 20% of total ITC against Rule-42, and marking

the Claim-Status as Complete.