GSTR-9C

Filing GSTR-9C

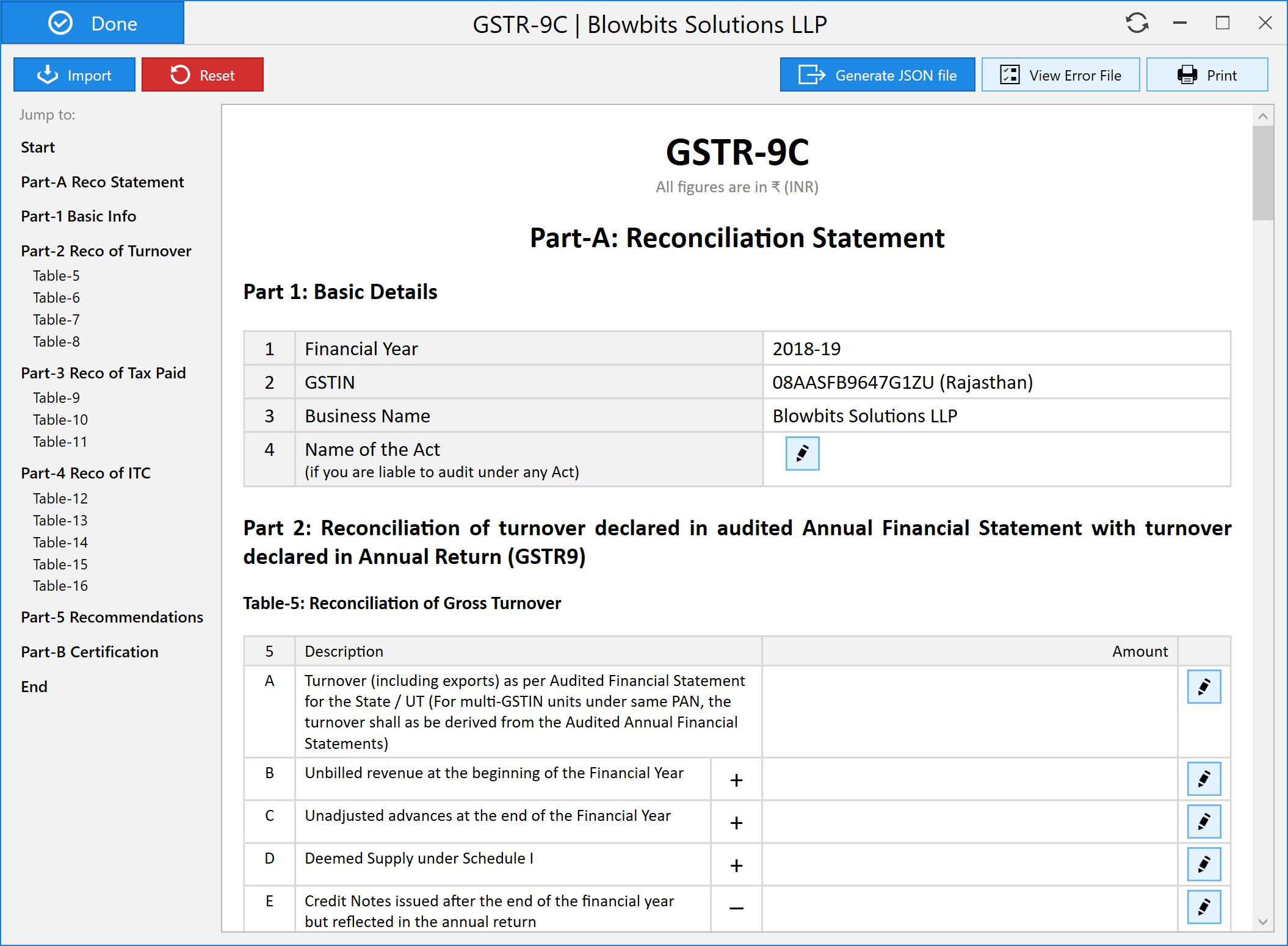

Introduction

Every registered person whose aggregate turnover during a financial year exceeds the prescribed limit, is required to get his accounts audited by a chartered accountant or a cost accountant. Such person is required to submit a certified reconciliation statement in the form of GSTR-9C.

GSTR-9C is broadly divided in two parts:

- Part-A: Reconciliation Statement

- Part-B: Certification

Using Octa GST, you can conveniently prepare the GSTR-9C by entering the relevant figures and generating a signed JSON file to upload on GST Portal.

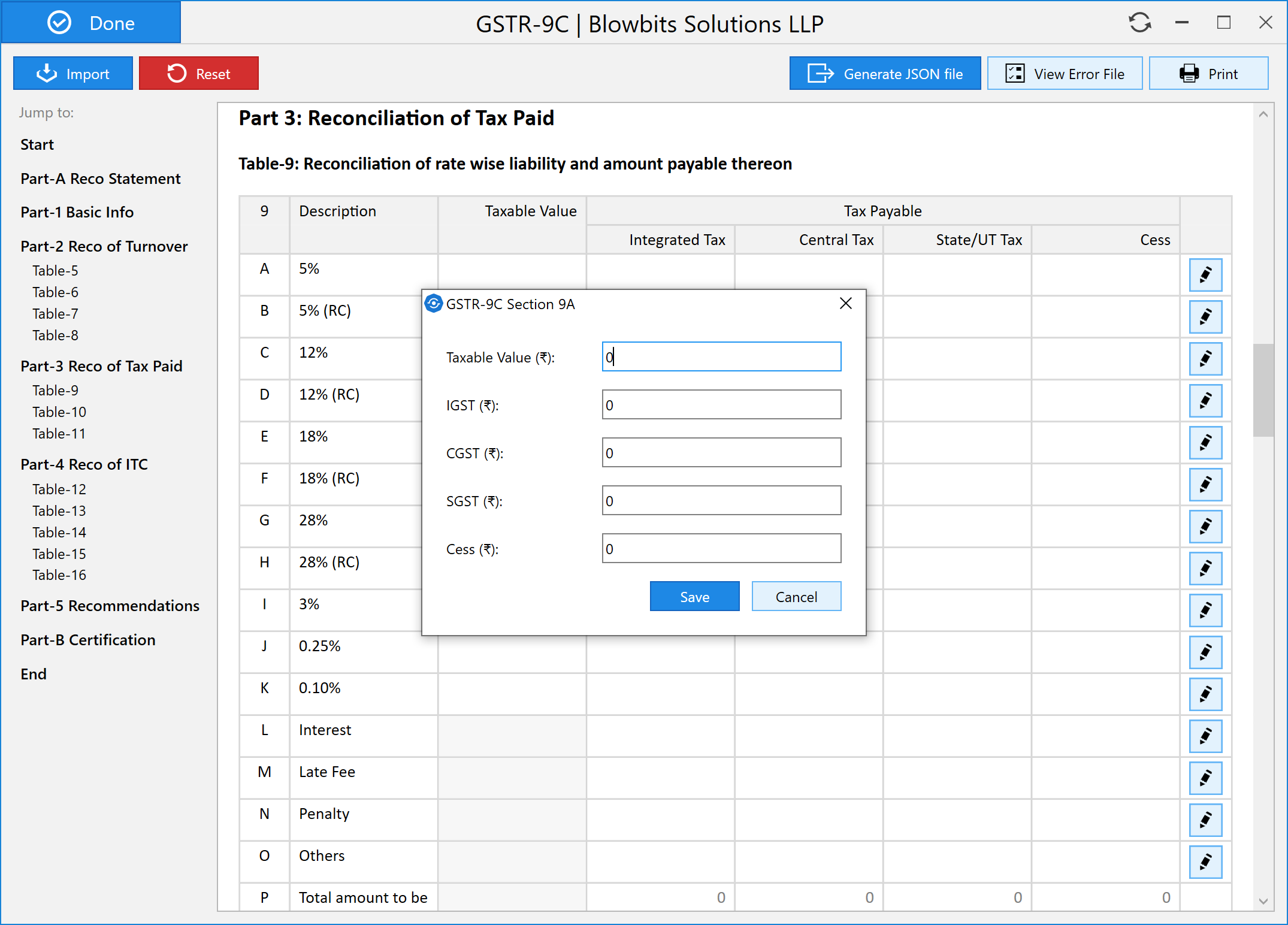

Prepare Reconciliation Statement

Reconciliation statement can be prepared by entering figures in relevant tables of GSTR-9C. Simply use the Edit button in each row and enter the figures.

It is also possible to import the GSTR-9C JSON file to pre-populate the tables. Octa GST can import the GSTR-9C JSON file generated using GST Offline Tool. Use the Import button and select the JSON file which you would like to import.

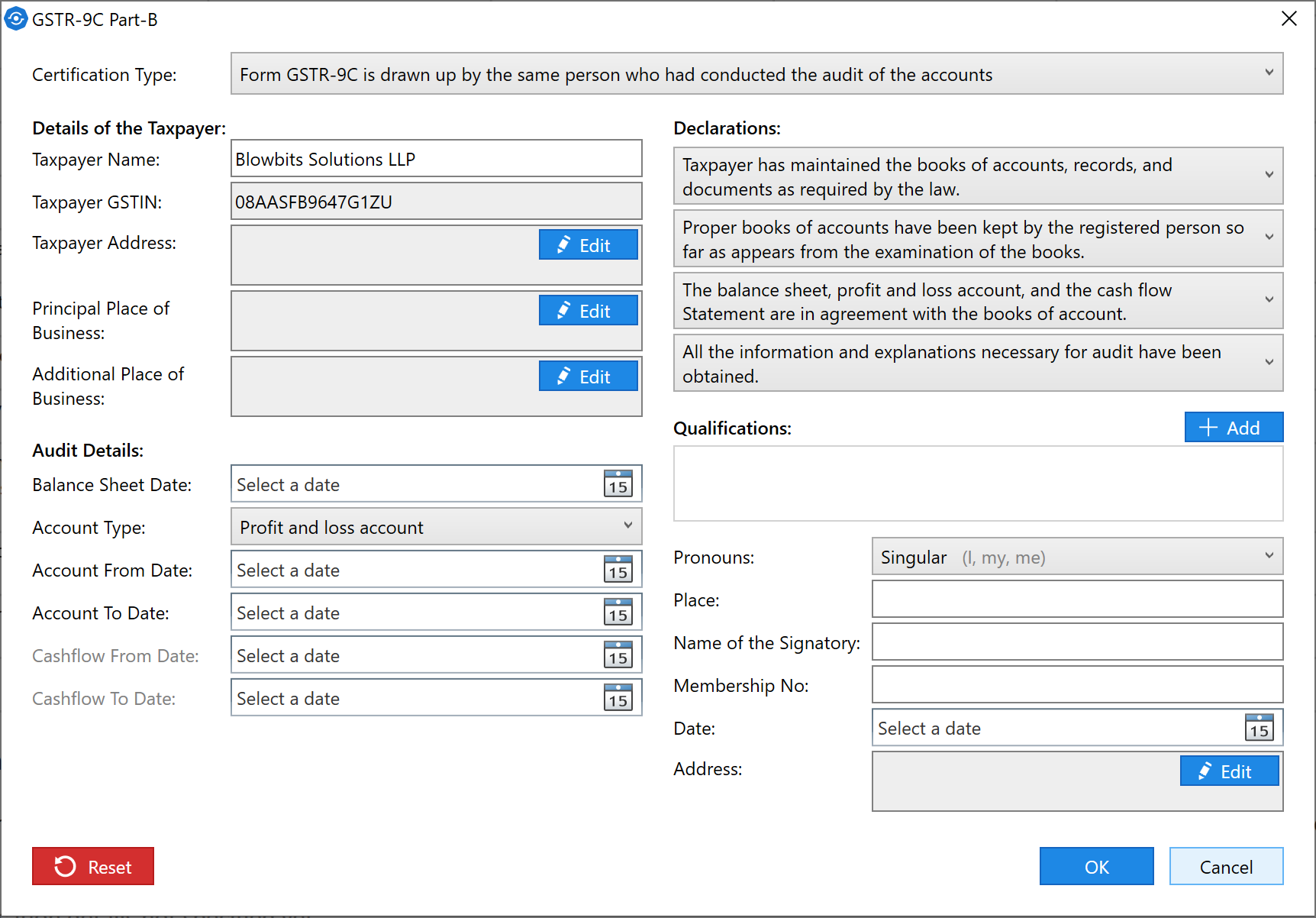

Add Certification Details

Once the GSTR-9C has been prepared, auditor needs to add the certification details including taxpayer and auditor address, any observations and qualifications if any. Simply click the Edit button in the Certification section and enter the relevant details.

Sign & Generate JSON

Once you have added & verified all the details, click on the Generate button. This option allows you to generate the JSON file with or without digitally signature.

Generate without Signing

If you wish to share the GSTR-9C data with someone else, you can generate the JSON file without signing. This JSON file can be imported by others using Octa GST or GST Offline Tool.

Sign & Generate

If you have verified all the details and you wish to send the signed GSTR-9C to the taxpayer for upload on the GST Portal, select the Sign & Generate option. Connect the digital signature token to your computer and select it to sign the JSON file.

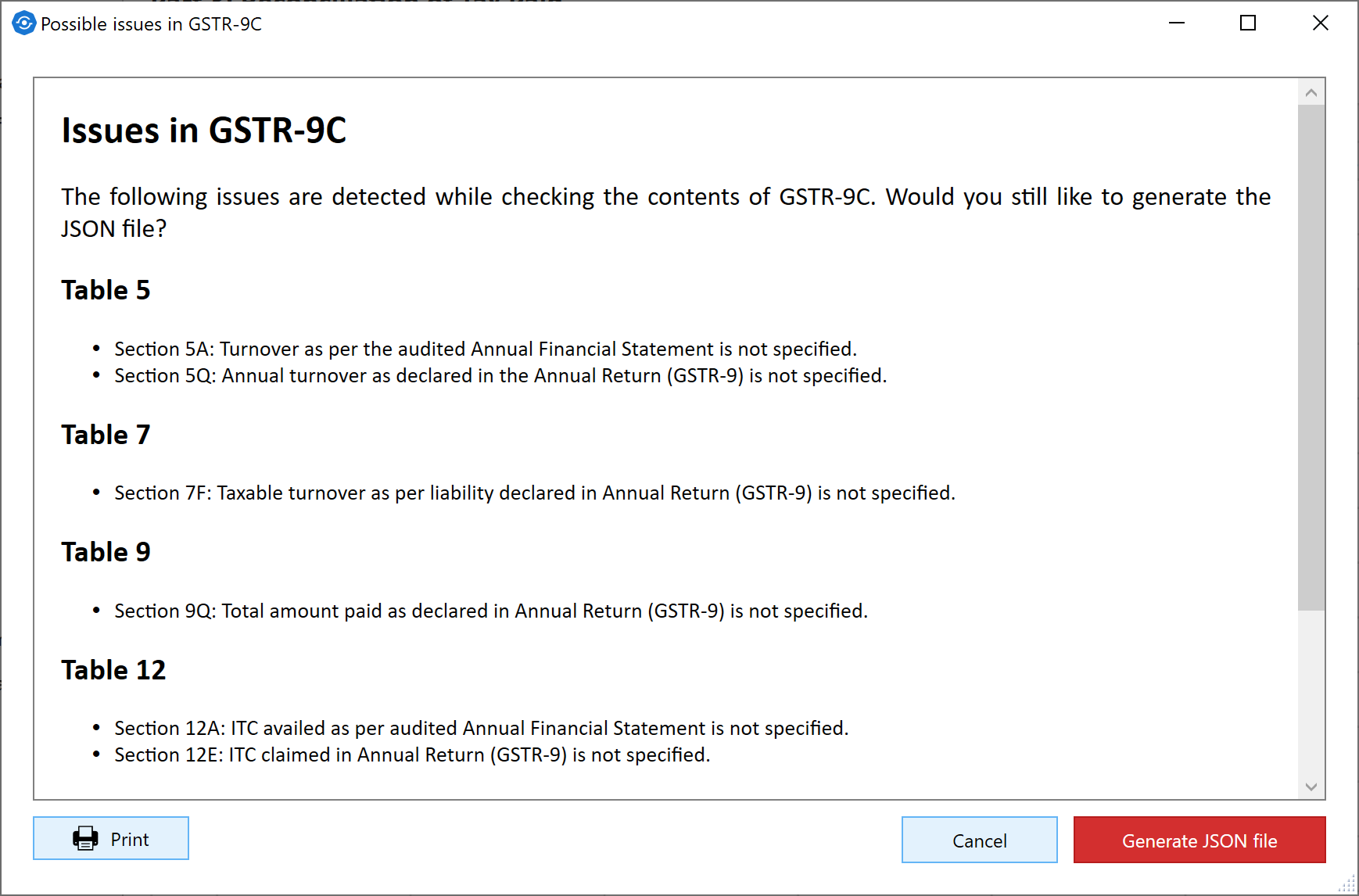

View & Fix Error

When GSTR-9C JSON file is generated, Octa GST will check the data and warn about possible issues that might be encountered while uploading the JSON file to GST Portal.

If you upload GSTR-9C JSON file to GST Portal and this file is processed with errors, you can generate & download the error file. Click on View Error File button to view the contents of this error file. Depending on the errors, you can correct GSTR-9C and regenerate the JSON file for upload.