Powerful GST Insights

Experience the most advanced GST analytics engine

Financial year reports

GSTR-1 Reports

- Single dashboard of filing status of all states

- Pull data of filed returns in one click

- Check data availability in one glance

- Export data of all states in one go

- Export data of whole financial year in one report

- Filter by customer GSTIN or PAN – for customer specific report

- Smart reports with effective (net) value of amendments

- Export credit notes rejected by recipients

GSTR-2B Reports

- Pull data of multiple periods and states in one click

- Check data availability in one glance

- Export data of all states in one go

- Export data of whole financial year in one report

- Filter by supplier GSTIN or PAN – for supplier specific report

- Smart reports with effective (net) value of amendments

- Search, view, and print GSTR-2B invoices

Sales vs GSTR-1 Reconciliation

- Reconciliation at the financial-year level

- Intelligent comparison across relevant sections

- Instant highlighting of key differences

- Detailed, invoice-level reconciliation

- Month-wise comparison across all return sections

- Easy-to-use reconciliation reports in Excel

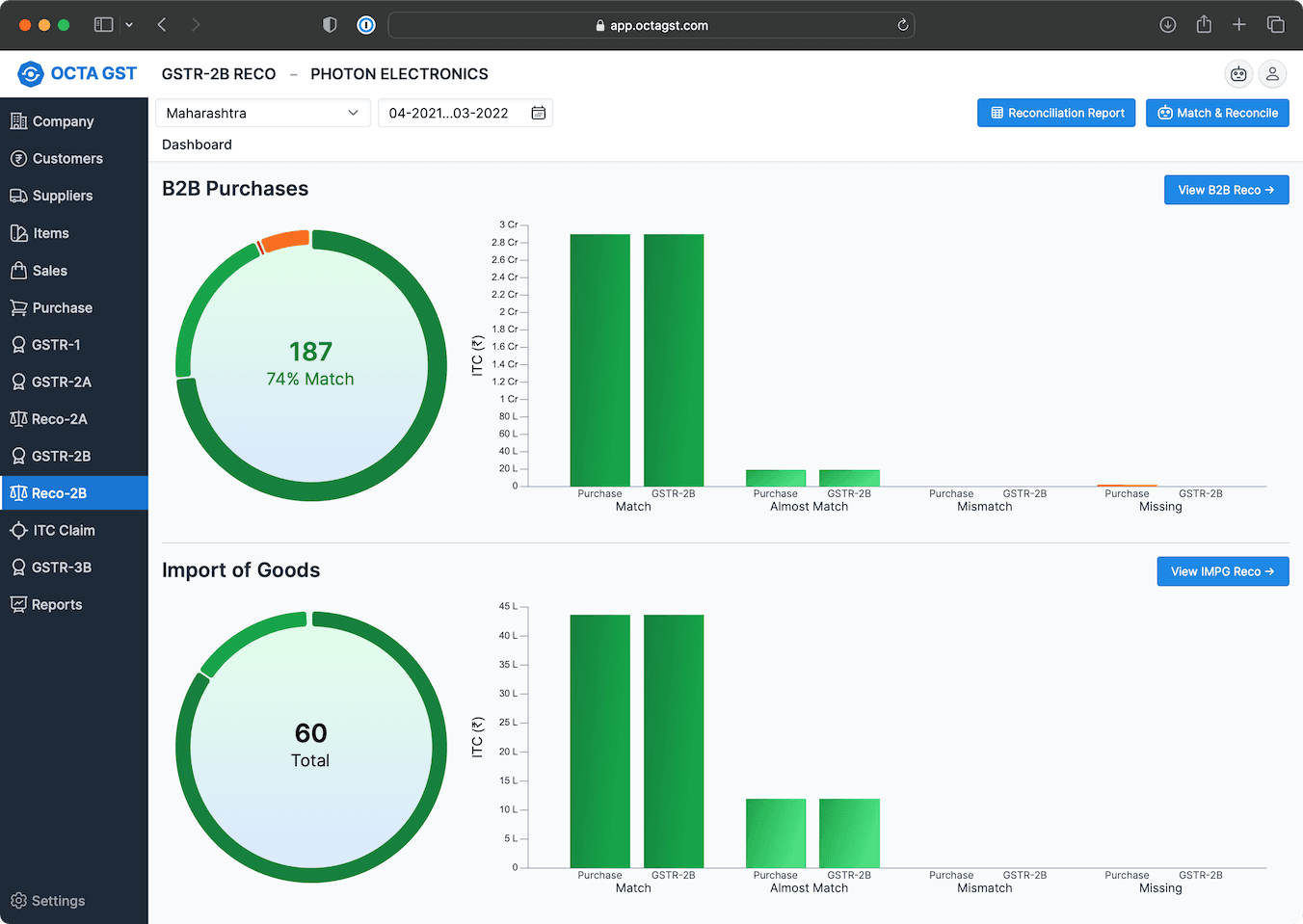

Purchase vs GSTR-2B Reconciliation

- Supplier level or invoice level reconciliation

- Reconcile for month, quarter, or full financial year

- Appropriate handling of reverse charge invoices

- Ignore the small differences to focus on significant differences only

- Smart linking of invoices based on patterns & similarity

- Reonciliation report in Excel format

GSTR-1 Annual Report

- Month-wise summary report for financial year

- Covers overlapping period (rolling 24 months)

- Classification based on different sections

- Separate analysis of amendments

- Net value for amendments

- Seperation of invoices of different financial year

GSTR-2B Annual Report

- Month-wise summary report for financial year

- Covers overlapping period (rolling 24 months)

- Classification based on different sections

- Separate analysis of amendments

- Net value for amendments

- Classification based on eligible/ineligible ITC

- Seperation of invoices of different financial year

GSTR-3B Annual Report

- Month-wise summary report for financial year

- Classification based on different tables/sections

- Financial year summary

- Liability paid details (cash/ITC)

- Liability & ITC claim details

GSTR-1 & GSTR-3B Comparison

- Section wise comparison

- Month-wise difference

- Highlight of significant differences

- Clear classification of financial year

- Classification based on different sections

- Comparison using net value for amendments

GSTR-2B & GSTR-3B Comparison

- Section wise comparison

- Month-wise difference

- Gross difference in whole financial year

- Clear classification of financial year

- Classification based on different sections

- Classification based on eligible/ineligible ITC

- Comparison using net value for amendments

GSTIN Status Report

- GSTIN registration status (active/cancelled)

- Registration & cancellation date

- E-invoicing status

- Type of taxpayer registration

- Filing frequency

- Last GSTR-1 filed

- Last GSTR-3B filed

- Compliance rating by Octa

Filing Status Report

- GSTR-1 filing status and filing date

- GSTR-3B filing status and filing date

- GSTR-9 filing status and filing date

- GSTR-9C filing status and filing date

- Multiple financial year in single report

Faster Audits. Smarter Analytics.

Drive faster, smarter audits and analytics with Octa GST, empowering your team to achieve more in less time.