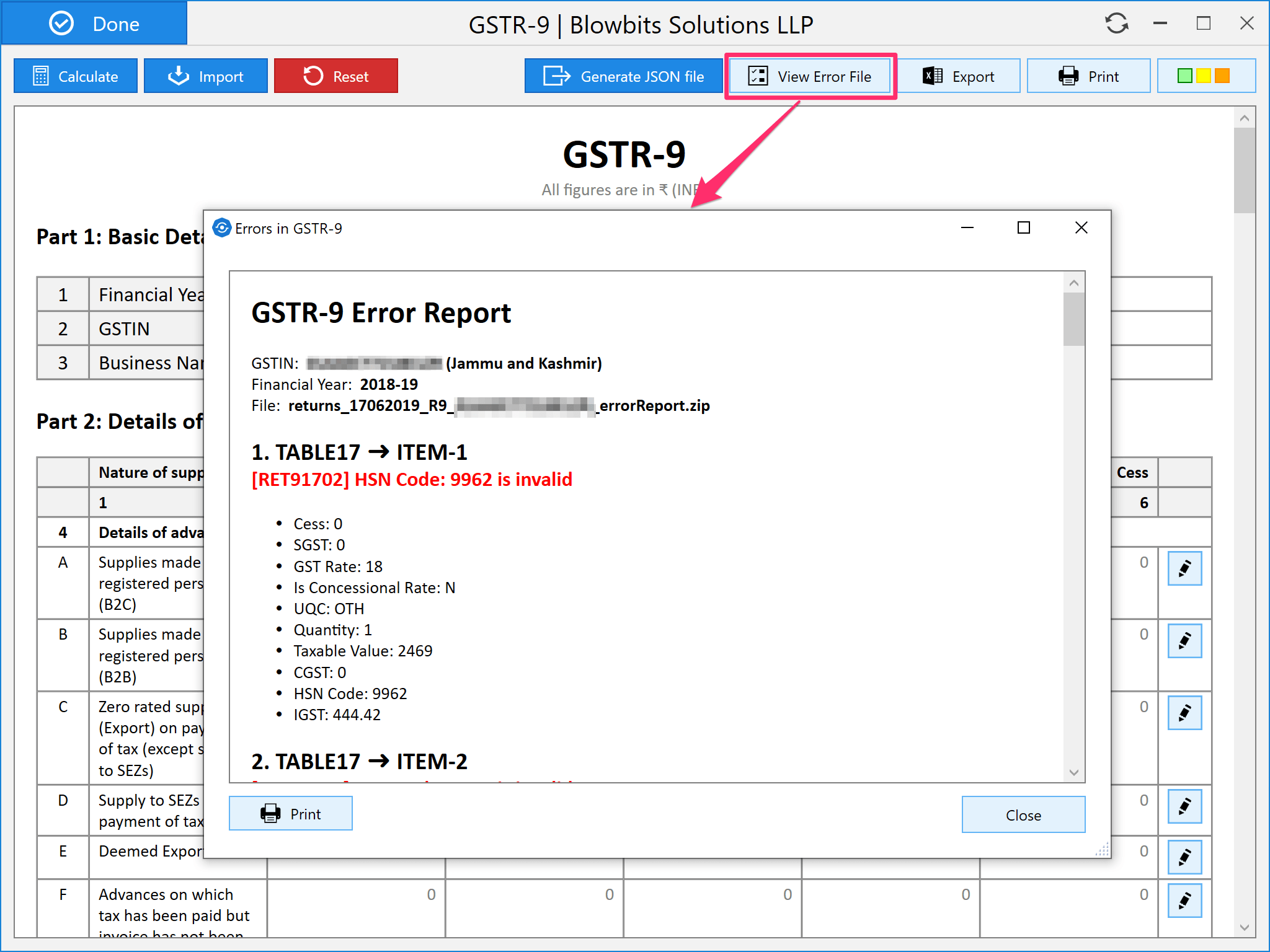

GSTR-9

- Added the facility to view the GSTR-9 error file generated by GST Portal.

- Improved the issue checker to add a warning when taxable value or tax amount in HSN summary is negative.

- Improved the table headings to make them dynamic as per selected financial year.

- Fixed an issue which resulted in small negative value of tax amount while making adjustment in HSN summary.

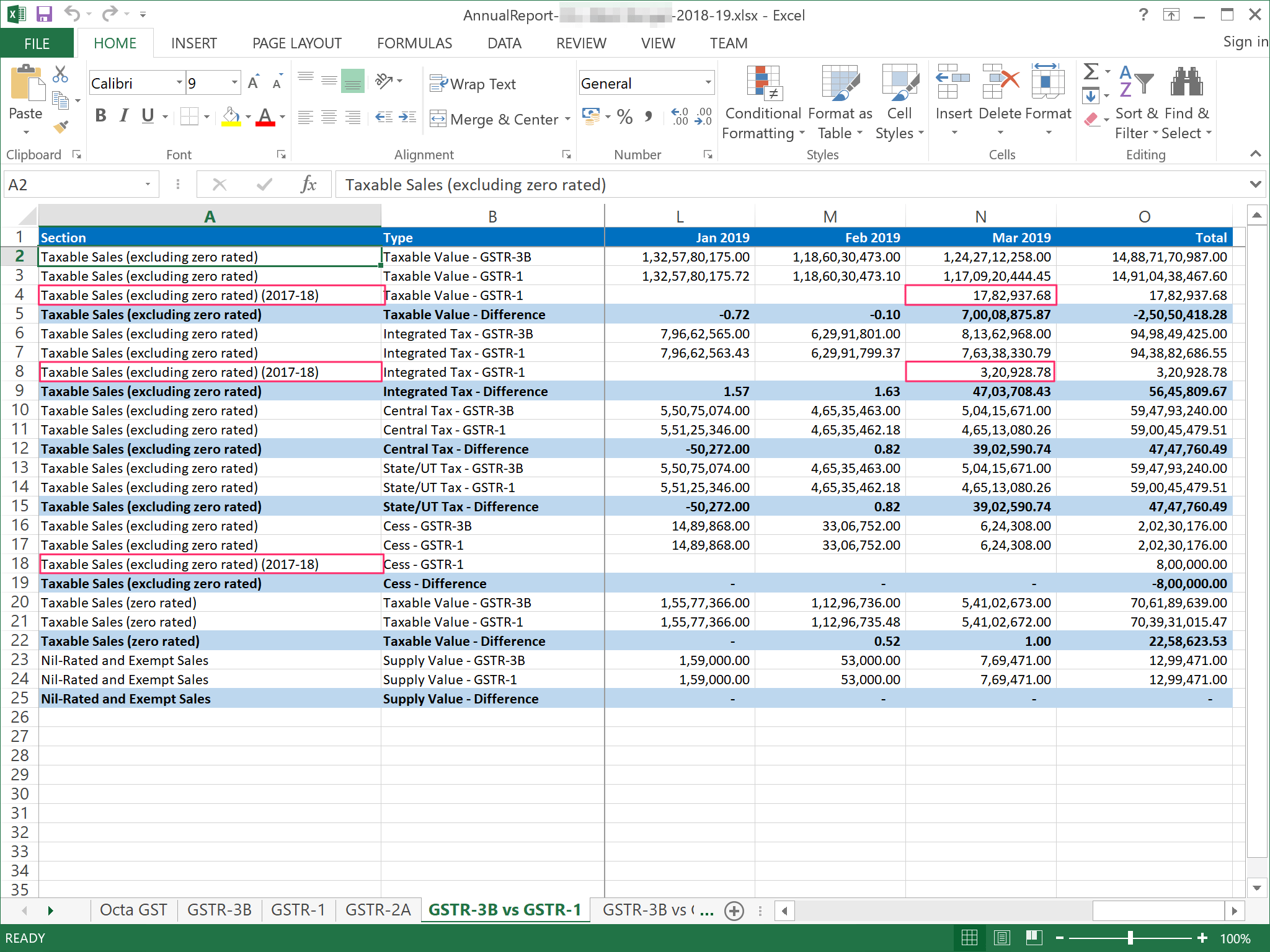

GST Returns Annual Report

- Updated the comparison reports (GSTR3B vs GSTR-2A, GSTR3B vs GSTR1) to show the data of different financial years in

separate heads for better visibility and understanding.

- Updated to export data of 4 months when running in trial mode. Earlier only 1 month data was being exported.

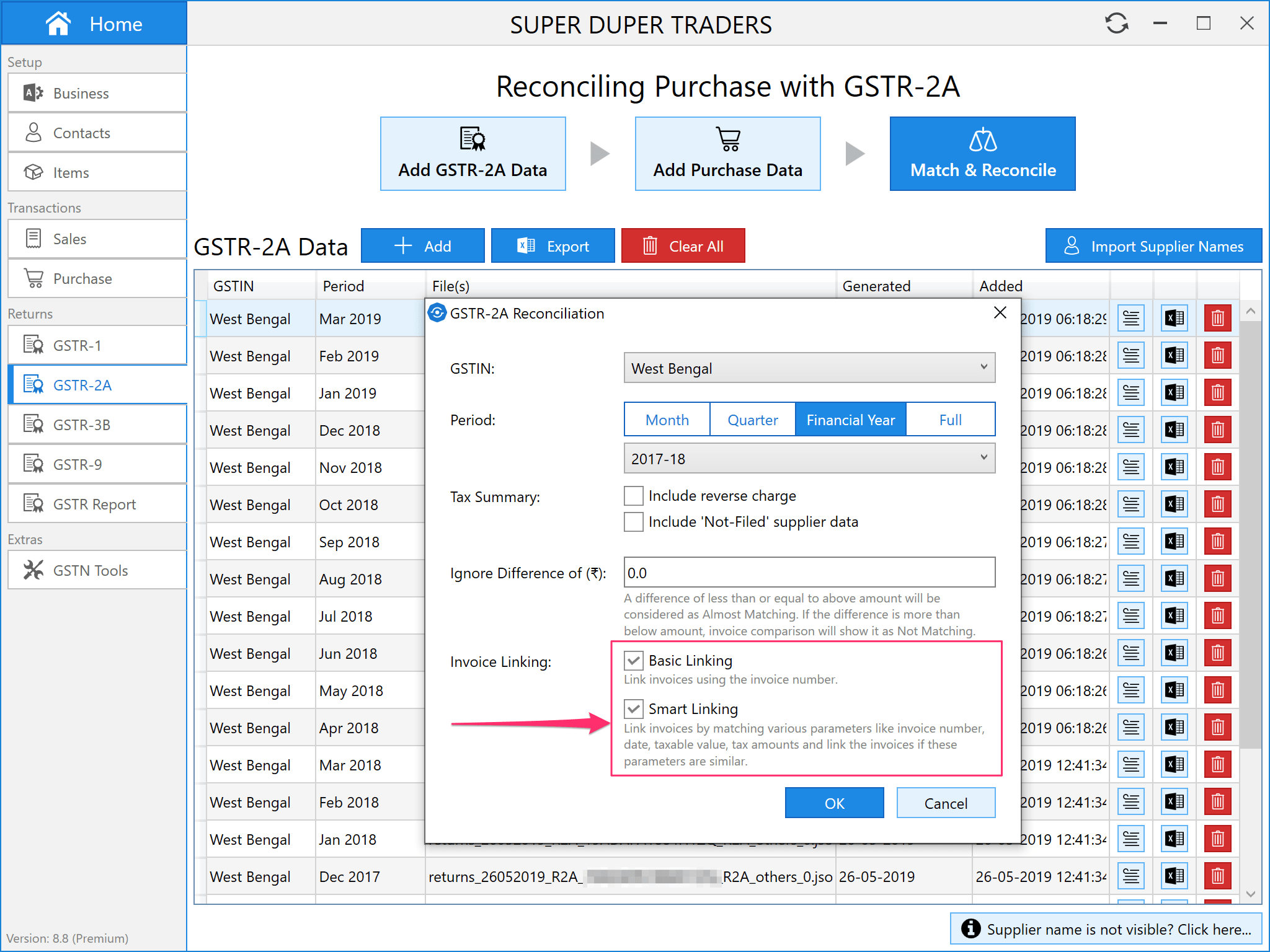

GSTR-2A Reconciliation

- Added the user configuration to control the invoice linking. Now user can individually enable or disable the basic and

smart invoice linking.

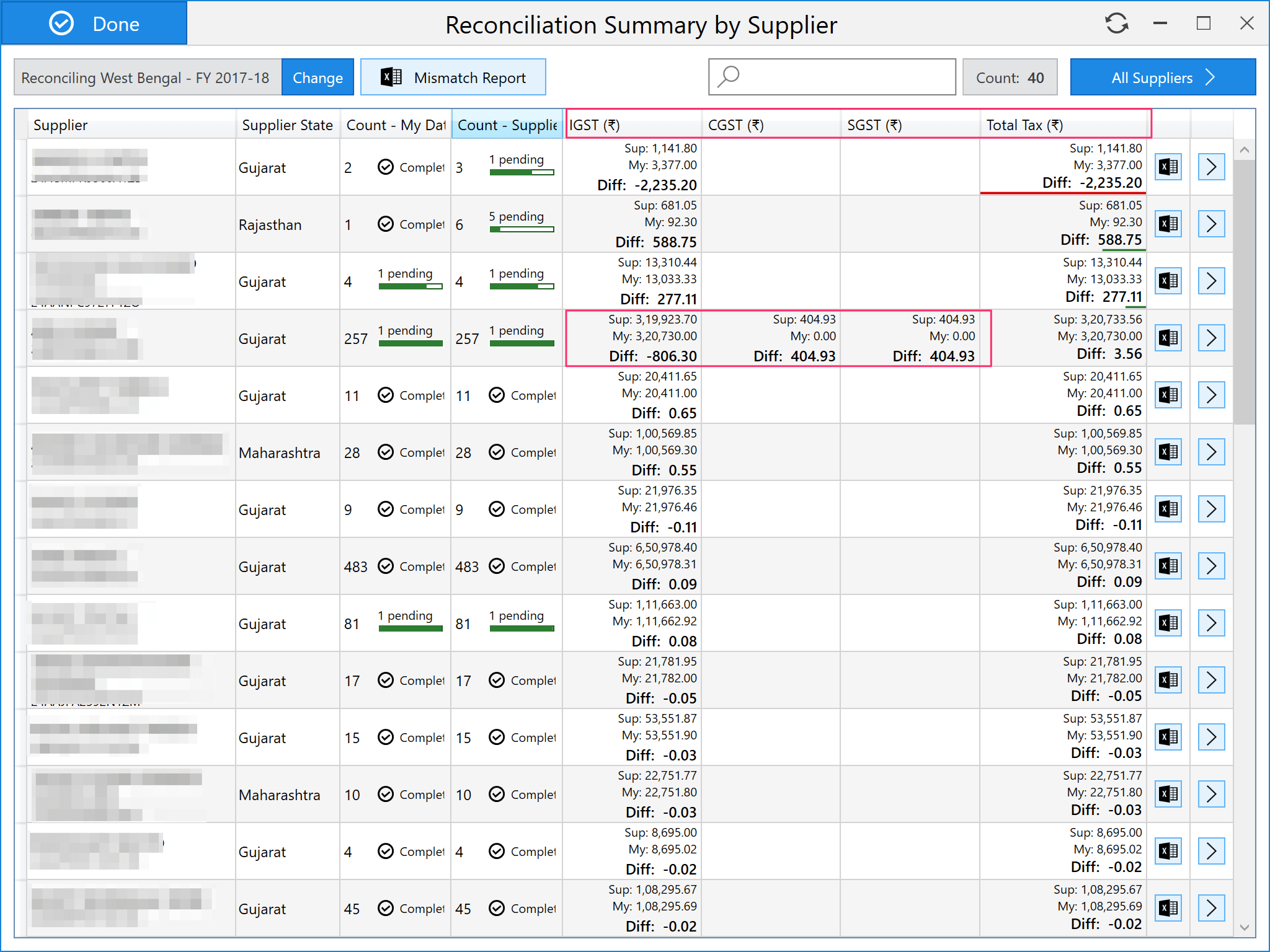

- Improved the supplier summary to show the tax amount and difference for individual tax heads (IGST/CGST/SGST/Cess).

Same is exported to mismatch summary also.

- Improved the invoice summary in mismatch report to show the tax amount and difference for individual tax heads (IGST/CGST/SGST/Cess).

- Fixed an issue in importing supplier names from GSTR-2A Excel file. It was caused by blank supplier names in GSTR-2A Excel file.

Others

- Updated to automatically select the server while logging in when its address is changed.

- Fixed an issue of whitespace characters when adding new GSTIN number for the same business.

- Fixed an issue while importing purchase data from Excel file in Octa format.