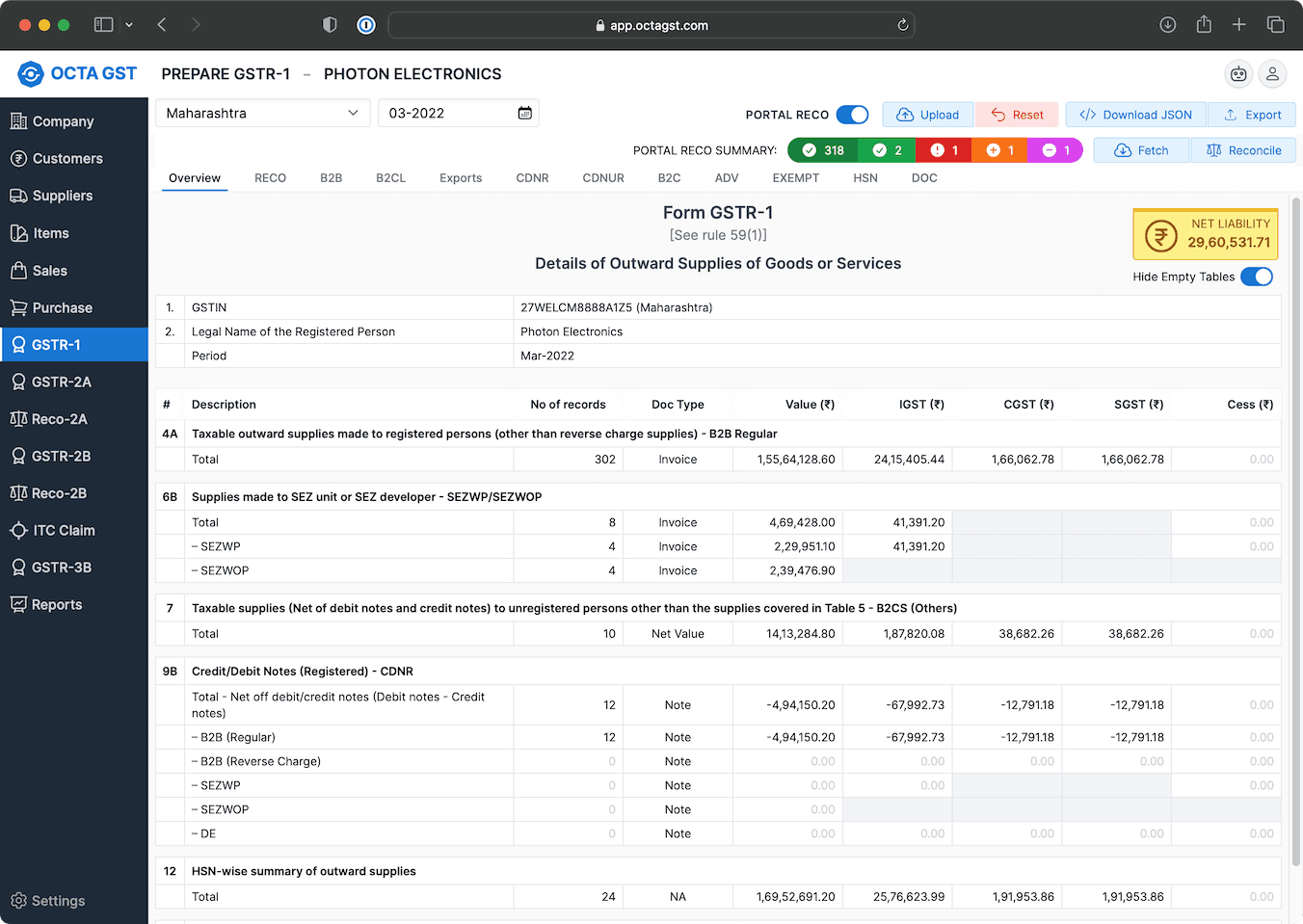

Prepare Accurate GST Returns

- Data import from multiple sources

- Auto-calculates the return data from sales/purchase transactions

- Reconcile with e-invoices and upload only the differences

- Full support of amendments in GSTR-1

- Run validation rules before return preparation to avoid mistakes in filing

- Return preview and analysis

- Generate Excel report to share with others

- View liability and ITC summary

- View ledger balances

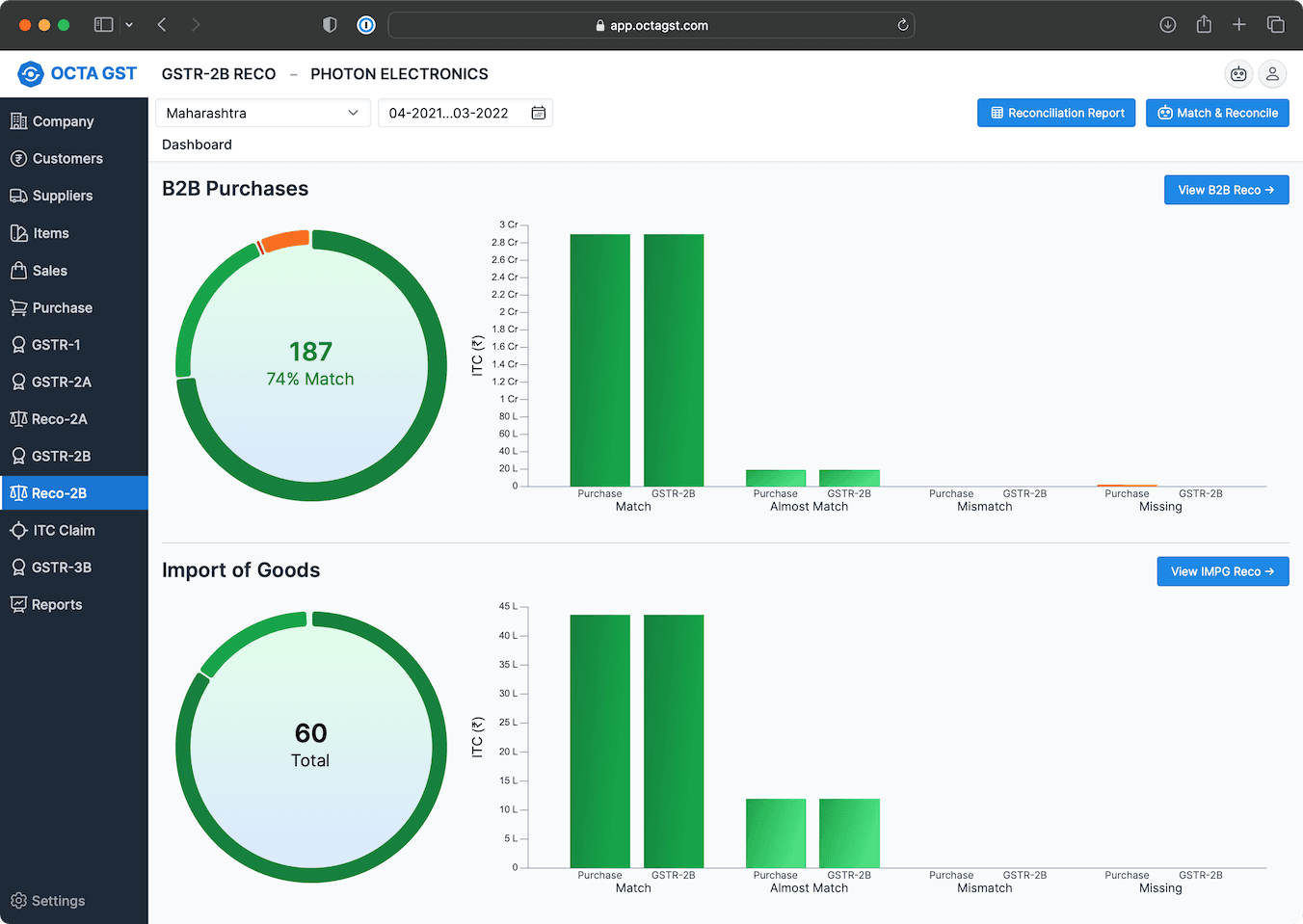

Purchase & GSTR-2A/2B Reconciliation

- Supplier level (party-wise) or invoice level reconciliation

- Reconcile for month, quarter, or full financial year

- Option to include/exclude reverse charge invoices

- Option to ignore the small differences to focus on significant differences only

- Smart linking of invoices based on invoice number patterns. Link and compare invoices even if invoice numbers does not match.

- Generate mismatch report in Excel format. Include or exclude the invoices based on mismatch status.

- Send notification emails to suppliers in single click

- Reconciliation of import of goods with ICEGATE

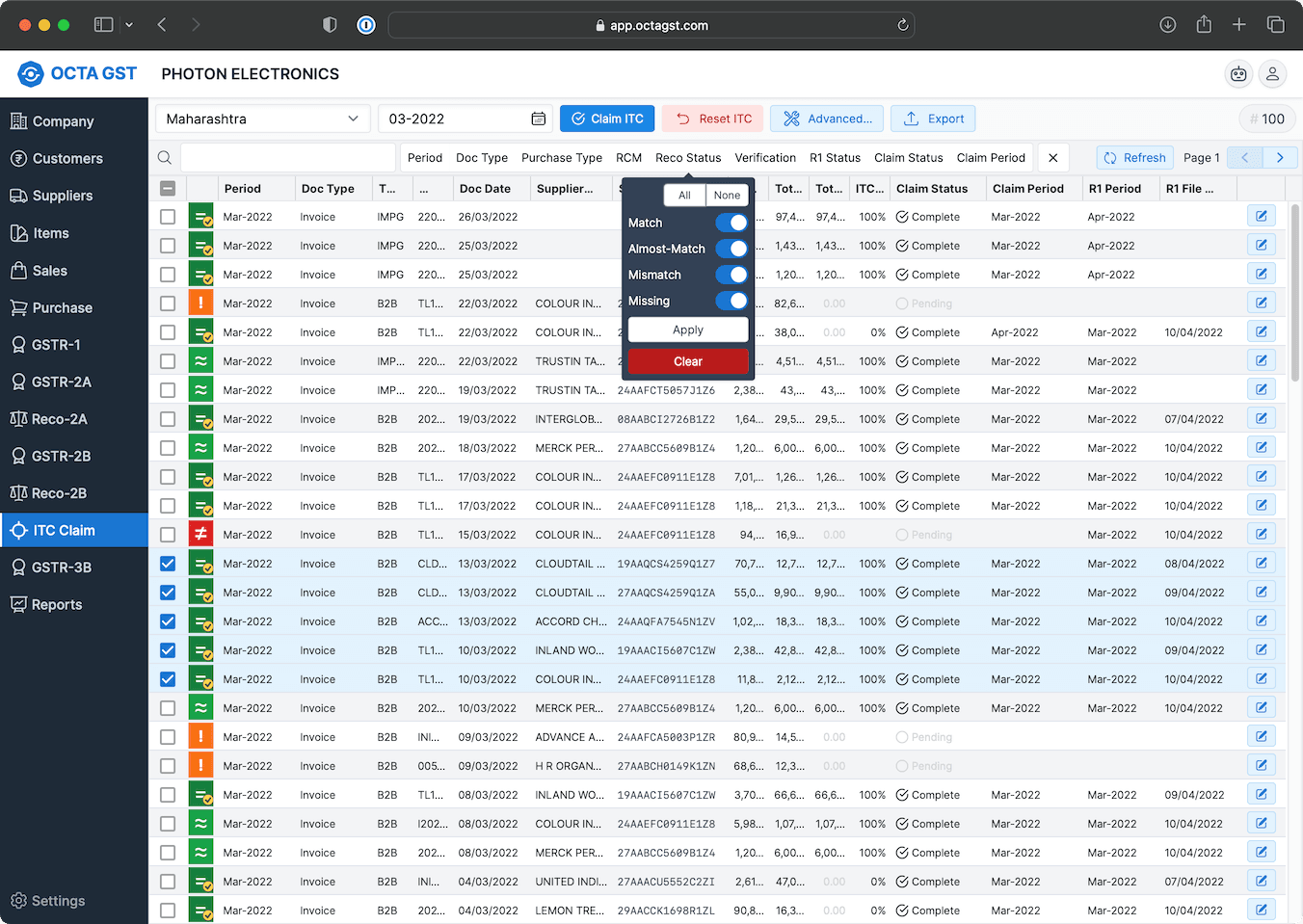

ITC Claim & Tracking

- Filter and bulk ITC claim

- ITC claim status tracking for each invoice

- Automatic handling of ineligible ITC

- Accurate calculation of ITC reversals

- Support of RCM liability and ITC claim

- ITC claim on bill of entry for import of goods

- Auto calculation of ITC in GSTR-3B

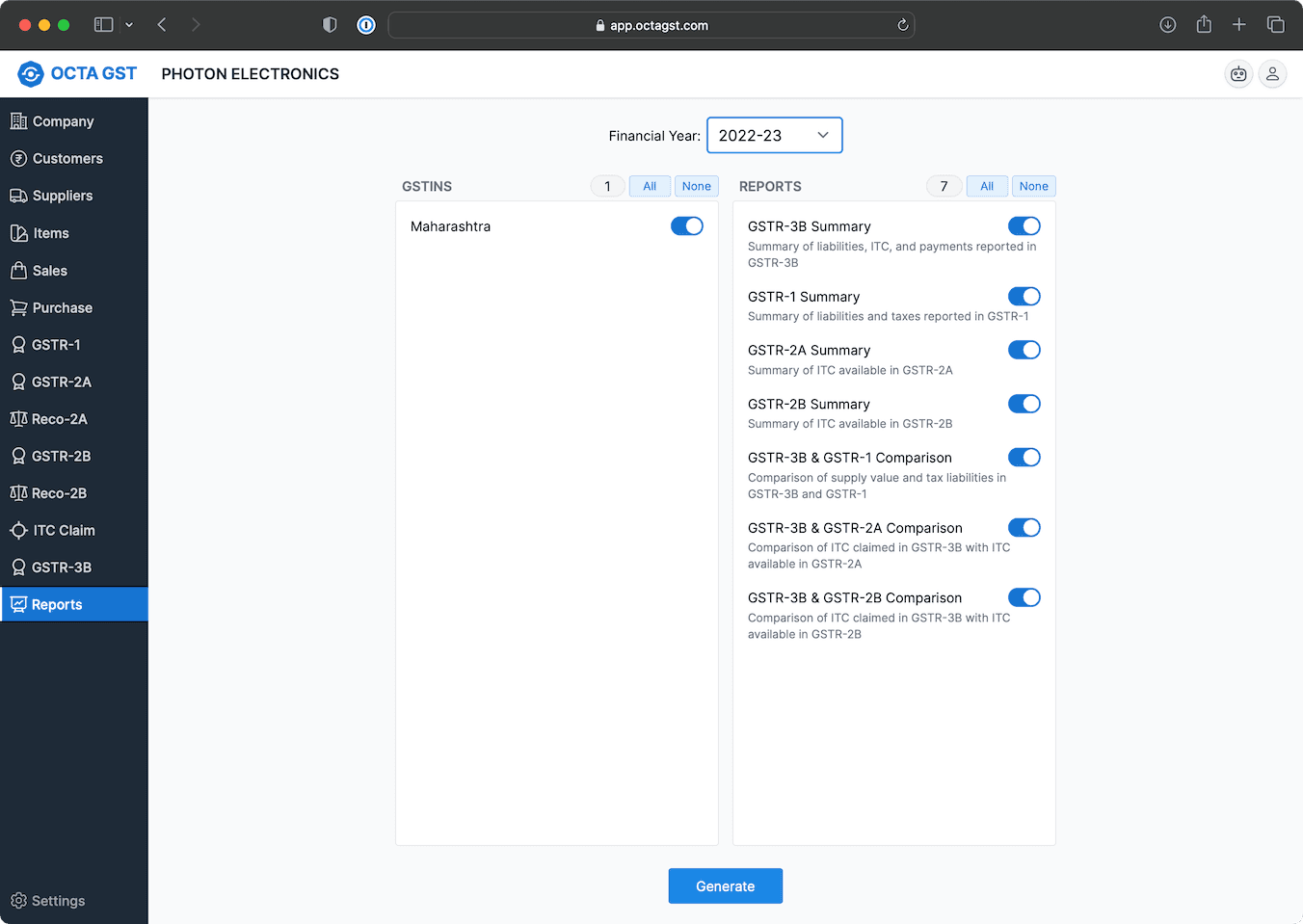

GST Annual Reports

- Single consolidated Excel report

- Month-wise consolidated report of GSTR-1, GSTR-2A, GSTR-2B, and GSTR-3B

- Liability comparison between GSTR-1 & GSTR-3B

- ITC comparison between GSTR-2A & GSTR-3B

- ITC comparison between GSTR-2B & GSTR-3B

- Separate heads of different tax types

- Separate heads depending on nature of transactions

- Process millions of transactions in seconds

Get started today

Power your business with Octa GST and experience the hassle-free GST compliance...

Contact Sales:

+91-82093-27184

sales@octagst.com