Introducing New GST Returns

Octa GST version 9 bring the initial support of new GST returns. Using Octa GST, you can:

- Add your sales/purchase data for new GST returns using Octa & Offline Tool templates

- Generate ANX-1 from sales/purchase data and preview the summary

- Generate ANX-1 JSON file & upload to GST Portal

- Download & add ANX-2 JSON files

- View ANX-2 documents

- Export ANX-2 documents to Excel

Business Units

With Octa GST version 9, we are introducing the concept of business units. As per GST law and rules, only one GSTIN can be issued to a business vertical in a state but in real life, there can be multiple business units or branches with-in a state. For example, hotels or shop in multiple cities, manufacturing or service units etc. Using business unit definition, you can import the sales/purchase data of different units. This allows you to easily identify which documents belong to which business units and at the same time, you can still generate single consolidated GST returns for multiple units.

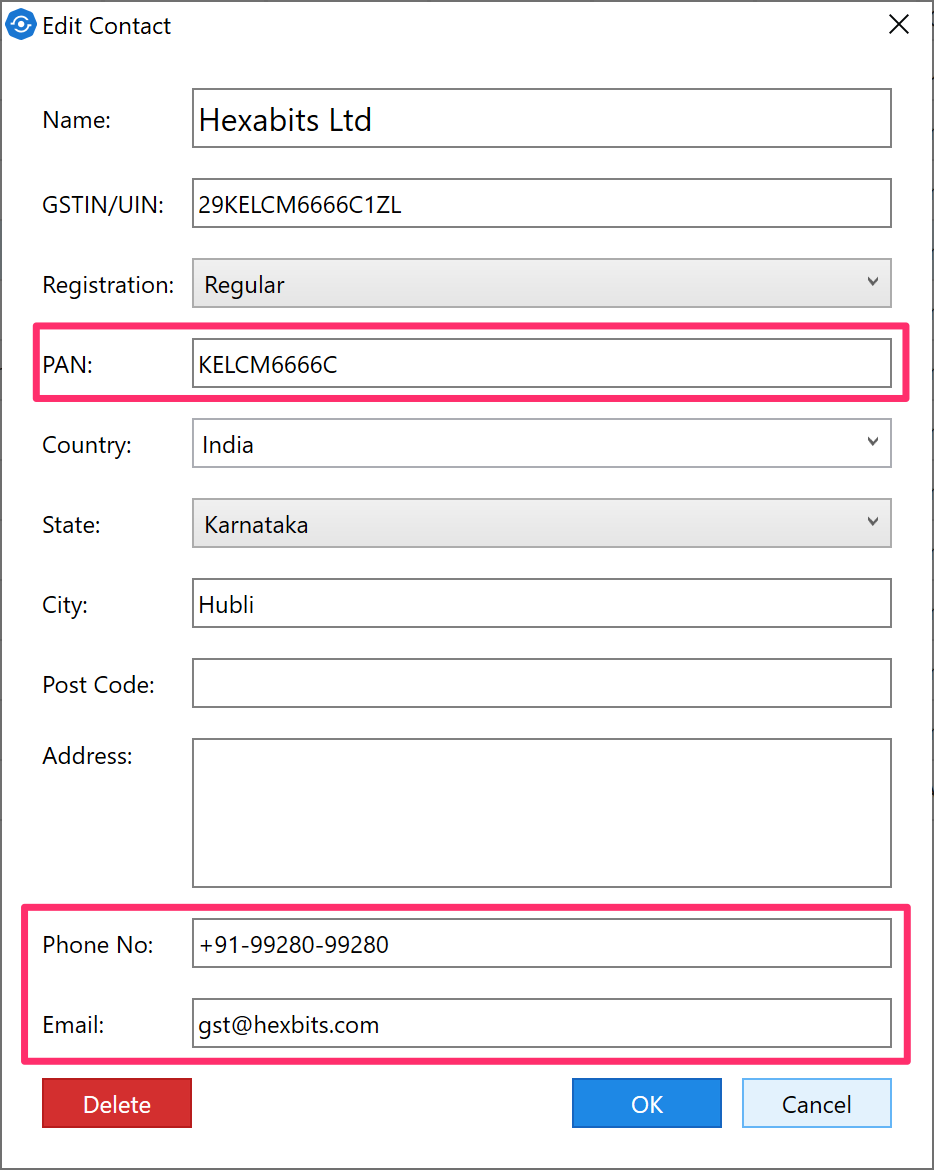

Contacts

The following fields have been added to Contacts master fo easy reference:

- PAN

- Phone number

- Email address

HSN Codes

Octa GST version 9 has a built-in database of HSN codes. You can search by code or dscription to find the HSN code:

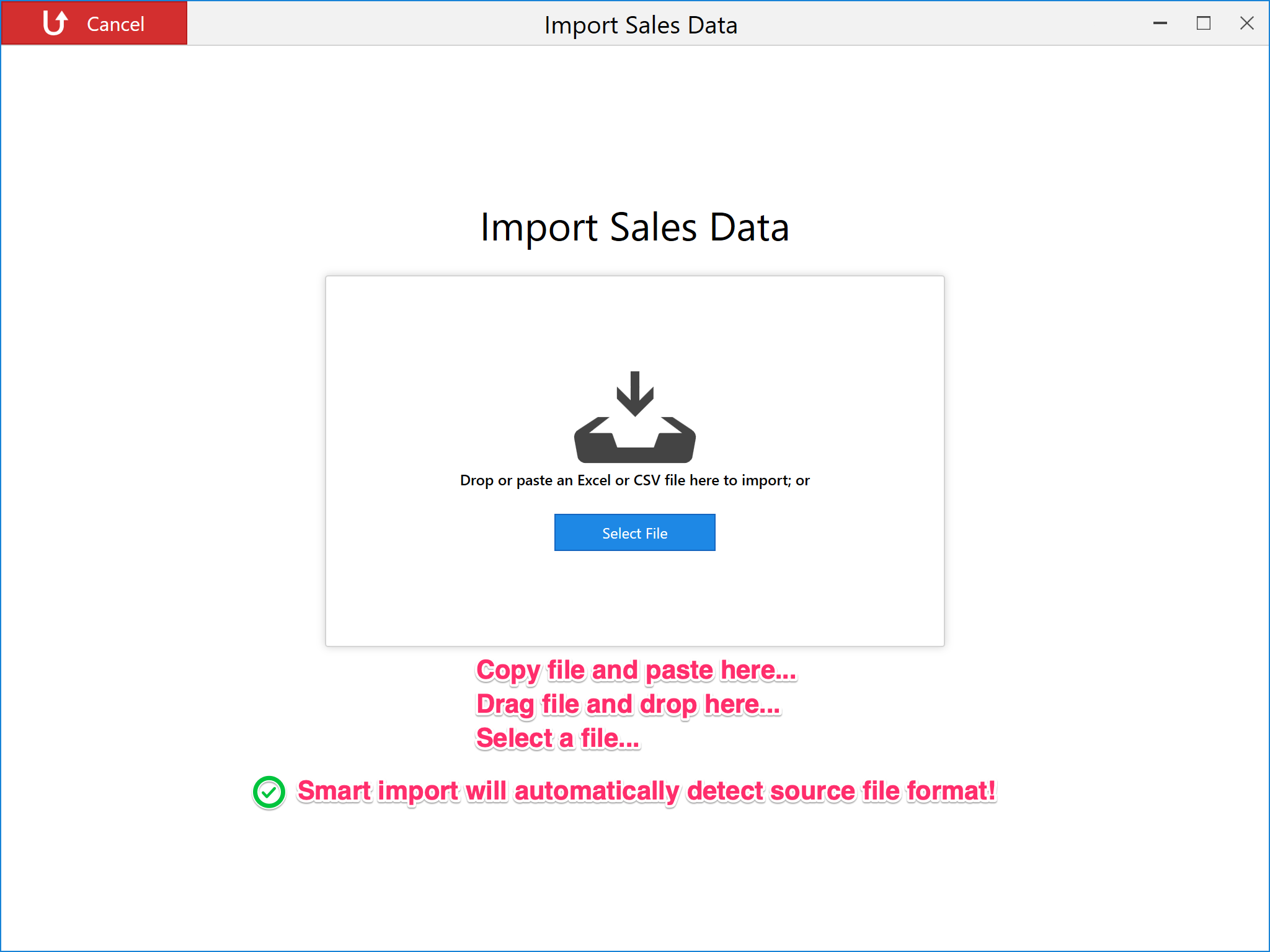

Smart Import

We are very happy to introduce smart import process in this version of Octa GST. It now automatically detects the source file format so that you don't have to specify which format you are importing. You can now simply select the file you wish to import and Octa GST will use the right format everytime. This saves the user from having to select the format and file type and prevents the error caused by wrong selection.

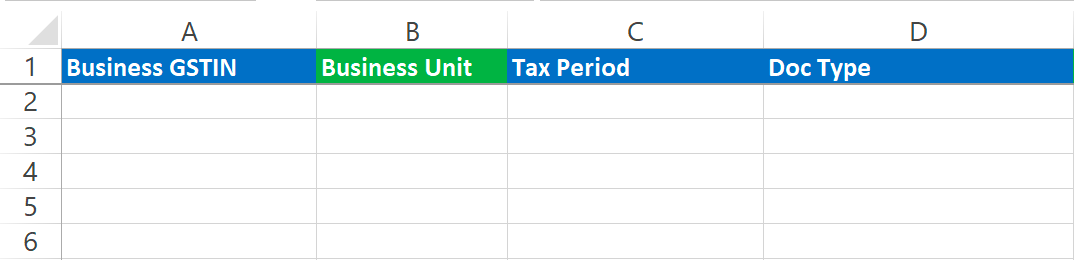

Advance Import Formats

Octa GST version 9 supports advance Excel formats for importing sales and purchase data.

- In one go, you can import the data of:

- Multiple business GSTINs

- Multiple business units

- Multiple return periods

- Automatic calculation of tax amount from taxable value and GST rate if tax amount fields are left blank.

- Automatic calculation of document value from sum of line items if document value is left blank.

- ERP Ref No field in each purchase document for own reference. You may use this field to save the reference number generated by your ERP software.

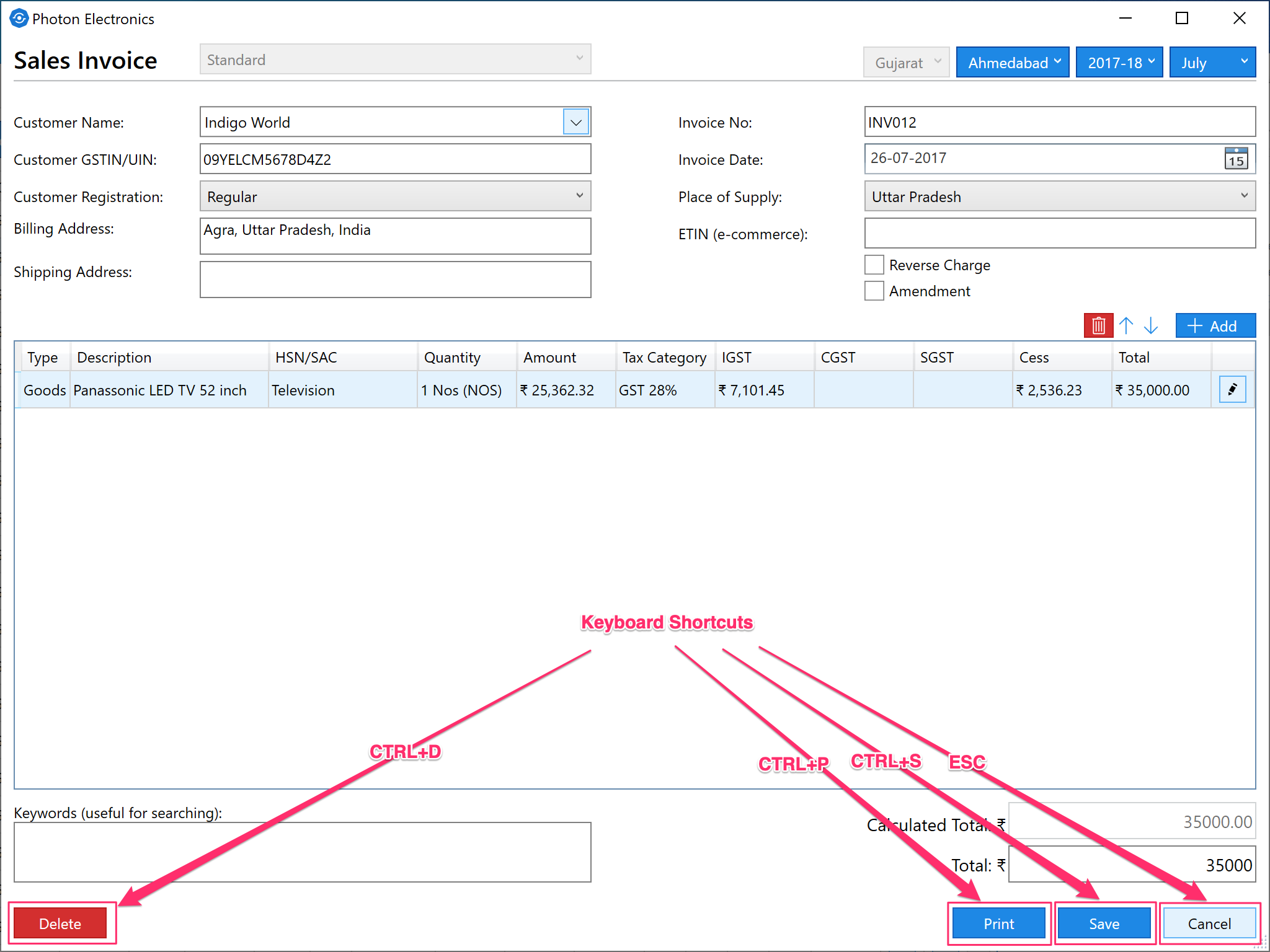

Keyboard Shortcuts

Documents editors have been updated to support the keyboard shortcuts for saving, deleting and printing the document.

| Operation | Shortcut |

|---|---|

| Saving | Ctrl+S |

| Printing | Ctrl+P |

| Deleting | Ctrl+D |

| Cancelling | Escape |

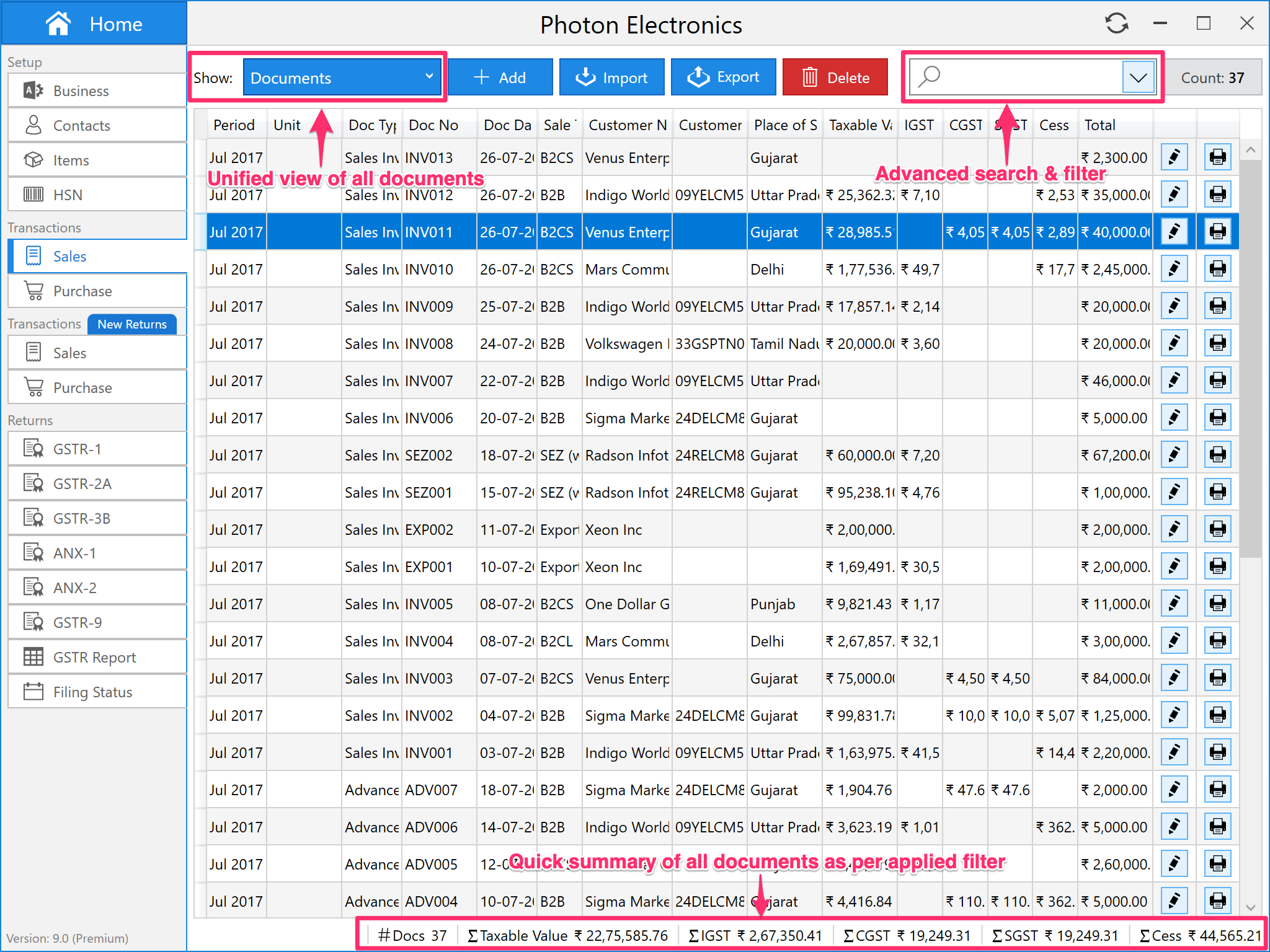

Sales & Purchase View

- Single unified view of all documents (invoices, credit/debit notes etc)

- Advance filter and search capability. Filter by GSTIN, period, business unit, doc type and many other parameters.

- Quick summary at the bottom to verify the details in a glance

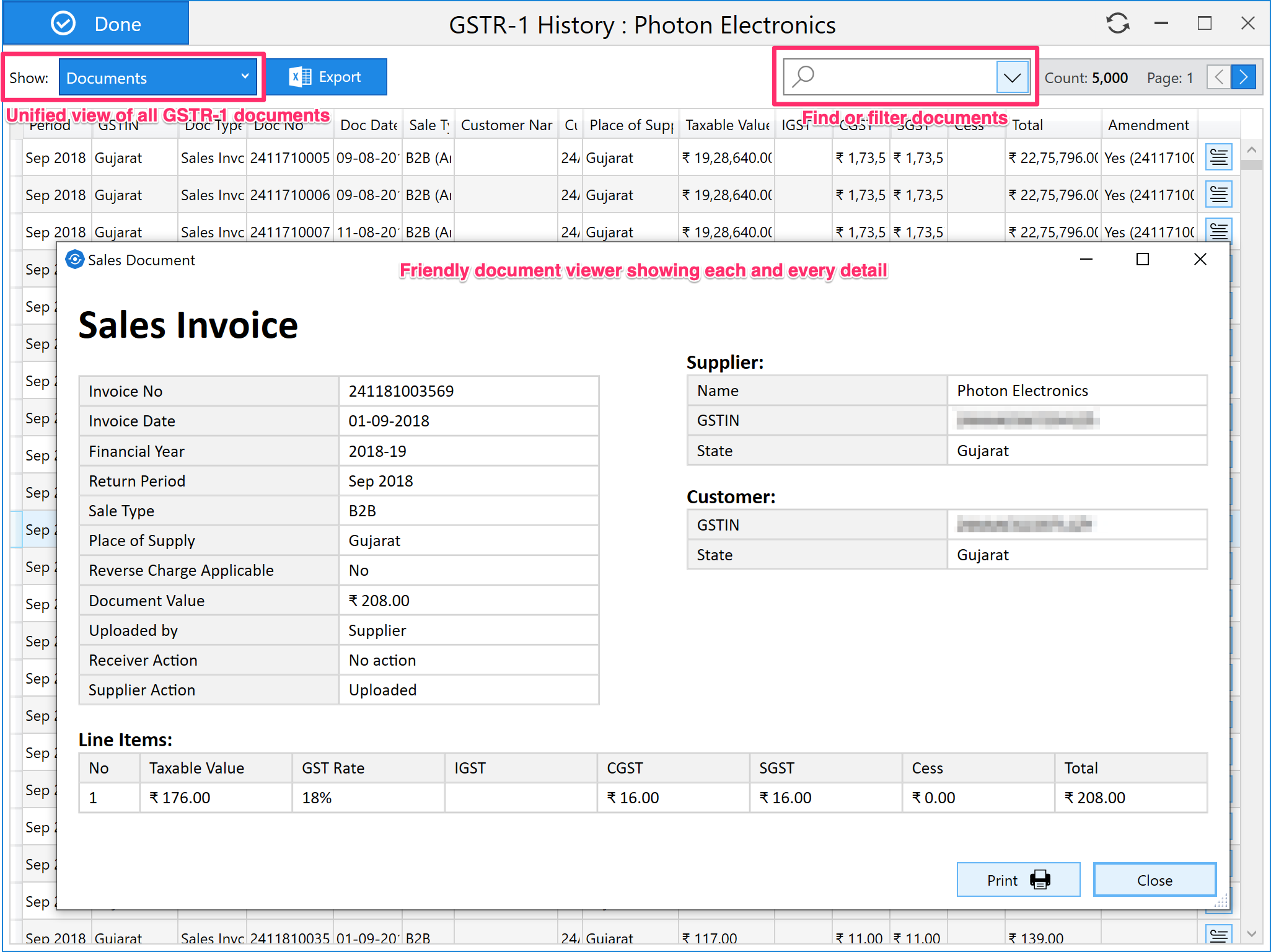

GSTR-1

Octa GST 9 provides a unified document viewer of all GSTR-1 filed in past. This help in quickly finding and referring a document without the need to export all the data. You can double click on any document and see the full details of that document.

The new version also uses a simplified and easy to understand template to export GSTR-1 data. The new template has only 4 sheets as opposed to old GSTR-1 Govt template which had more than 20 sheets. Using the new template, you may export the data of multiple GSTINs and periods to one Excel file.

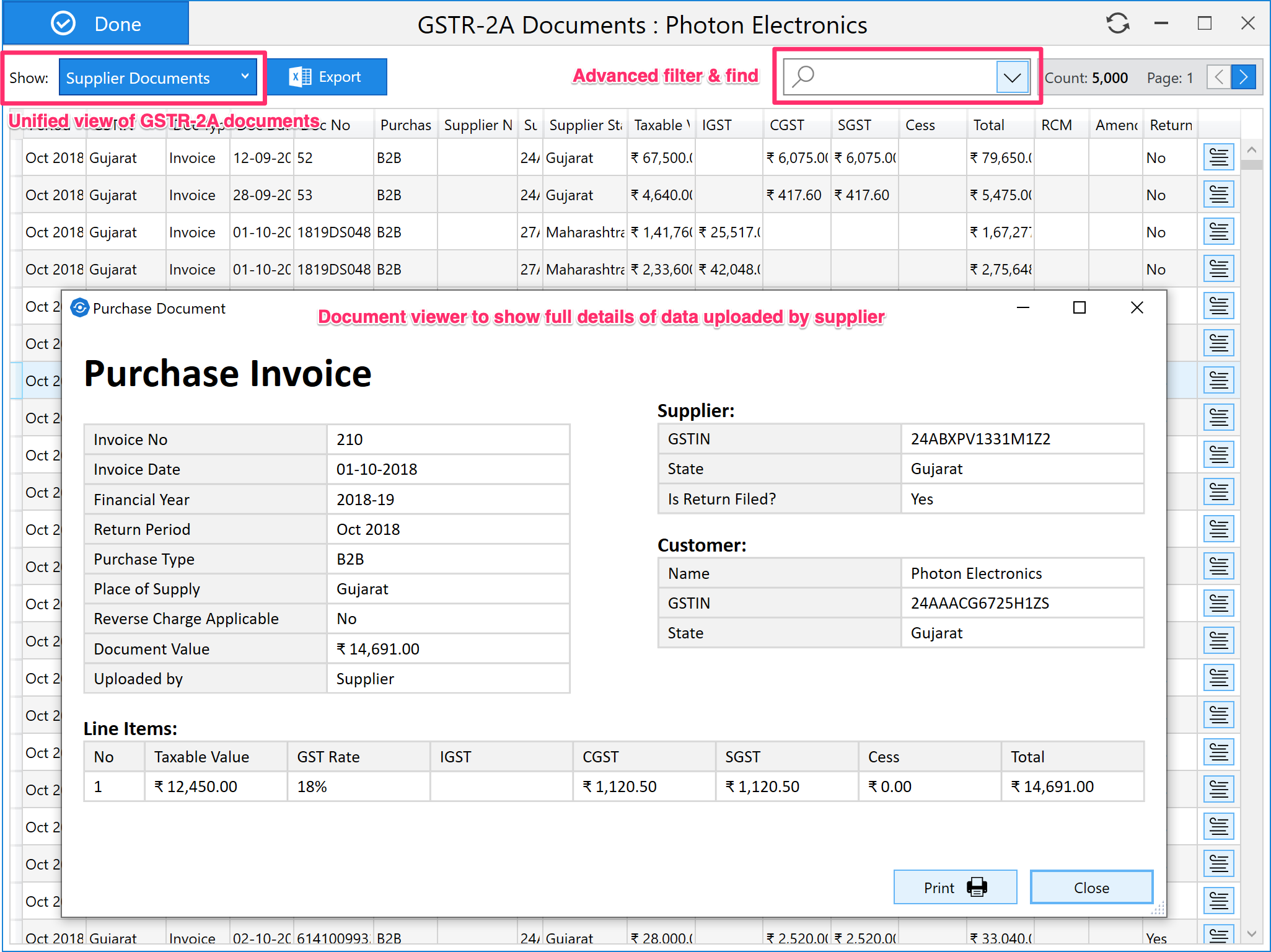

GSTR-2A

Octa GST 9 provides a unified document viewer of all GSTR-2A data. This help in quickly finding and referring a document without the need to export all the data. You can double click on any document and see the full details of that document.

The new version also uses a simplified and easy to understand template to export GSTR-2A data. Using the new template, you may export the data of multiple GSTINs and periods to one Excel file.

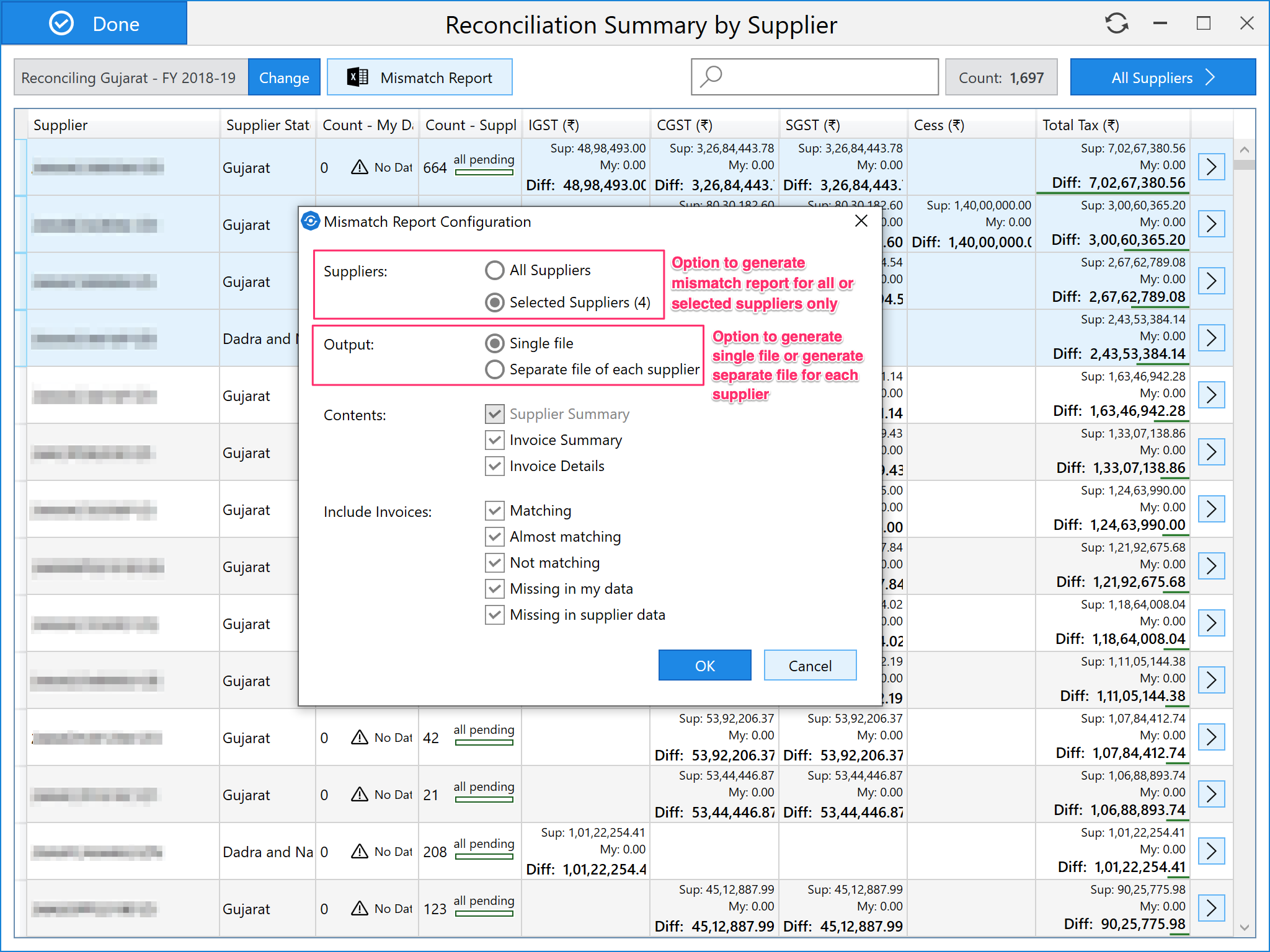

GSTR-2A Matching & Reconciliation

Mismatch report can now be generated for all or selected suppliers only. In addition to that, you can now choose to generate a single file or separate file for each supplier. Separate mismatch report is useful if you wish to share the mismatch details with the supplier.